Where to even begin?

In the span of about 48 hours, we’ve seen Biden’s first budget since losing the House, the second biggest bank failure in U.S. history, and a third Norfolk Southern train derailment.

The collapse of Silicon Valley Bank (SVB) is obviously dominating the news, and I’ll speak to that below, but I want to start with some good news. Yesterday’s jobs report.

The Good News

I joined Bloomberg TV to discuss the report at 4:00 pm ET. I saw a number of economists and market analysts referring to it as another “hot” report that could (or should) push the Fed to accelerate the pace of its next rate hike to 50-basis points. And that was after we learned that regulators had shut down SVB. Sheer madness.

The February jobs report came in “hot” only relative to expectations about the headline number. Instead of the 225k jobs the market was expecting, the economy added 311k jobs in February. But the report was actually pretty “cool” overall. Or, as I put it on Bloomberg, it was a “net disinflationary print” filled with good news.

Here are some of the things that jumped out at me:

Jobs are coming back in the sectors where we desperately need them

healthcare, childcare, social services, K-12…

The vast majority of jobs were created in the lowest-paying sectors

Labor supply is responding to demand!

Third month in a row of rising participation rate

The unemployment rate ticked up (still ~50 year low) from 3.4% to 3.6% almost entirely due to a BIG jump in the labor force (+419K)

The employment-to-population ratio for prime-age (25-54) workers is basically back to pre-pandemic level after 3 yrs (It took ~12 yrs to restore prime-age EPOP after the Great Recession. Major win for fiscal policy!)

Nominal wage growth and hours worked continue to decelerate, confirming further labor market cooling

Quits are basically back to pre-pandemic levels

At 2.9 percent, annualized average hourly earnings are clearly NOT adding to inflationary pressures

Nominal wage growth has been trailing—not leading—inflation most of last 16mo

Wage growth is slowing but inflation slowing faster so real wages rising for lower-income workers (Good!)

It is time to put the ridiculous wage-price spiral fears to rest

If you were in the “soft landing” camp, this jobs report should have put a spring in your step

Except, of course, for the collapse of the nation’s second-largest bank and ensuing worries about contagion.

The Bad News

Most of the stuff I’ve been reading suggests that worries about contagion from the blowup of SVB are overblown. I hope that’s right. But even if the meltdown doesn’t “spill over” into the broader banking system, there is a reckoning coming.

As Alan Blinder argued back in January, the “stunning drop in inflation” we’ve witnessed (now) over the last 7 months occurred mostly organically, as the economy shook off many of the supply-side problems that drove inflation in the second half of 2021 and the first half of 2022.

I mentioned Blinder’s op-ed in the Bloomberg interview, and I think too many people are still forgetting about the lagged effects of monetary policy: In spite of what we’ve witnessed so far, most of the effects of the Fed’s rate tightening haven’t even been felt yet.

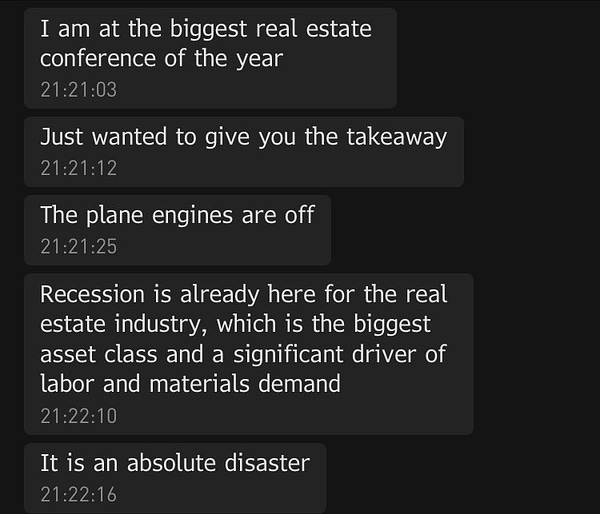

Of course you can point to real estate, crypto, FTX, Silvergate, the stock market, tech layoffs, etc. I’m not arguing that the rate hikes haven’t taken a toll on asset prices, financial markets, or in certain parts of the real economy.

What I’m saying is that the rate hikes don’t flush through the system quickly or evenly. It’s not like flipping on a light switch that sends the cockroaches scrambling for the darkness in unison. Even super aggressive tightening—like hiking 500-basis points in the span of twelve months—takes time to catch people out. It works more like a dimmer switch that exposes more and more financial weakness with each passing day.

So what I’m saying—and what I have been saying for months—is that the Fed will eventually break something. And while I’ve recently shared some of Warren Mosler’s thinking about how the rate hikes might—counterintuitively—be supporting the economic recovery, I’ve made clear that my own view is that the Fed’s excessive tightening (coupled with historic deficit reduction) was likely to tip the economy into recession and end up breaking something in financial markets. I am a Minskian at heart.

