A few days ago, Democratic Congressman John Yarmuth of Kentucky announced that after sixteen years in Congress he would not seek re-election in 2022. Yarmuth, who once considered himself a “Rockefeller Republican,” was instrumental in getting the $1.9 trillion American Rescue Plan to President Biden’s desk in March of this year. Since then, the formerly fiscally conservative Congressman has worked tirelessly to authorize trillions more.

As Emily Cochrane of The New York Times put it:

“[Yarmuth played] a leading role in shepherding President Biden’s sprawling domestic agenda through Congress…

He has also drafted the $3.5 trillion budget blueprint that Democrats pushed through over the summer to pave the way for Mr. Biden’s signature domestic bill addressing climate change, expanding health care and public education programs and increasing taxes on businesses and wealthy individuals.”

Supporting the Build Back Better agenda isn’t particularly noteworthy. Nearly every Democrat in Congress is fully on board with the president’s plan. What makes Yarmuth different is the way he talks about what Congress can afford to do. And why.

After years of listening to economists, CBO directors, fellow lawmakers, and others warn of an impending debt crisis, Yarmuth began to notice that reality kept evading the tales of doom and destruction. Years later, with an already fertile mind, the Congressman’s son introduced him to MMT.

You can listen to them talk about their journey to MMT in this recent podcast.

Based on my own interactions with lawmakers on the Hill, I would estimate that roughly one-third of Congress is now MMT conversant. By that I mean that they could articulate—in very general terms—that the federal government is the issuer of the currency, that its budget is not constrained like that of a household or private business, and that inflation (not solvency) is the relevant constraint on spending.

Congressman Yarmuth is more than generically conversant with MMT. He put in the time and effort required to really understand the framework. It’s the confidence that comes from mastering the MMT lens that made it possible for him to pursue this line of questioning with Acting White House Budget Director, Shalanda Young back in June.1 The following exchange occurs at the 3:03:40 mark.

Chairman Yarmuth: “We’ve been accumulating debt in this country for two-hundred-and-thirty-some odd years. Has anybody ever been asked to pay off their share of the debt?”

Acting Director Young: “No, Mr. Chairman.”

Chairman Yarmuth: “Is there any likelihood that that would happen?”

Acting Director Young: “No, Mr. Chairman.”

Chairman Yarmuth: “There’s a book out now called The Deficit Myth by economist Dr. Stephanie Kelton, and when she talks about the debt she says you shouldn’t think of it as the debt. You should think about that as the total investment the federal government has made in the United States people—the population— over the history of the country, minus taxes.

Acting Director Young: “It seems fair, and I would add that if we’re worried about the debt when it comes to investment we have to be concerned when it comes to consideration of tax cuts.”

I can’t recall a member of Congress casually flipping the script on the way we think about the national debt like that. And he didn’t stop there.

