Why Are We Kneecapping the Recovery?

The July jobs report shocked almost everyone. It wasn’t entirely rosy—e.g. the unemployment rate ticked up slightly for blacks and for teens (16 to 19 years), the number of people working part-time for economic reasons moved slightly higher, the labor force participation rate (and employment-to-population rate) fell off a bit, and the number of people working multiple jobs jumped +92,000, a whopping 549,000 more versus July 2021.1

But, overall, it was still a shocker of report, with 528,000 nonfarm payroll jobs created last month, upward revisions to May (+2,000) and June (+26,000), a decline in the overall unemployment rate from 3.6 to 3.5 percent—the lowest in 50 years—and average annual earnings up 5.2 percent. Hiring was strong and broad based.

Let the celebrations begin?

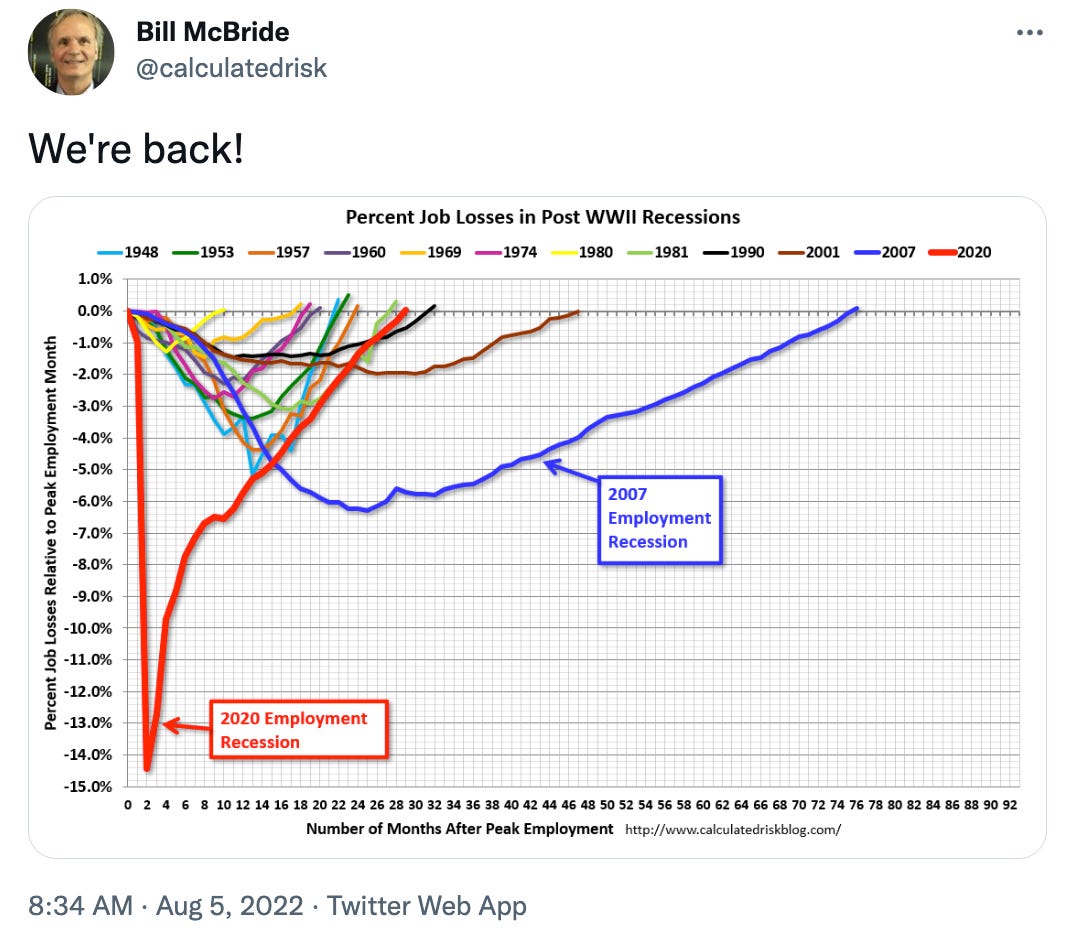

Bill McBride at Calculated Risk wasted no time updating his famous jobs chart to commemorate the achievement. Whereas it took 75 months to claw back the nearly 9 million jobs that were lost during the Great Recession, it took just 30 months to add back the 22 million jobs that were lost in the COVID recession. Instead of yet another long and painful jobless recovery, we got a V-shaped jobfull recovery.

