It’s been one week since we learned that President-elect Donald Trump will nominate hedge fund manager Scott Bessent as Treasury Secretary. Considered a “safe pick” by some, the nomination has drawn praise from both Steve Bannon (Trump’s longtime advisor) and Jason Furman (President Obama’s senior White House economist).

I hadn’t paid all that much attention to Bessent until he emerged as a frontrunner for the job, but I’ve learned some interesting things about him, thanks in part to macro strategist Dario Perkins.

The interview, which took place in October, was part of the 2024 Entering the Fall Thought Leadership Series. I watched the whole conversation, and I want to comment on a couple of things, especially since Bessent invoked Modern Monetary Theory (MMT) in response to a question about inflation and whether the Fed waited too long to raise interest rates.

Bessent suggested that Powell may have been reluctant to hike sooner because President Biden hadn’t yet committed to giving him another term at Fed chair. Let’s leave that not-so-subtle accusation aside. He then complained that the Fed, which waited until March 2022 to raise interest rates, was “still doing full-blown QE until February 2022.” By that point, consumer prices (CPI) were already up 7.9 percent from February 2021. Bessent said:

The Fed could have stopped it. Instead, the Fed monetized…Someone asked me yesterday about MMT. And I said no, we’ve had MMP. We’ve had Modern Monetary Practice. The Fed actually engaged in Modern Monetary Practice.

Apparently, Bessent thinks MMT is something governments “engage in” when the monetary authority holds down interest rates and conducts large-scale asset purchases (buying government bonds and mortgage-backed securities) while the fiscal authority ramps up the deficit.

In reality, MMT is a framework for analyzing monetary operations and the mechanics of government finance. As I’ve written before, MMT has nothing to do with QE.

Bloomberg’s Joe Weisenthal explained in his newsletter back in 2021 what people are getting wrong when they talk about putting MMT into “practice.” Here’s Weisenthal:

Since Bessent is being asked about MMT, it would be helpful if he understood that MMT is not: QE + aggressive fiscal policy. Now let’s turn to his views on the rate hikes.

Bessent Sees Rate Hikes as Inflationary

Bessent was asked whether inflation is “always and everywhere a monetary phenomenon.” He declined to pin the 2021/22 outbreak entirely on so-called “monetization.” In fact, he told a pretty conventional story about inflation being driven by a “multitude of factors,” many (if not most) related to supply-side shocks. Still, he claims the Fed was “complicit” in pushing inflation higher because it failed to counteract the fiscal stimulus from the American Rescue Plan (ARP) and the Inflation Reduction Act (IRA) by tightening monetary policy quickly enough.

And then things got interesting.

There was a lot of discussion about the “haves” (those who already have assets or generate income off those assets) and the “have nots” (those struggling to acquire assets). The host, Michael Green, noted that the “bottom 50% is getting crushed” while the rate hikes were making “the upper-class extraordinarily well-off in this cycle.” This is something that MMT economists have been pointing out for years, but it has only gotten mainstream traction more recently. Bessent agreed that the rate hikes have helped to create what he called a “bifurcated equilibrium” which he said was “distributionally unhealthy.”

And then he described his “divergent view” on Japan, which relaxed its control over the yield curve, allowing interest rates on longer duration government bonds to trend higher. Here’s what he says could happen now:

I believe that the Bank of Japan is actually going to stoke growth when they raise rates. This could really surprise. Because households are net savers. Corporations are net savers. There’s this famous line that Ben Bernanke talked about that we could just drop money from a helicopter. Well, raising rates is like a transfer from the Bank of Japan into household and corporate accounts….

I think we cannot dismiss the idea that the economy actually accelerates as they raise rates.

