Eighty-Seven Years and Counting

To preserve Social Security for future generations, we need to move beyond the usual "solvency" fights.

Social Security recently turned 87. You may have seen various people, including President Biden, wishing the program a Happy Birthday. Someone who didn’t mark the occasion by sending positive vibes was Sen. Ron Johnson (R-WI).

Instead of reflecting on the vital role this popular program plays in supporting tens of millions of seniors, their survivors, and the disabled, Senator Johnson has suggested that Social Security and Medicare be eliminated as federal entitlement programs and treated like any other discretionary program that Congress must vote to approve (or not) an annual basis.

I’ve long argued that Social Security’s Achilles heel is its so-called funding mechanism. I won’t repeat those arguments here. To understand my views, you can read Chapter 6 of my book or refer back to the series of posts I did earlier this summer (here, here, here).

History shows that as long as there are projected “shortfalls” in the program’s finances, Social Security is vulnerable to attack. The vast majority of Democrats will try, as they always have, to preserve the program by proposing various ways to reduce or eliminate the projected shortfalls.

More progressive members of the party will continue to push to lift the cap so that the higher-income earners don’t max out their contributions at $147k and to call for non-wage income (or wealth) to be subjected to the payroll tax withholding. So-called “moderate” Democrats might even join Republicans (as they have in the past) in supporting means-testing, raising the retirement age, or opening the program up to some form of privatization.

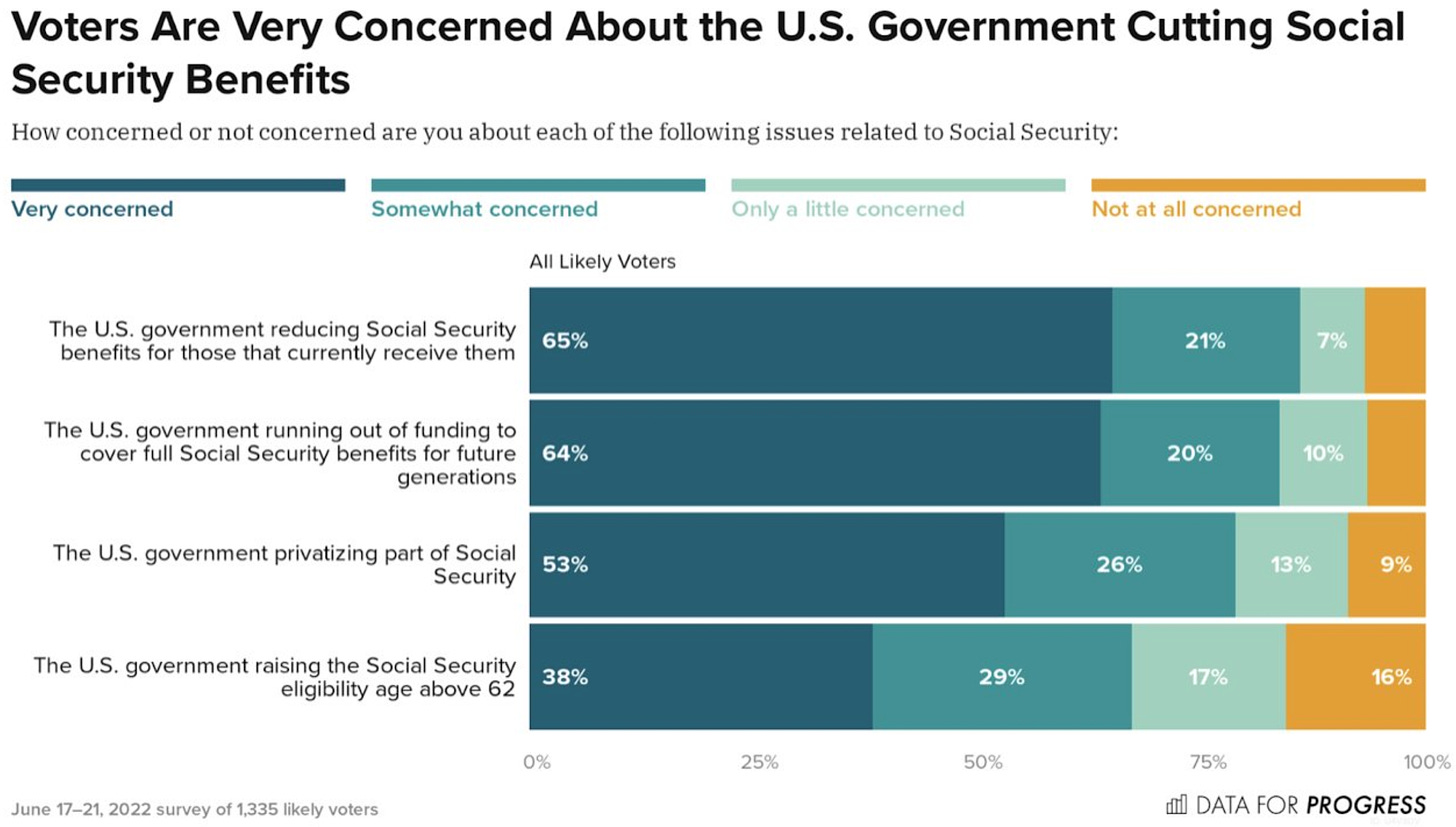

As Data for Progress reminds us, polls show that anything that amounts to a cut in Social Security remains extremely unpopular.

In spite of the program’s popularity, the push to undermine Social Security will only intensify if the Democrats lose one or both houses of Congress. Unfortunately, the whole debate over program “solvency” is rooted in a flawed understanding of our monetary system.

I’m going to post a rejoinder tomorrow. It’s a long screed from MMT economist Scott Fullwiler. It was originally posted on Twitter, but you can no longer find it there. Fortunately, Scott held onto a copy of the thread and agreed to let me feature it at The Lens. Every advocate of Social Security should read it.

The funding shortfall that is forecast can easily be solved by taking off the cap on the payroll tax . It's that easy. The fund currently has a balance of approx $2.8 trillion, there is no reason why it should be allowed to run down. The other thing that would benefit the fund and would be easily done is to invest some of the excess funds in the market. Currently the fund is exclusively invested in US treasuries, at an artificially low interest rate.

Isn’t double taxation when I have to pay taxes on my SS monthly benefits. My retirement income is very moderate?