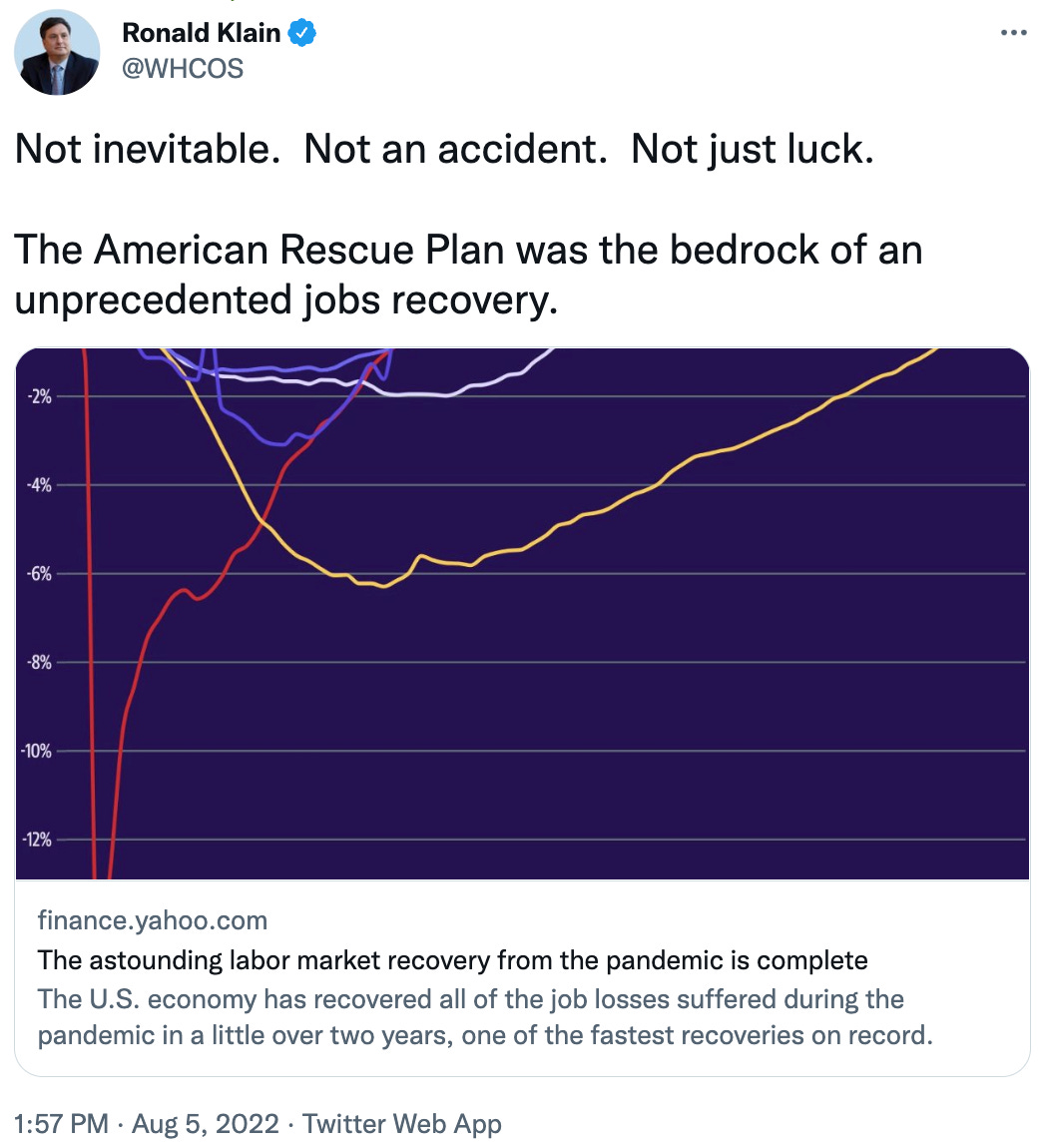

White House Chief of Staff Ron Klain celebrated The Great Restoration™ by reminding everyone that the (much-maligned) $1.9 trillion rescue package is what turbocharged the recovery.