I’m not suggesting that the rate hikes alone drove the collapse of SVB. It seems clear that there were also regulatory failures as well as internal failures from a risk-management perspective. I have neither the time nor the expertise to adjudicate that debate. For differing views on these matters, you might check out Matt Levine, Dan Alpert, and Chris Whalen. Another macro trader I like very much, Alf, did a deep dive into the SVB blowup and promises to have a full write up on his Substack tomorrow.

Regardless of the trigger, the big question on everyone’s mind right now is whether the failure will escalate or whether US and UK regulators will be able to ring-fence others from the turmoil surrounding the collapse of SVB.

While not warning about SVB specifically, Chris Whalen painted a pretty clear picture of the coming chaos in his newsletter last month.

In the world of dynamic stochastic general equilibrium (DSGE) models, where FOMC members spend most of their time, the real world is an abstraction. It may seem reasonable to FOMC members to move short-term rates 500 basis points in 12 months, but in the world of secured finance, which is governed by short-term interest rates, such a magnitude change implies a disaster.

Chris warned that the Fed’s rate hikes were already causing problems for “nonbank lenders from mortgage companies to commercial real estate conduits [who] are facing negative carry on their assets.” As a result, “many firms are simply choosing to liquidate positions and shut-down.” If you read his piece, you’ll see how it plays into to the dynamic described here.

Markets are now pricing in a 25-basis point cut in December. Depending on the pace at which it all unravels, that might be an optimistic outlook.

As always, thank you for reading and enjoy the weekend. Oh, and remember to “spring forward” tonight. We lose an hour. More bad news.

Why is the Fed still selling treasury bonds? Why not just pay guaranteed "Interest On Excess Reserves"--fully guaranteed by the federal gov't, and be done with it? We see what happened to Silicon Valley Bank. They protected themselves by purchasing bonds at a very low rate of return, but the Fed turned around and screwed them by raising interest rates so quickly that they had no time to hedge their position. Does anyone else think this is just stupid?

And why on earth would any company place their funds in a bank that couldn't fully insure their deposits? This is beyond crazy. Lots of people are going to be unnecessarily screwed out of their paychecks--and for what? Because the Fed wants the space to maintain its target interest rate?

The "natural interest rate" is zero if the Fed doesn't get involved. If excess currency is allowed to stay in the banking system (in other words, if the Fed doesn't sell bonds to remove excess currency from the banking system), then no bank will ever have the need to borrow money from any other bank to settle its accounts. Lots of money + no borrowers = 0% interest rate.

So what happens in a world of zero interest rates? The conventional wisdom is that investors will take their money elsewhere. Really? As we've just seen with SVB, depositers there would gladly have paid a NEGATIVE interest rate to protect their money. The fact is, owners of US dollars HAVE NO LEVERAGE. They will accept any interest rate--positive or negative--that the Fed offers. They have nowhere else to go.

This leaves the question of what happens when inflation rears its ugly head and, because the interest rate is already zero, the Fed has no operating room to affect the economy. This is true. But that's when the federal gov't has to step in and impose temporary price controls until supply can catch up with demand. So the question becomes: Does the gov't want to put millions of people out of work or does it want to figure out a price control regime (admittedly a thorny problem) that imposes less economic damage on its citizens?

Gr8 post, I hope it is correct. One mystery to me with the recent bank failure is why didnt the Fed bail this bank out. The story goes that the bank conservatively invested in safe long term treasury bonds to deal with the ocean of reserves they had on hand. They are a venture capital bank, and not a normal bank, in the sense that they get lots in and lots can potentially go out in the short term, but they are a high risk long term banking enterprise. They are not a short term retailer, like the big banks. So, they have these risk free, low interest bonds which with the high interest of the current market, are not of great value in this short run, but in the long run, the investments are solid. The fed has the repo market and are the lender of last resort, why not loan this bank the funds necessary in the short run to to preserve its value for the long run. We need the venture capital, we dont need well balanced retail banks. We have the Fed. So I noticed that over the last year, the Fed Repo market is above $2T daily, and pretty stable. This means that the Fed is giving our cash and taking back securities. Why not do the same for this bank. Me thinks that pure capitalist greed has raised its ugly head and will destroy what is left of the lesser banking systems. Welsfargo wants to buy the SVB investments for pennies on the dollar, rather than help them by lending them excess reserves during this short term crisis facing the nation. The contagion is the greed of the Major Banks (we know who they are), supported by the Fed. Its time to fight back and demand that the FED save the children and let the adults fend for themselves. Sorry, too much morning coffee.