You probably remember the line. George H.W. Bush uttered the infamous phrase at the Republican National Convention on August 18, 1988. His message was aimed at Democrats (who took control of the Senate and retained control of the House after the 1986 midterm elections).

Don’t try me, Bush warned. I am telling you in no uncertain terms where I stand today and where I will stand in the future. Believe me when I say:

My opponent won’t rule out raising taxes but I will. And the Congress will push me to raise taxes, and I’ll say no. And they’ll push. And I’ll say no. And they’ll push again. And I’ll say to them, ‘Read my lips. No new taxes.’

By the summer of 1990, President Bush was embracing a fiscal package that included raising taxes. So much for the fiscal rhetoric.

Today, all ears are on Powell & Co., as financial markets continue to discount the Fed’s commitment to holding interest rates higher for longer. While markets expect the terminal rate to peak before the Fed anticipates and for the Fed to begin cutting rates in the second half of the year, Fed officials have been ratcheting up their hawkish messaging.

Just yesterday, Minneapolis Fed President Neel Kashkari wrote about why he thinks the Fed’s models failed to capture the inflationary dynamics that led to the initial surge in prices and what he thinks the Fed must do now.

While I believe it is too soon to definitively declare that inflation has peaked, we are seeing increasing evidence that it may have. In my view, however, it will be appropriate to continue to raise rates at least at the next few meetings until we are confident inflation has peaked.

Once we reach that point, then the second step of our inflation fighting process, as I see it, will be pausing to let the tightening we have already done work its way through the economy. I have us pausing at 5.4 percent (see figure), but wherever that end point is, we won’t immediately know if it is high enough to bring inflation back down to 2 percent in a reasonable period of time. Once we see the full effects of the tightened policy, we can then assess whether we need to go higher or simply remain at that peak level for longer. To be clear, in this phase any sign of slow progress that keeps inflation elevated for longer will warrant, in my view, taking the policy rate potentially much higher.

As many of you know, Kashkari has flipped from being the FOMC’s biggest dove to (probably) its most hawkish member. To put a spin on an old mantra, this Fed isn’t even thinking about thinking about cutting rates.

Read my beak. No pause. No pivot. No put. Not until the job is done.

A couple of hours ago, I listened to an interview with Kansas City Fed President Esther George. She’s retiring this month, so she won’t be casting anymore votes, but here’s my quick-and-dirty summary (not a transcript) of her conversation with CNBC’s Steve Liesman.

SL: Markets vs the Fed. Are you worried that financial markets are pricing in rate cuts?

EG: High inflation is going to require continued action. We recently moved our inflation forecast higher. The Fed will be holding strong until we’re confident inflation is coming down.

SL: OK, but markets aren’t listening.

EG: I see the fed funds rate staying above 5 percent for some time.

SL: What would you need to see to convince you that you’ve done enough and inflation is moving back down to target?

EG: Where we really see persistence in inflation is in services ex housing. We stay the course until we’re convinced that’s coming down.

SL: Is that well into 2024?

EG: It is for me

SL: Can we avoid recession?

EG: I’m not forecasting a recession, but we should be realistic that a sustained period of below trend growth—which the Fed is aiming for—doesn’t leave a lot of margin for error. Bringing demand down raises the possibility of recession.

SL: How worried are you that the economy is vulnerable to a shock that could cause recession?

EG: The global outlook poses a certain risk to the US.

SL: Some say you’re ignoring trends that inflation is coming down. Critics say the Fed is too focused on lagging indicators and not paying attention to coincident and leading indicators that seem to be telling us that we have already won the fight against inflation.

EG: There’s still a lot of money sitting on household balance sheets. If they hang onto that money, it makes it easier to bring inflation down. If they spend it, we’ll have a harder time getting inflation back down.

SL: Talk about the Fed’s plans for balance sheet reduction.

EG: It’s important that the committee follow through with quantitative tightening. We didn’t get very far last time we tried to unwind the balance sheet. We moved to an “ample reserves regime,” but this time we need to put duration back into the market

SL: Was QE a mistake?

EG: We experimented and still have a lot to learn about consequences of doing large-scale asset purchases.

SL: Did the Fed provide too much accommodations?

EG: It’s unclear.

SL: Doesn’t the fact that inflation surged mean you did too much?

EG: No. There was fiscal too.