Perhaps unsurprisingly, Jason Furman and Larry Summers were in no mood to celebrate. Both men were vocal opponents the American Rescue Plan (ARP) and both continue to blame the package—especially those $1,400 “stimmies”— for overheating the economy by causing too much money to chase after too few goods.

In their story, the basic problem is that demand—for workers, goods, and services—has been outpacing supply, forcing workers’ wages and consumer prices higher. A self-fulfilling wage-price spiral remains their bogey, despite any compelling evidence of that kind of 1970s-style dynamic taking hold.

After opposing the ARP on the grounds that it risked stoking inflation, Summers and Furman have come out in support of the latest reconciliation package, arguing that it will help to ease inflation, at least modestly. But, they believe, the only way to truly solve the inflation problem is for the Federal Reserve to slow the frontrunner way down by continuing to raise interest rates in order to kneecap demand.

Unfortunately, the Federal Reserve agrees. As Fed Chair Powell recently explained, he wants to solve the inflation problem by synchronizing things so that both runners are jogging along at the same steady pace. To do that, he said it was necessary to constrain aggregate demand so that supply can eventually “catch up.” Here’s Powell:

We think it’s necessary to have growth slow down…We actually think we need a period of growth below potential in order to create some slack so that the supply side can catch up…We think that’s probably necessary to get inflation back down on a path to 2 percent.

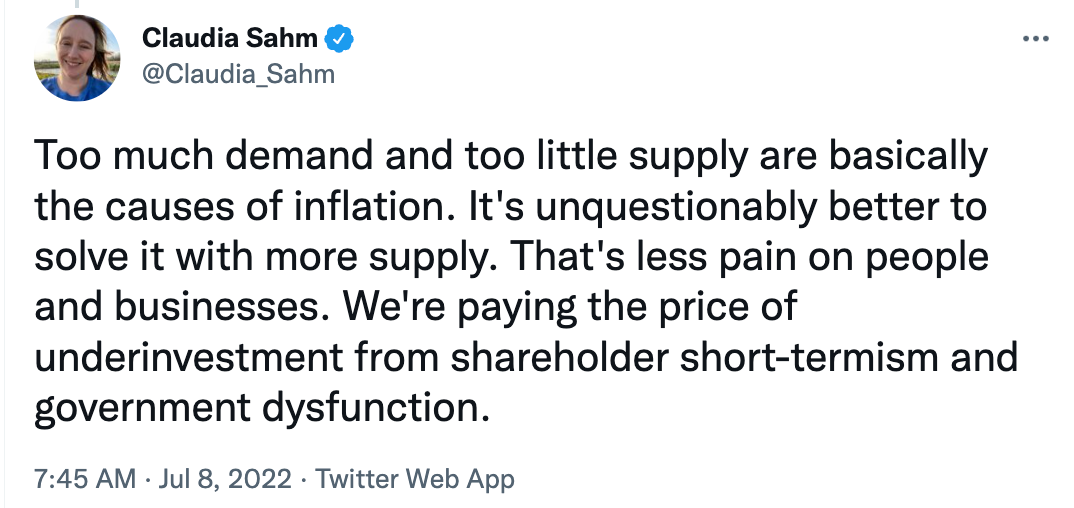

I’ve written about why I think kneecapping demand is the wrong way to treat our current inflation problem. And I’ve written about the kinds of things I would like to see policymakers do instead. As former Fed economist Claudia Sahm often writes, the best way to fix a supply shortage is with greater supply.

Many economists agree. Moreover, as Skanda Amarnath shows here, the Fed’s rate hikes don’t just drag down consumer demand, they kneecap the supply side of our economy as well, which makes it harder for supply to eventually “catch up.” One of the lessons of the post-Great Recession era is that demand destruction (in things like housing, energy, etc.) often spills over into supply destruction as well, leaving you more vulnerable to inflationary shortages down the road.

