Last week, I wrote about Trump’s executive order to begin the process of establishing a sovereign wealth fund (SWF) for the United States. The administration sees it as a way to turn a relatively small pile of cash into a much bigger slush fund, which could then be used to invest in domestic industries, buy TikTok, or whatever. But since the U.S. runs neither budget surpluses nor large trade surpluses, everyone is wondering where the Trump administration expects to “find” the small pile of cash to seed the SWF in the first place.

Trump has floated the idea of directing revenue from tariffs into the SWF, and the fact sheet that accompanied his executive order pointed to a “vast sum of highly valued assets that can be invested through a sovereign wealth fund for greater long-term wealth generation.” To turn those highly valued assets into cash-on-the-books, Treasury Secretary Scott Bessent said the U.S. will “monetize the asset side” of the federal balance sheet.

As Gillian Tett reported in the Financial Times yesterday, one of the assets that might be slated for the monetization scheme is gold. The idea is that the U.S. Treasury could revalue America’s gold stocks, which are currently valued at $42.22 per troy ounce in national accounts. If they were accounted for at current market values—around $2,800 an ounce—Tett reports that “it could inject $800bn into the Treasury General Account (TGA), via a repurchase agreement.” By topping up the balance in the TGA, the move would also create additional breathing room with the debt ceiling limit (since Treasury could issue fewer bonds).1 Or as Larry McDonald put it in The Bear Traps Report on February 2, “it's time to get creative around the asset side of Uncle Sam's balance sheet.”

Time to Get Creative

Tett acknowledges that this is all highly speculative. At this point, Secretary Bessent hasn’t indicated that revaluing America’s gold stock is part of the president’s plan. But she suggests that investors would be wise to take the prospect seriously, because “Bessent has an incentive to be creative, given the scary fiscal hole.”

If you’ve followed this newsletter for some time, then you know that I don’t subscribe to the (dominant) view that the U.S. is facing a “scary fiscal hole.” Unfortunately, the current Trump administration (unlike Trump 1.0) hasn’t adopted the more cool-headed understanding that comes from embracing an MMT-Functional Finance perspective on debt and deficits. So they’re looking for creative ways to stitch up the numbers—tariffs, mass layoffs, monetizing assets, etc.— in order to show that they’re addressing the “scary fiscal hole.”

I’d much rather see Trump calling out the genuine fake news that passes for informed commentary in virtually every corner of the financial press. So I’ve got a creative idea of my own: issue an executive order to ban the use of the words “debt” and “deficit” as they relate to the government’s finances in all federal communications and rename them.