SL: Should you have responded to the fiscal?

EG: Possibly. It’s an open question. Maybe we will learn that we should have leaned against it.

SL: Are you concerned about financial stability?

EG: You always have to be. But, I’m not worried we’re on the verge of something blowing up. But you have to think about the reach-for-yield implications of QE.

SL: What advice do you have for your replacement?

EG: Represent the interests of your district and try to do a good job.

I’ll be speaking to the Financial Planning Association of Greater Kansas City in a couple of weeks. As I have been arguing for months, my own view is that the risk of further rate hikes far outweighs any perceived benefit. But, as I wrote back in September, the rate hikes will continue until morale improves.

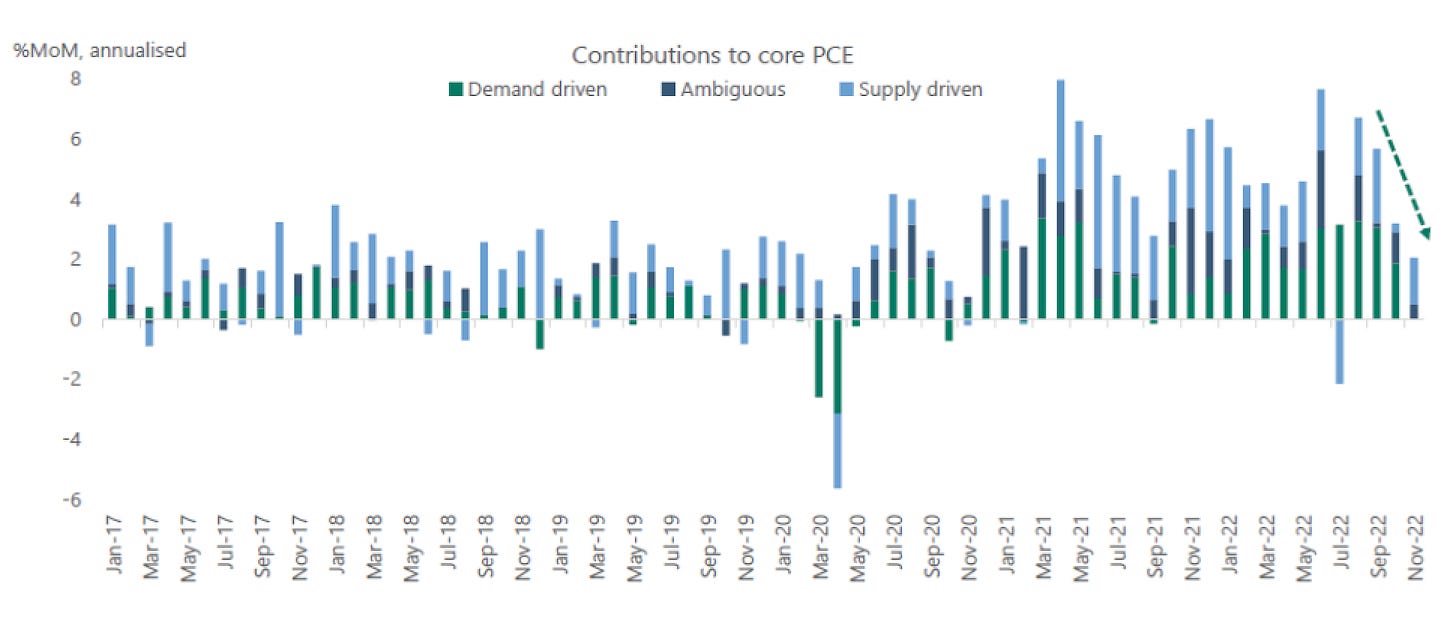

While the Federal Reserve Bank of San Francisco sees little trace of demand-driven inflation left in the system, Kashkari and the other voting members of the FOMC seem poised to make good on their rhetoric. They’re focused on wage growth, and they’re willing to trigger a recession if that’s what it takes to restore (even) weaker nominal wage growth.

This is a determined Fed.

I remember Mark Russell, the legendary comedian/satirist, reacting to Bush's "Read my lips--no new taxes." Russsell quipped: "Yeah, he'll raise the old ones."

Why is the FOMC myopically focused on wage growth, which is long overdue and deserves a long upside, instead of corporate profits/price gouging?!?!