While I was in graduate school at the University of Cambridge in the mid-1990s, I won a scholarship through Christ’s College. It was funded by the Jerome Levy Economics Institute, and it provided support (housing, office space, and a stipend) for young scholars to carry out research while in residence on the campus of Bard College.

I spent a year (August 1997-August 1998) at Levy, working alongside MMT economists L. Randall Wray and Mathew Forstater, although no one called it “MMT” at the time. The great British economist Wynne Godley occupied the office adjacent to mine, and Hyman Minsky’s office was situated directly across from me, although he passed away the year before I arrived so I never met him.

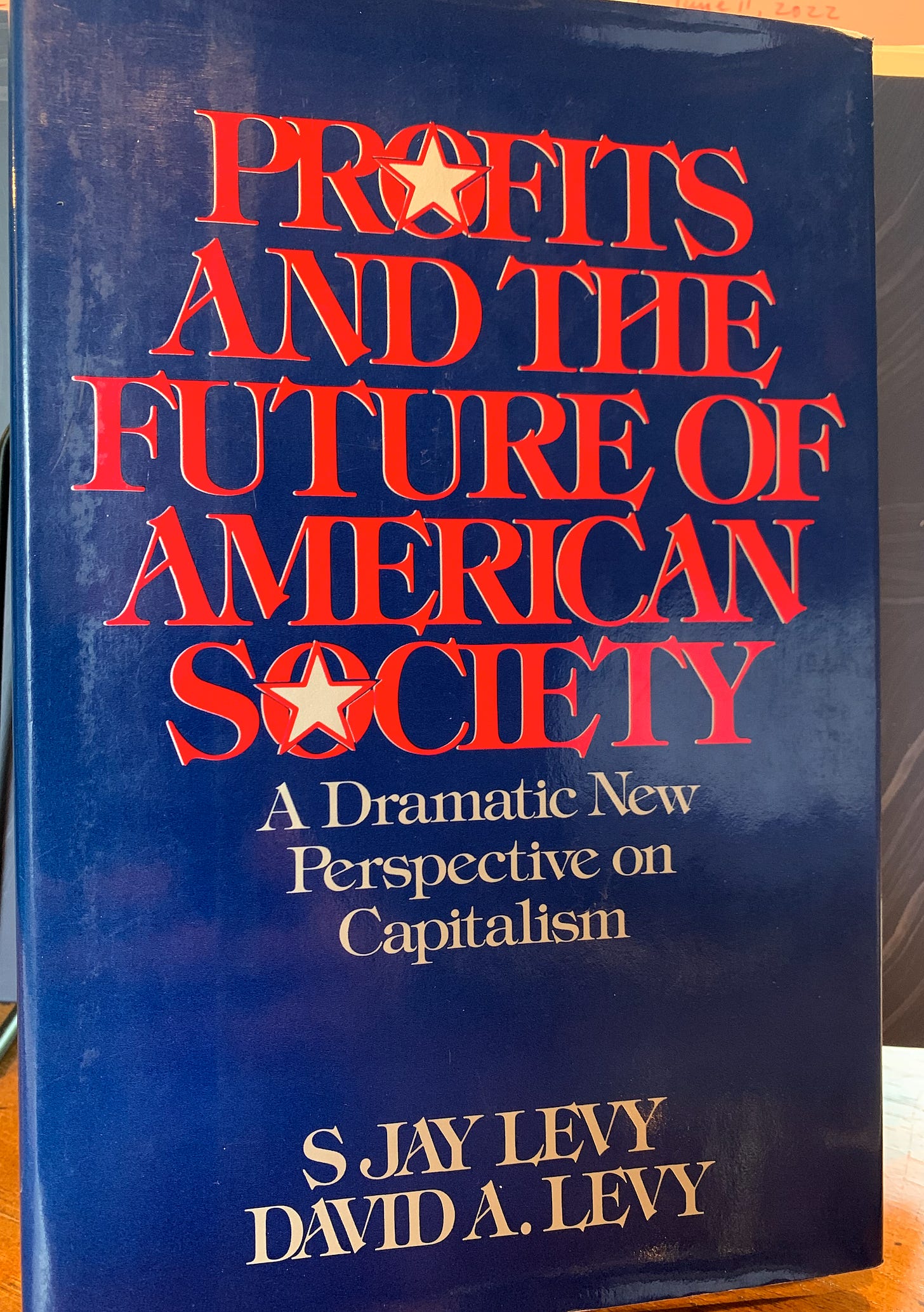

It was an exciting time, and it’s where I wrote some of the papers that contributed to the early MMT scholarship. On most days, I read far more than I wrote. One of the books I read was given to me by Jay Levy, whose brother Leon founded the Institute to honor his father, Jerome. The book was called Profits and the Future of American Society, and it was written by Jay and his son David, who still runs The Jerome Levy Forecasting Center. While doing some research for my next book, I picked it up again last week.

The book takes as its starting point an appreciation for the central role of profits in maintaining an economy with high levels of employment. As Jay and David put it, “profits are the lifeblood of business, and credit is the lifeblood of profits.” Central to their argument is the Levy-Kalecki profit equation, which basically answers the question Where Do Profits Come From? using a detailed (macro) accounting identity.

As the Levy’s saw it, macro policy should be calibrated to ensure an “optimum” rate of profit. When the flow of profits is insufficient, the result is unemployment. At the other extreme, excessive profit margins can contribute to inflation.

Ideally, just enough profit should flow to business to assure that every available worker who can contribute to production has the opportunity for employment. But what if more profits flow into the business sector than this minimum amount? Firms in many industries will have inordinately high margins. Such margins are incentives to expand. Expansion would require additional employees, but business cannot hire more workers when no one is unemployed. Since the extra-wide margins serve no social purpose, they are excessive.