I consider myself a fairly vocal critic of the strategy to bring down inflation by indiscriminately jacking up interest rates. And while I have mostly focused on the Fed, other central banks are pursuing similarly troubling policies. For example, just last week the Bank of Englands’s Monetary Policy Committee (MPC) delivered the biggest rate hike (50 basis points) since 1995 while simultaneously delivering news that the British people are facing a long and painful recession. For a critique of British policy, I recommend reading Richard Murphy and David Blanchflower. Both have advised policymakers in the UK, and Blanchflower, who is a former member of the MPC, says that if he was on the committee today, he would be voting to cut rates by 50 basis points. Here they are in tandem:

And after avoiding a single rate hike for the last 11 years, the European Central Bank (ECB) surprised markets with a larger-than-expected rate hike earlier this month. I don’t see that move as patently bone-headed. It is more complicated in the Eurozone, due to the challenges involved in navigating the fractious politics that nearly tore the EMU apart only a decade ago. For smart commentary on macro policy across the European continent, I recommend economists Daniela Gabor and Dirk Ehnts.

And then there’s the Reserve Bank of Australia (RBA), which has adopted the same unfortunate approach to fighting inflation as the Federal Reserve and the Bank of England. For critiques of Australian policy, I suggest following Steven Hail and Alan Kohler. You might start with this piece by Alan. Here’s an excerpt:

Unlike previous episodes, this inflation is NOT caused by galloping consumer demand or runaway wages, which is what higher interest rates are designed to suppress, but by two colossal stupidities that are entirely impervious to the Reserve Bank.

The first, of course, is Vladimir Putin’s idiotic invasion of Ukraine, about which enough is said already…

The second stupidity (or is that three now?) is Australia’s poor excuse for an energy policy, which has more holes than a trendy pair of jeans…

Central bank economists are taught that the only cure for high prices of goods and services is to also raise the price of the money that’s used to buy them and, more importantly, is also used to buy somewhere to live, otherwise they would have no reason to exist…

So here we are in the midst of an acknowledged cost-of-living crisis and the remedy is to worsen it.

What all of us are basically saying is that central banks have committed to a wrong-headed strategy of relying on indiscriminate rate hikes that will intensify hardship on all but a few, do lasting damage to our productive capacity (i.e. the supply side), and push millions of people out of work.

All because we have misdiagnosed the root cause of the global inflation problem. Even as some economists continue to claim that our current inflation is demand-driven—the result of an oversized fiscal package that put too much money into too many hands—mounting evidence suggests otherwise.

According to research published last week by the Economic Policy Institute (EPI), that argument “is not supported by the data.” Their study compares inflation between the US and “a large set of other rich countries that undertook a wide array of fiscal responses.” Here’s what they found:

[E]ssentially all of these countries have experienced a rapid acceleration of core inflation…Inflation is not a uniquely U.S. problem [and it is] not connected to…the economic policies that spearheaded the rapid economic recovery…

Rather than the specific policies of the Biden administration driving inflation, the roots of today’s inflation are a more complicated cocktail of other forces: from the spike in raw material, energy, and commodities prices due in large part to the Russian invasion of Ukraine, to lingering supply chain disruptions and distorted consumer demand patterns stemming from the pandemic. These shocks and their unexpectedly large ripple effects are the global explanation for rising inflation.

Why It Matters

If we’ve misdiagnosed the inflation problem, and we’re treating it with bad medicine (tightening of monetary and fiscal policy), then we could end up doing a lot of damage (near and longer term). Unfortunately, what we have underway in the US and across much of the world, are synchronized policies of retrenchment that amount to a deliberate and coordinated effort to kneecap what has otherwise been a remarkable economic recovery, particularly here in the US.

Elsewhere, ZipRecruiter reports that 1.5 million people are out sick from work, compared to the usual 860,000 or so prior to COVID, and about twice as many people aren’t working due to challenges involving child care.

Today’s edition of The Lens is the best to date. It seems so obvious; increase supply, don’t constrain demand. You brought clarity to a critical issue, muddled by pedantic ideologues. Thanks. Cheers!

I am frustrated by the media coverage which assumes that only Fed action can impact the inflation rate. How does making housing and credit more expensive mitigate a housing shortage?