Well, they did it. For the second time in two years, democrats in the Senate held together to pass a fiscal package via a process known as budget reconciliation. The climate, tax, and health care bill—dubbed the Inflation Reduction Act (IRA)—received its deciding vote (51-50) from Vice-President Harris on Sunday afternoon. Every republican voted against it. Now it’s over to the House of Representatives, where it is expected to pass later this week, and then on to President Biden for his signature.

Unlike the $1.9 trillion American Rescue Plan (ARP) that democrats passed in March 2021, the IRA is fully “paid for.” Actually, because of Senator Manchin, it is more than “paid for,” meaning that it is expected to reduce the deficit by around $300 billion over the next decade. Democrats—and many economists—maintain that the legislation will help to bring down inflation, in part of the deficit reduction. I’ll have more to say about that in an upcoming post. For now, I just want to quickly reflect on how this all played out.

When I launched this newsletter in August 2021, I dedicated many of my early posts to the unfolding “pay for” debacle (see here here here and here). Back then, democrats were hoping to move forward on an agreed-upon budget resolution that would have allowed them “to pursue a sweeping $3.5 trillion reconciliation package that would expand Medicare benefits, boost federal safety net programs and combat climate change.” Together with the bipartisan infrastructure bill that was being crafted alongside the Build Back Better Act, “every major program” Biden had endorsed was potentially within reach.

By September, it was becoming clear that Democrats would struggle to come up with the votes to pass a $3.5 trillion package. President Biden had been clear from the beginning that his plan would not add “a single penny to our deficit” and also that “no one making under $400,000 will see their federal taxes go up. Period.”

The problem, it turned out, is that Biden wanted to raise too much revenue by raising too many different taxes. Despite what many in the administration had long believed, the votes simply weren’t there. Neither Sen. Joe Manchin (D-WV) nor Sen. Krysten Sinema (D-AZ) supported the slew of tax increases the president had outlined to “pay for” his agenda. To get a deal done, both senators would have to be persuaded to vote with the rest of their colleagues in support of a reconciliation bill. As the window of opportunity began to close, I wrote this post, urging democrats to “pick the low-hanging revenue fruit and grab some easy cost-savings” to try to win over the holdouts and get something done.

I made it clear that my recommendations were not inspired by “MMT budgeting” but rather designed to scratch the necessary itches—i.e. be fully “paid for” without raising taxes increase on the “middle class.” In the spirit of making progress, I mapped out what I considered the path of least resistance. I suggested trying to forge agreement around just three “pay-fors.” Here’s what I recommended almost a year ago:

Enforce existing tax laws: This has to be the lowest-hanging “pay-for” fruit on the tree. Lawmakers could have used it to offset the cost of the bipartisan infrastructure bill that passed the Senate last month, but Republicans wouldn’t go for it. So this big, juicy “pay-for” is now available for use in reconciliation. And it doesn’t even require a tax increase. All you have to do is enforce the laws that are already on the books…provide the IRS with an additional $80 billion to improve taxpayer services and to help the agency go after high-income tax cheats.

Raise the corporate income tax rate to 25 percent and impose a 15 percent global minimum tax on ‘book income’ for corporations with at least $100 million in annual income: Republicans lowered this rate from 35% to 21% as part of the 2017 Tax Cuts and Jobs Act (TCJA). Vermont Senator Bernie Sanders (and a relatively small group of other Democrats) wanted to restore the rate to 35 percent. That never stood a chance. Biden’s plan called for an increase to 28 percent, which would have raised about $1.3 trillion over 10 years. But that also met with too much friction. What appears to have broad support is a 4 percentage point increase in the corporate tax rate. Raise the rate to 25% and Democrats can count another $600-$700 billion in offsets. And if Democrats want to stop large, profitable corporations (like Nike and FedEx) from paying nothing--zero--in federal income tax, then they can support Secretary Yellen’s push for a global minimum tax. That could generate another $200-$300 billion in offsets.

Let Medicare negotiate the cost of prescription drugs: The same legislation that expanded Medicare to include prescription drug coverage in 2003 also prohibited the federal government from lowering drug costs by negotiating prices with drugmakers. Apart from those who work in the pharmaceutical industry, those who lobby on their behalf, and those who benefit from their campaign contributions, almost no one thinks this makes any sense. Indeed, the Kaiser Family Foundation recently found that almost 90 percent of those polled would like to see Medicare negotiate drug prices. It’s wildly popular, and it generates hundreds of billions in offsets.

Lo And Behold, They Did It

The bill passed by senate democrats on Sunday afternoon includes more than $400 billion in spending on energy and health care and more than $700 billion in “pay-fors.” (The extra revenue gets attributed to deficit reduction.)

So how is the spending “paid for”? Democrats settled on a combination of: (1) IRS tax enforcement, (2) higher taxes on corporations, and (3) prescription drug pricing reform. They didn’t raise the corporate tax rate, and they didn’t opt for Secretary Yellen’s global corporate minimum tax, but they did establish a corporate minimum tax to ensure that corporations that report at least a billion dollars in annual profits pay at least 15% in federal income tax. And they added a 1% excise tax on corporate share buybacks. So it’s almost exactly what I mapped out nearly a year ago.

It’s unfortunate that it took so long for democrats to coalesce around a bill that makes important investments in climate and health care, and it’s unfortunate that the deal would have been impossible without making painful concessions to the fossil fuel industry. But, to paraphrase Don Rumsfeld, ‘you go to climate war with the senate you have, not the senate you might want or wish to have at a later time.’