Excessive profit margins cause two problems. First, competition relaxes. Companies can afford to be less efficient and less responsive to consumer needs than formerly. Consequently, human and material resources are not used to the best advantage. Second, excessive margins mean excessive prices. Widening margins are one of the phenomena that can contribute to inflation.

To keep the economy healthy, the government needed to keep profits flowing at an optimum rate. And here’s where you begin to see the overlap with MMT:

The government’s best tool for regulating the flow of profits is fiscal policy—the adjustment of its taxes and spending in order to produce a desired deficit or surplus. The government deficit is, of course, a source of profits, so fiscal policy is a direct way to adjust the flow of profits. . .

There are other ways, less desirable than fiscal policy adjustments, to regulate the flow of profits. The government—or more precisely its central bank, the Federal Reserve—can affect the flow of profits indirectly by influencing investment and consumption decisions. . .

But the Federal Reserve should not design monetary policy to influence the flow of profits. . . attempts to use monetary policy to combat inflation seriously impair the ability of markets to serve society.

The Levy’s published their book in 1983, shortly after the Volcker-led Federal Reserve triggered the 1980-81 double-dip recession with rate hikes that pushed the federal funds rate from an average of 11.2 percent in 1979 to a peak of 20 percent by June 1981. As the recession took hold, Volcker’s policies sent the US unemployment rate soaring above 10 percent. The rate hikes also intensified crises in Latin America and across the Global South. And yet to this day, Paul Volcker is lionized for having had the “courage” to slay the inflation dragon even as his policies inflicted decades of immense pain, both domestically and across much of the developing world.

Unlike Federal Reserve Chairman Jerome Powell, Jay and David Levy did not hold Volcker or his policies in high regard.

Bad Medicine

Chapter 14 of the Levy book is called Bad Medicine. It opens with the following paragraph:

In October 1979, with the tacit approval of the president and the Congress, the Federal Reserve adopted a program of increasing unemployment, reducing corporate profits, widening the federal deficit, restraining productivity, and lowering the standard of living. The policy was credit restraint. The government’s objective was to strengthen the American economy. One may well wonder what more effective actions could have been taken if the goal had been to weaken the economy.