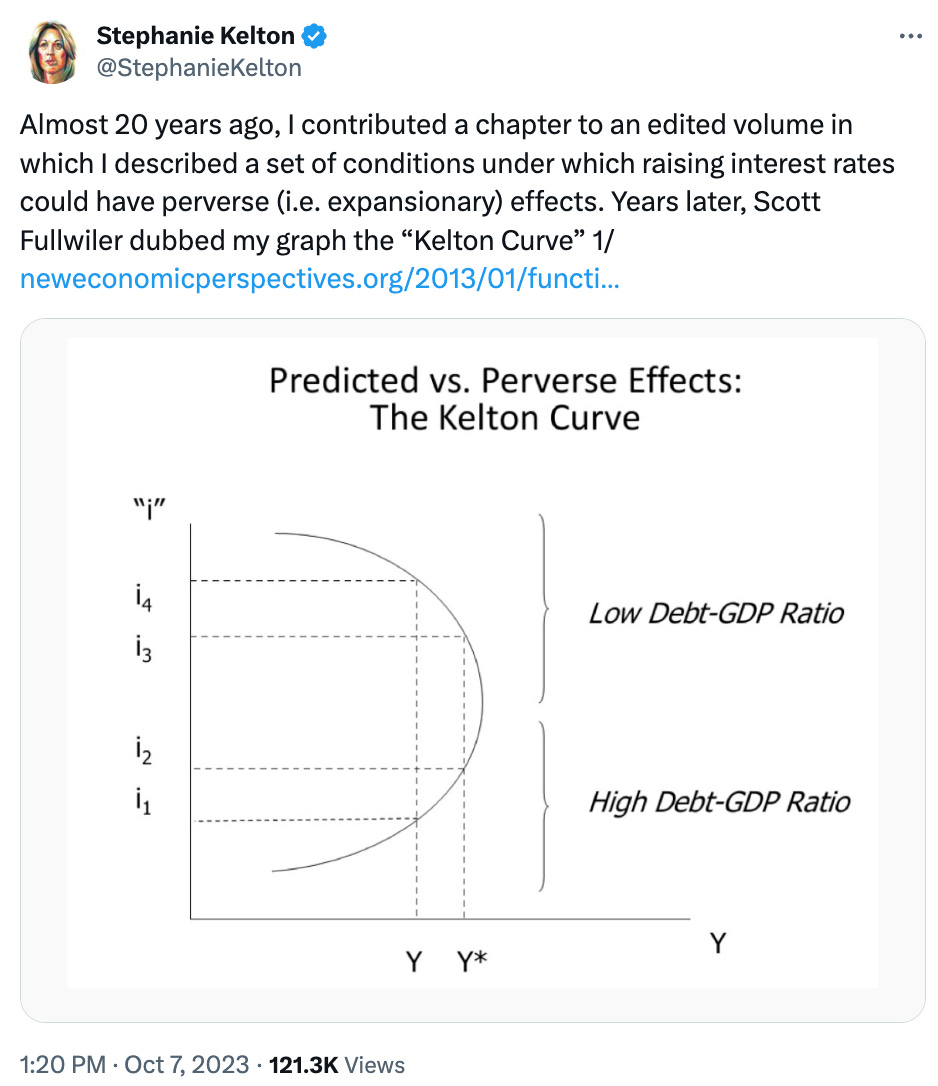

MMTers have been describing these dynamics for decades, and we’ve been ridiculed for even raising the possibility that rates hikes could be (net) stimulative at the macro level. Check out this thread.

If you’re interested in this kind of stuff, you should watch the entire interview. There are several other places where Bessent lays out MMT-adjacent views (Minskyian financial fragility, fixed vs floating exchange rate regimes, critique of QE…). What isn’t clear (though I can imagine how he might respond) is how he squares his argument that the Fed waited too long to raise rates with his positions that rate hikes generate “unhealthy” distributional effects, pose risks to financial stability, and potentially have the opposite of the intended macro effects.

Give Scott Bessent credit for calling out the fed rate hikes for its regressive stimulus for the rich while hurting the poor. That said, its still beyond silly to see people still think MMT and QE are one and the same. Also Joe Wiesenthal's piece about MMT is a must read too.

Fascinating and not quite what I had been anticipating. And thanks very much for the interview link.