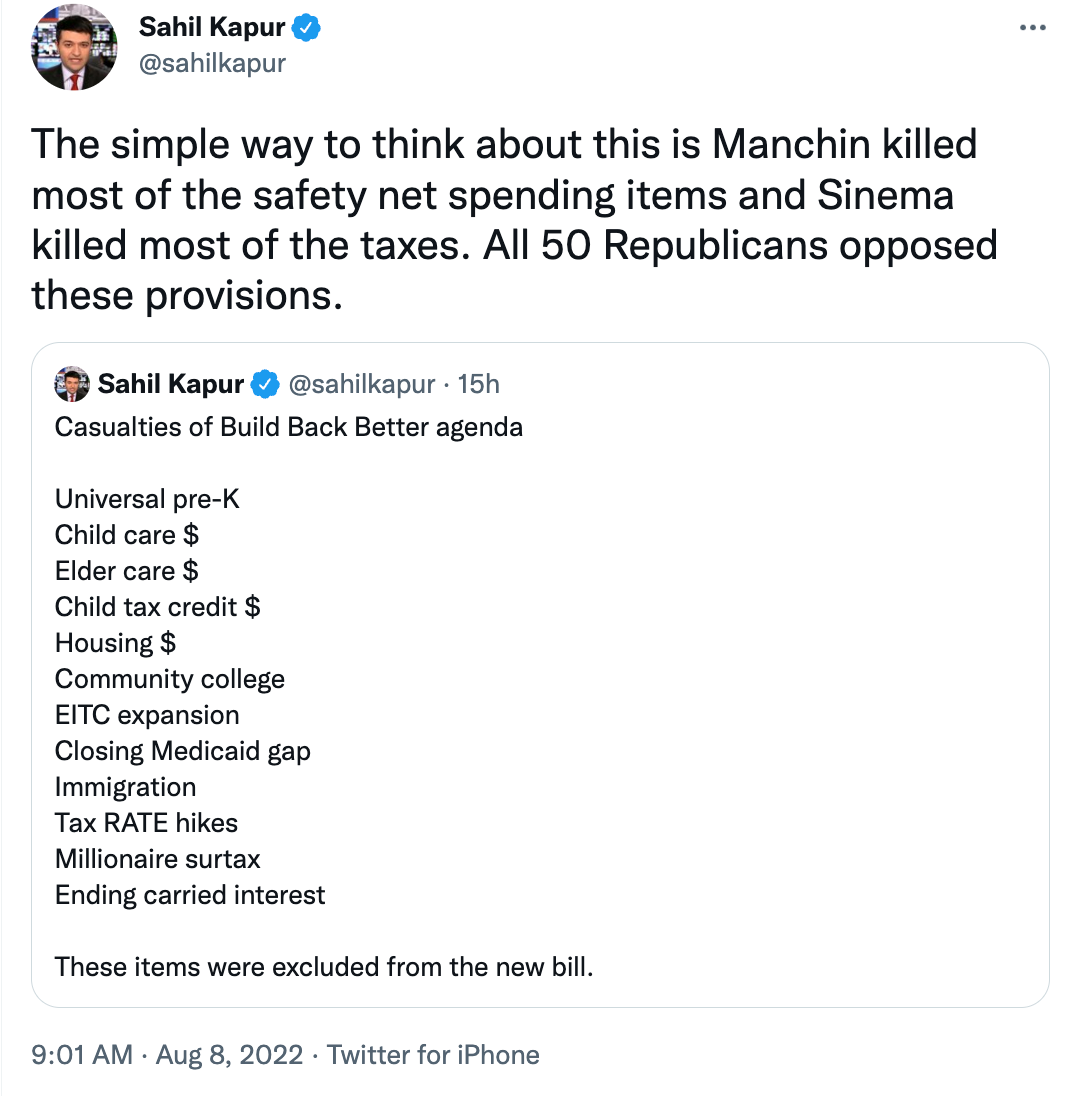

Although it is but a shadow of its former Build Back Better self, there is still a lot to celebrate in this bill. Even Vermont Senator Bernie Sanders, who was visibly frustrated heading into Sunday’s vote-a-rama, described it as “a major step forward in addressing the enormous climate crisis the planet faces.” He pushed for amendments that would have restored many of the provisions that were once considered within reach, but none of them were adopted. To build some of these things back into future legislation, Democrats will need to expand their majorities.

Let's assume we lived in a world that understood we don't need "pay for's".

Then,

Do we need to tax corporations at all, if we

1) greatly increase individual taxes for the wealthy corporate shareholders, executives, and all other super rich people to reduce their political power and the income inequality gap,

2) make lobbying illegal

3) make corporate donations to political parties and individual politicians illegal

4) eliminate individual influence on public policies by making it illegal to donate more than 20 bucks to political parties and politicians,

5) limit corporate executive pay to x% of the lowest paid employee (not sure what that % would be, but we can figure it out)

6) make it illegal to allow politicians who exit office to land cushy jobs or get freelance consulting gigs for corporations

7) require corporations to include an x precent of labor representative on their boards

8) enforce the above

Note that "corporations" should include any business entity including shell companies, proprietorships, non-profits, etc.

I got most of these ideas from reading a great book called "The Deficit Myth".

Ps. I didn't include regulations to enforce corporate behavior for society benefits since that would stretch the scope of the taxing corporations topic even more.

"...there is still a lot to celebrate in this bill."

So we're supposed to congratulate Democrats for bringing 51 water pistols to a 5-alarm fire? Anyone under the age of 40 is totally screwed.