To be successful in any fight against inflation, the Levy’s emphasized that it was important to correctly diagnose the source of the inflationary pressure. As I often say, “prices don’t just go up.” You’ve got to understand what’s driving the inflation in order to determine how best to tackle it. As Jay and David put it:

Prices rise when sellers raise them. . . Just as a doctor must determine what disease is causing a fever in order to administer the proper medicine, we must diagnose the causes of inflation before we can prescribe a remedy. The treatments for excessive profit margins and rising costs are not the same.

Sometimes, excessive profit margins become the driving force behind inflation. Jay and David argue that’s what happened “following the outbreak of the Korean war in 1950, and again after the US expanded its participation in the Vietnam War in 1965.” But it’s not what was happening from 1969-1981. During that period, sellers were raising prices in an effort to keep pace with rising costs—labor and commodities (especially oil).

Many of the book’s passages, like the one below, could easily have been written about our current situation:

Monetary policy cannot prevent real costs from rising. It cannot replace the oil in an empty well or put iron ore back in an exhausted mine. Nor does monetary policy have much to do with a worker’s degree of satisfaction with his standard of living.

What it can do, as the Levy’s remind us, is to administer a dose of bad medicine that kills the patient under the guise of delivering an effective treatment for the disease of inflation. Here are David and Jay again:

When tight money is used to fight inflation, ‘monetary policy’ is really ‘unemployment policy.’ The strategy pursued by the Federal Reserve after October 1979 was not advertised as a plan to break the trend toward higher pay by putting many workers out of their jobs, but only by creating unemployment could it have any effect.

That’s not how Chairman Powell describes the Federal Reserve’s current strategy. Instead of talking about rising unemployment, he prefers to talk about the mismatch between the number of job openings, relative to the number of job seekers. The goal, as he articulates it, is to “bring supply back into balance with demand,” robbing the economy of job openings without robbing it of (too many) jobs.1 That’s the “softish landing” scenario Powell has described in recent months.

I see little reason to expect things to play out like that.

What happens, in the first instance, is that rate hikes increase payments to holders of US Treasuries. In other words, monetary tightening becomes a fiscal expansion, at least in the category of spending known as interest on the government debt.2 This is a point stressed repeatedly by Warren Mosler. With higher income available to spend, bondholders can thus add to inflationary pressures by spending from those elevated cash flows. Additionally, as Jay and David (along with Minsky) noted, tighter credit adds to business costs, which tend to get passed on to consumers in the form of higher prices.3 And, if business investment is impaired and productive capacity shrinks, then rate hikes can add to inflation through supply channels as well as demand channels.

Under such a scenario, Professor James Galbraith writes:

Inflation would get worse until the Fed tightened so much that the economy cracked. That is what happened—and what finally squelched inflation—after Paul Volcker became Fed chair in 1979.

What this means is that conventional monetary policy, like hydroxychloroquine, can take a sick patient and make him even worse off.

This would weaken labor’s bargaining power—by design—dampening wage pressures, which might then mitigate inflation somewhat.

Notice how mainstream economists readily agree that businesses will pass on higher wages and rising material costs to end consumers, but they never seem to apply the same logic to interest rates. It’s curious, given that many companies rely on short-term debt to finance working capital. In an era of rising interest rates, those debts get rolled over at higher rates. It’s reasonable to expect, as both Minsky and the Levy’s did—that firms will attempt to defend their profit margins by passing higher borrowing costs on to consumers.

Per Warren Mosler, "With higher income available to spend, bondholders can thus add to inflationary pressures by spending from those elevated cash flows."

While that's certainly a logical possibility, has Mosler (or anyone else) produced data demonstrating that bondholders do in fact increase spending when interest rates go up? If so, what is their marginal propensity to consume out of interest income?

More conventional wisdom to be undone. Not sure why this one is so hard to crack, since Powell himself said rates won't affect the price of food or fuel. Who beyond old school economists and politicians buy into this? Wall St doesn't like rate hikes. Businesses don't like rate hikes. Yet here we are marching along to the said old tired story.

Brant