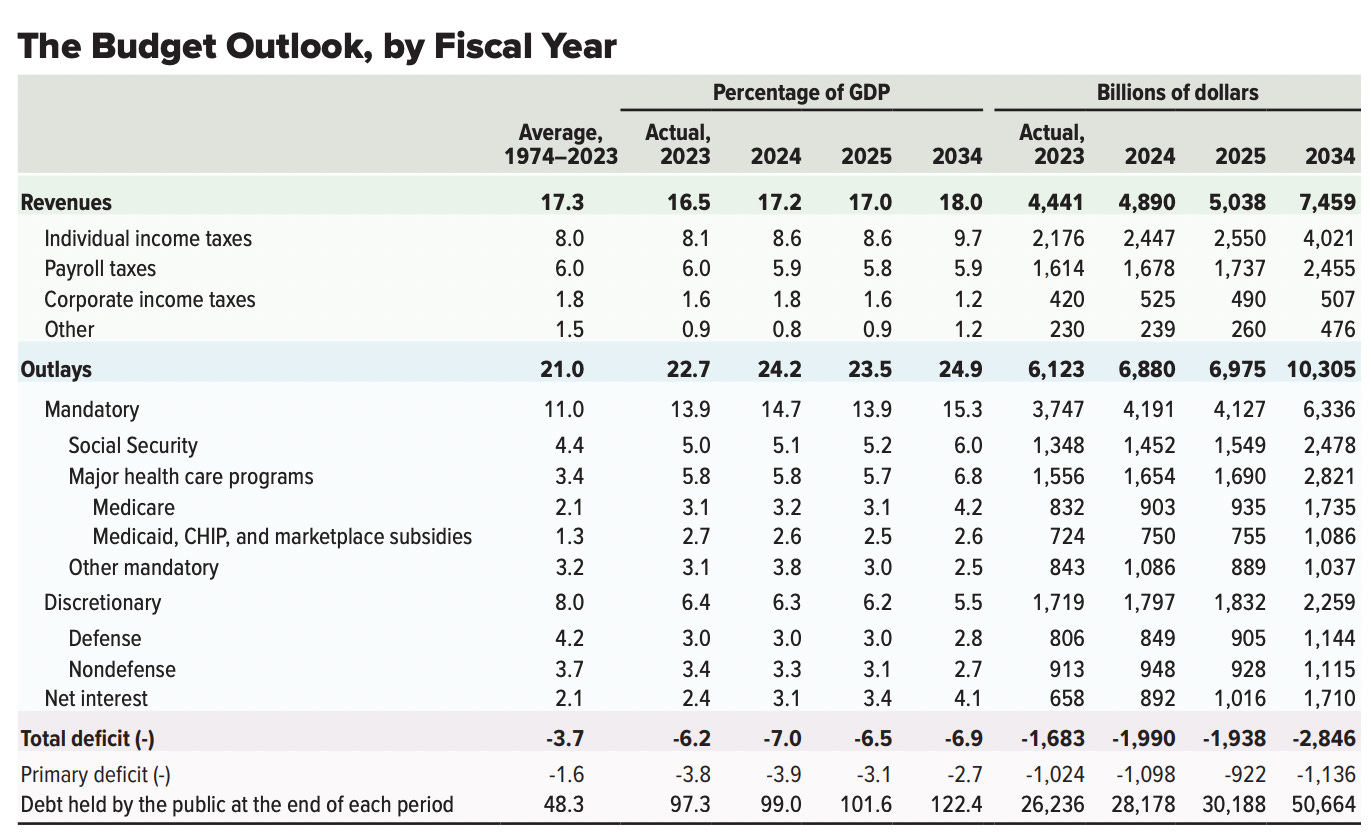

So, instead of the Congressional Budget Office (CBO) producing a table like this:

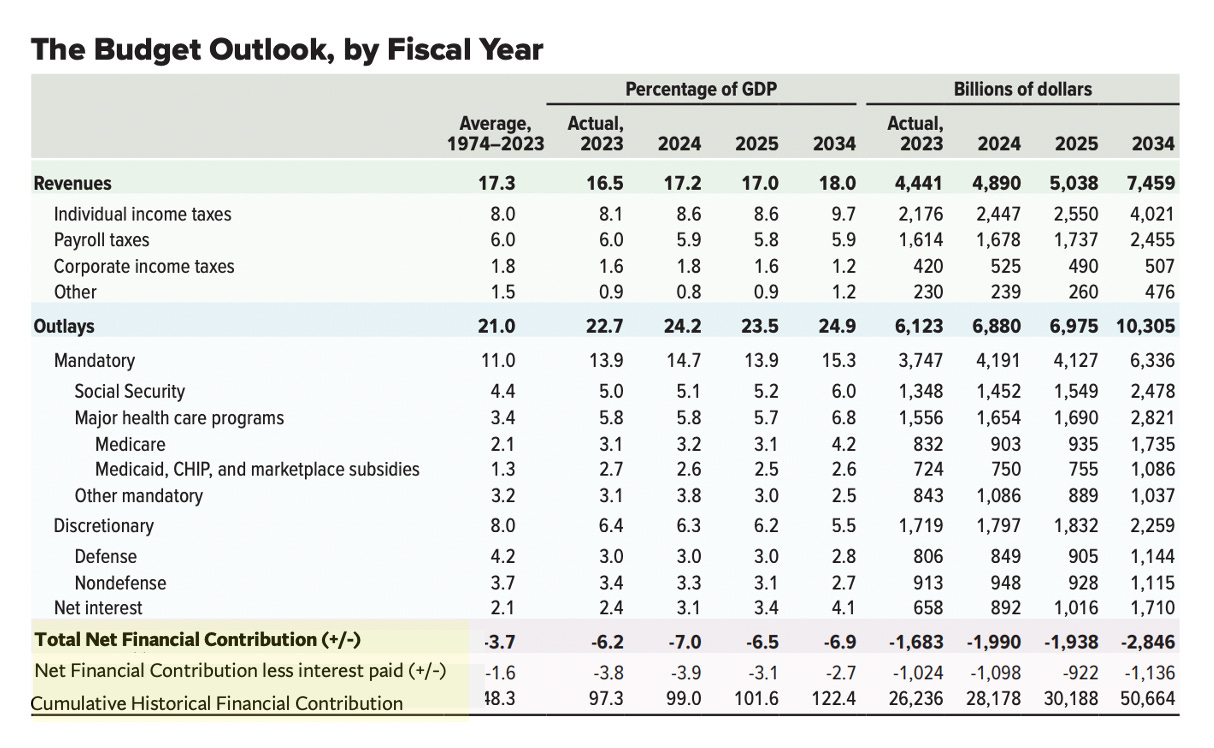

It would report something like this:

Unlike renaming geographic landmarks, this would not be some petty gesture. It would tell people what actually happens when outlays exceed revenue. It would explain that the government is adding dollar-denominated financial assets to the non-government sector. Over the entire sweep of history, the federal government has put nearly $29 trillion into our hands. That means that over the centuries, the federal government has contributed—in total—enough to buy about one year’s worth of GDP. Don’t call it the “public debt.” Call it the government’s cumulative financial contribution.

Once the federal government assigns the debt and deficit more accurate and meaningful names, the financial press will follow. And then we can stop being tormented with headlines and commentary and “fiscal holes” and “debt crises” and get down to real economics.

The idea appears to have been the brainchild of former Credit Suisse strategist, Zoltan Pozsar.

The key issue is that the Felon wants to have the funds in the executive branch so he doesn't have to go to Congress for appropriations. Also "sovereign" usually refers to a monarchy which is why the US hasn't done anything like this.

Thoroughly enjoy reading your perspective on economics. I wish there could be a broader consensus on MMT to ease the fear factor from the politicians!