Lately, I’ve been writing about Social Security (here and here). With everything else that’s’ commanding our attention at the moment, it’s not a topic that feels particularly urgent. It soon will.

The debates have already started, and I expect them to heat up after the midterms. Just think back to what happened after the midterm shellacking in 2010, when a newly-emboldened group of republicans lawmakers joined forces with a group of so-called “moderate democrats” to push for cuts to Social Security as part of a “Grand Bargain.”

Of course, no one ever comes right out and says they want to CUT Social Security. That would be political suicide. Instead, lawmakers—democrats and republicans—describe their positions as well-intentioned and grounded in the harsh reality of budgetary math. They want to SAVE Social Security.

Robert Eisner, who spent most of his career as a professor of economics at Northwestern University, was onto this charade.

In 1998, Eisner published an article called “Save Social Security from its ‘Saviors’.” I strongly encourage you to read the entire thing.

In addition to that article, Eisner wrote a number of books and op-eds about Social Security. He was frustrated by the policy debates, which he saw as entirely misguided. Here’s the closing sentence from an op-ed he published in The Wall Street Journal in 1997.

Politicians and pundits should stop playing games with a confused public, and focus on total spending and total taxes, how they affect the economy, who gains and who loses.

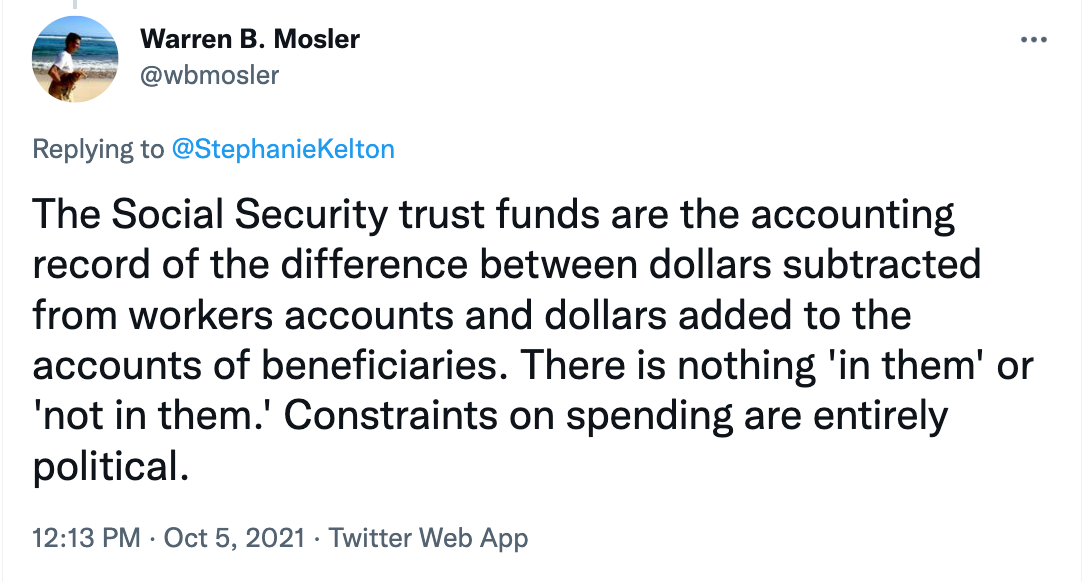

If you go on to read the article I recommended, you’ll see that Eisner echos this little-known fact made by MMTers like Warren Mosler.

Eisner’s main message was that the obsession with Social Security’s Trust Funds (OASI and DI) is a distraction. To borrow a phrase from Gertrude Stein, “There is no there there.” The trust funds exist merely as accounting entities. We don’t need them to carry a positive balance—or any balance whatsoever—in order to preserve Social Security for future generations. Here’s Eisner:

Expenditures alleged to be related to trust funds are often less than their income—witness the highway and airport funds as well [as] Social Security. There is no particular reason they cannot be more. The accountants can just as well declare the bottom line of the funds’ accounts negative as positive—and the Treasury can go on making whatever outlays are prescribed by law. The Treasury can pay out all that Social Security provides while the accountants declare the funds more and more in the red.

The only conceivable problem, as I explained last week, is with the way the enacting legislation was written.1 Congress could “fix” Social Security simply by amending that legislation to grant the Old-Age and Survivor’s Insurance (OASI) and Disability Insurance (DI) programs the same federal backstopping that already guarantees program solvency for the Supplemental Medical Insurance (SMI) Trust Fund.

If for some reason we choose to perpetuate the myth that the trust fund balances are vital to the program’s “solvency,” Eisner had this to say:

For those concerned, nevertheless, about the ‘solvency’ of the trust funds, there are simple, painless remedies for this accounting problem.

What he strongly opposed were the kinds of “remedies” that are often proposed in the name of “saving” Social Security—means-testing, raising the retirement age, reducing cost-of-living adjustments, diverting payroll contributions into privatized accounts, etc.

The proposed nibbling away of Social Security, including that by some of its presumed friends, is disingenuous and misleading. Even some of its defenders seem all too ready to accept ‘minor’ cuts in benefits to achieve prospective fund balance.

Eisner might have tweaked an old adage, “With saviors like these, who needs executioners?”

Under current law, OASI, DI, and HI are authorized to pay statutory benefits—i.e. what beneficiaries are entitled to under the law—only if there are adequate financial resources to cover those obligations.

I’m not a macro economist but this is what I have gathered from reading Stephanie Kelton and others.

In the end what we have is the ability of the market economy to produce goods and services desired by society. This depends on having the resources, infrastructure, and knowledgeable labor applying itself to the task.

We get money (a made up thing) as a means of bidding on these goods and services (real things) in this economy. We have to bid against everyone else who desires the same goods we want. If we increase the amount of money without increasing production we don’t get more goods we get higher prices.

We get more goods and services by taking care of and developing our resources, investing capital in infrastructure and research for more efficiency and capacity, increasing labor skills and applying it where needed.

Government needs to be a fair referee. It could help create a fairer, more equitable economy. I keep hoping.

Arrrrrrrrrrrrrrg … Stephanie, you, Mosler, and Robert Hockett are the most difficult reading I do each week. Also, the most thrilling. I have Dyscalculia so numbers and graphs are difficult, if not impossible, for me. When I found economic theory, via Robert, it was like reading a thriller I couldn’t put down.

MMT is so smart and simple to understand. It’s bloody frustrating that even well meaning policy makers are so thoroughly misled. Why are the chairman of the fed, sec of treasury, the damned federal reserve board, political appointees? Not sure how else one would do it but when I think of minds like Trump’s or Biden’s, for that matter, deciding who manages the economy, it’s, well … terrifyingly mind blowing.

Can’t think of it without thinking of Mosler’s stunning cars. Designed with the same elegant simplicity and logic of MMT, and would have changed the whole automobile industry when Elon Musk was still in high school. Mosler’s Consulier was shot down everywhere in media. Just like MMT and the principals that could pull us out of the quicksand that’s taking us under.

TIME FOR A BIG AD CAMPAIGN re SOC SECURITY. Something like, “Social Security – The Other Big Lie.”