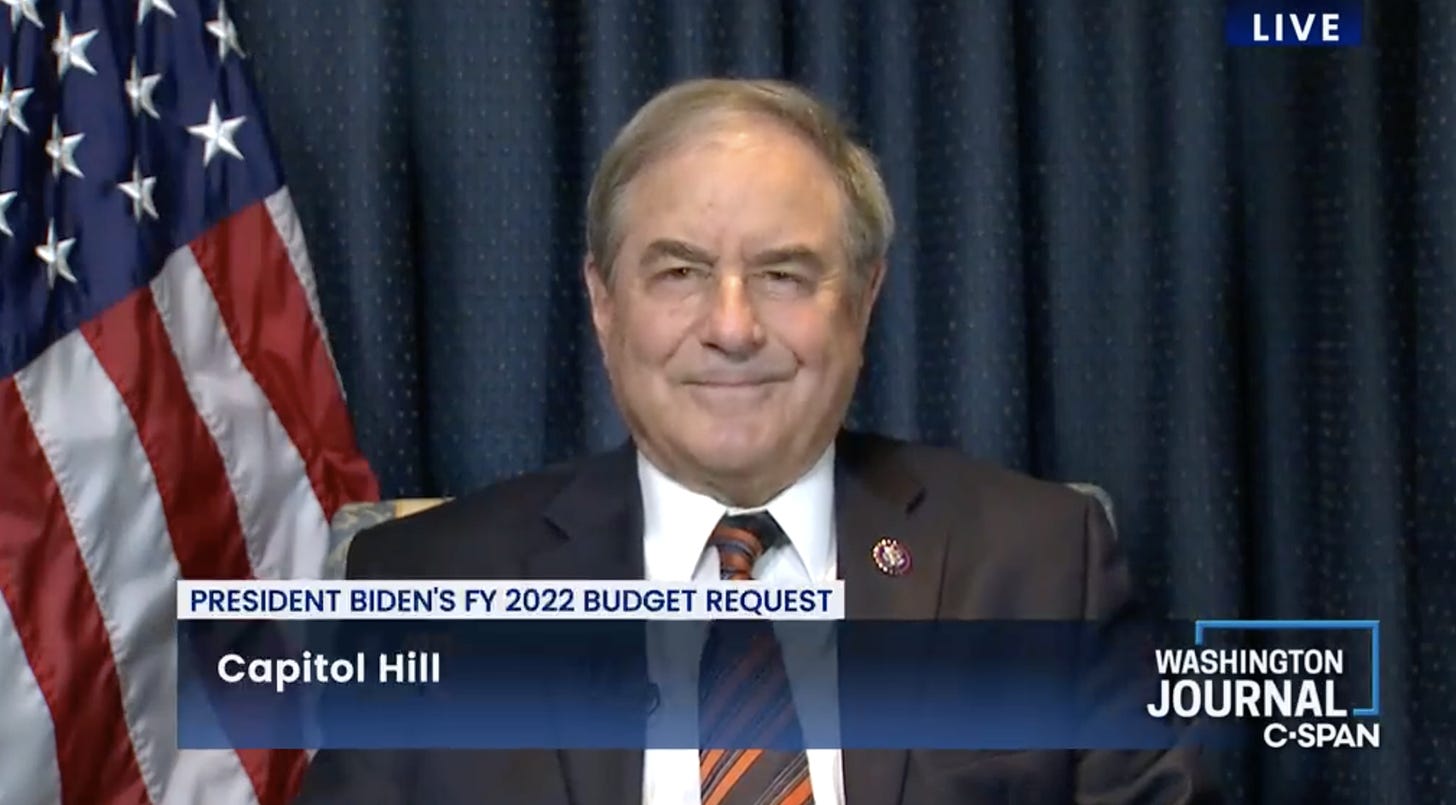

Later that month, in an appearance on C-SPAN, Yarmuth gave what I referred to at the time as “a master class on MMT.” The full (30 minute conversation) is well worth your time.

Following the C-SPAN appearance, The New York Times’ Peter Coy had this to say:

“If you happened to be watching C-SPAN’s “Washington Journal” on June 17, you saw a remarkable display of Modern Monetary Theory’s political influence. Representative John Yarmuth, Democrat of Kentucky, who is the chair of the House Budget Committee, gave a full-throated defense of the deficit-friendly theory to Washington’s sometimes skeptical viewership.

The influence of Modern Monetary Theory in Congress is growing faster than most people realize.”

It may not be clear to everyone just yet, but Coy is correct. The influence of MMT is growing faster than most people realize. In time, I expect to see many lawmakers giving it their full-throated support.2

If you find it refreshing to hear this sort of level-headed candor from an elected official, then join me in thanking Chairman Yarmuth for his service. And celebrate by pouring one out for the founder of the Congressional Bourbon Caucus and the most courageous Deficit Owl in Congress.

If you listen to his opening remarks, you’ll hear him defend the Biden agenda as something that would make vital investments in our economy 👍 and “set our nation on a fiscally responsible path” 👎 . That last bit isn’t consistent with MMT. It’s a throwaway line that merely echos what the White House and the Treasury Secretary have been saying in an effort to claim some kind of fiscally responsible moral high ground.

The climate crisis demands large-scale investments, and the time to act is now. I don’t personally see how we achieve the scale of intervention that is necessary without MMT.

Thank you so much for adding the Macro n Cheese to this blog post. Yarmuth and his son are national treasures.

Stephanie Kelton writes, "Based on my own interactions with lawmakers on the Hill, I would estimate that roughly one-third of Congress is now MMT conversant."

How do we raise that ratio from one-third to at least one-half? Do we send every member of Congress a copy of The Deficit Myth? Should we develop a district-by-district campaign to educate Congress members and their staff? Should we develop a scoreboard (http://lerner-minsky.org/resources/functional-finance-scoreboard.pdf) to rate Congress members on their MMT-conversancy?