I woke up expecting to spend the entire day working on my new book. Instead, I sat around agitating over something I found in my inbox. It was Bloomberg’s Weekend Edition, and it began, “This week we’re looking at scenarios for a US debt crisis…”

My previous book, The Deficit Myth, came out right in the middle of the pandemic. The U.S. and other national governments were spending aggressively to protect livelihoods and prevent their economies from collapsing. As large parts of the global economy shut down, growth slowed (or contracted), and government deficits (and debt) as a share of GDP exploded.

When The Deficit Myth became a New York Times bestseller, I was inundated with invitations to appear on television/radio, speak with the press, and meet with lawmakers in the US and around the world. Everyone seemed to be looking for a new way to understand—and appreciate—the fiscal firepower that was being deployed. With each new audience, I would explain why the conventional way of thinking about debt and deficits had led us astray.

It seemed to help.

The debt scolds retreated into their well-funded think tanks and complained about the fact that the popular mood was shifting against them. It was a much-welcomed reprieve. But it was never going to last.

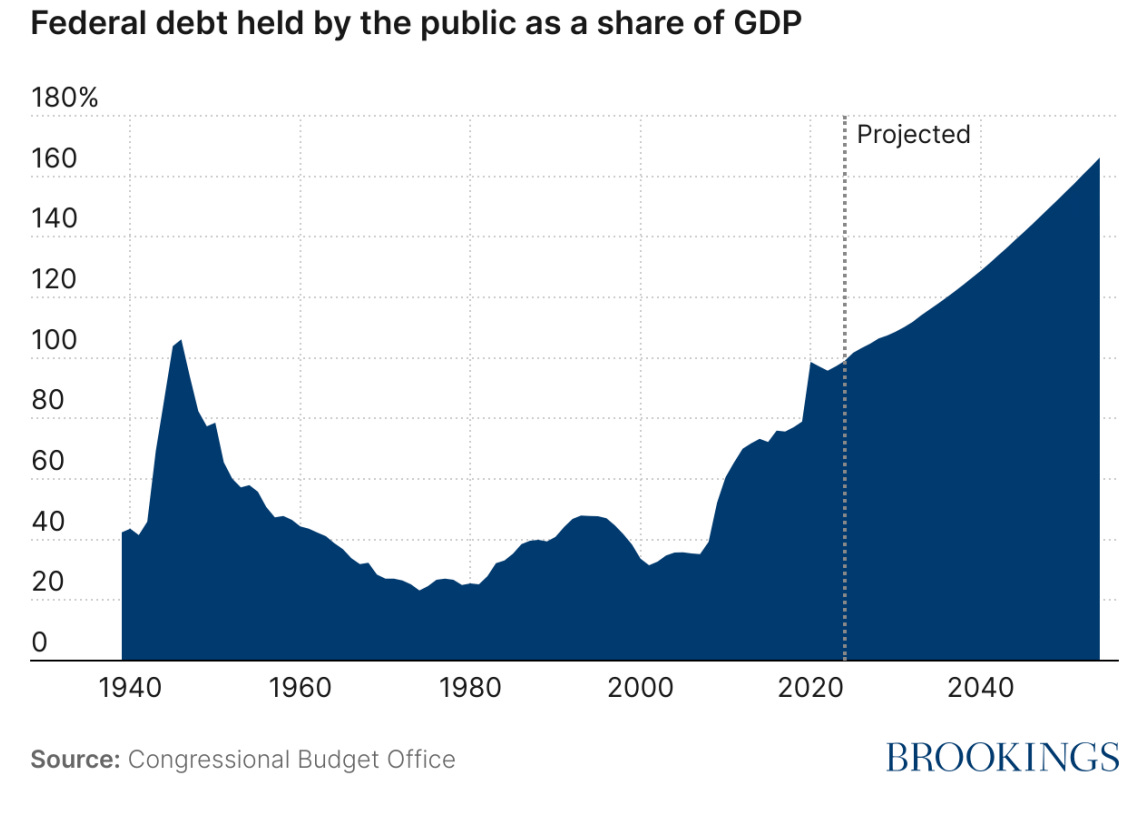

As Bloomberg demonstrated this morning, very large numbers with lots of zeros and scary images of the projected path of U.S. government debt are just too tantalizing. So, Bloomberg covered a new report from the Brookings Institution titled Assessing the Risks and Costs of the Rising US Federal Debt. It reproduces the projected path of government debt from the Congressional Budget Office (CBO). Yikes, right?

The report concludes that while America’s debt is certainly a problem, a full-blown sovereign debt crisis appears “unlikely.” It’s the typical, warmed over, things-are-bad-but-there-is-a-way-out-of-trouble-if-we-get-our-fiscal-house-in-order sort of paper. CBO has been issuing a version of the same warning for decades and so have economists on both sides of the political spectrum. (Democrats vs Republicans)

Meanwhile, the so-called national debt remains nothing more than a historical record of US$ that have been spent by government and not taxed away from us over the centuries (i.e. part of our financial savings); the coveted r < g debt sustainability condition continues to hold; issuing Treasuries and paying interest remains a policy choice (not an economic imperative) so r < g can always be achieved by design; and the numbers used to generate CBO’s scary debt graph “are completely bogus.”

Why Now?

So what explains the renewed angst over government debt? Maybe it’s because the world’s richest man keeps tweeting that “America is going bankrupt.” Maybe it has something to do with the fact that House republicans are looking to raise the debt limit by $4 trillion while enacting sweeping tax cuts and beefing up spending on border and other priorities. Even with President Trump posting BALANCED BUDGET! and DOGE flipping over seat cushions to save a billion here and there, deficits are on the republican menu. Maybe journalists are frustrated by the slow news cycle. (LOL It’s definitely not that!) Hey, maybe it’s because the U.S. Treasury Department’s own website uses inapplicable and reckless metaphors to “explain” the national debt!

Whatever it is, I’ve done more interviews and been invited to write more columns on the “debt crisis” since the start of 2025 than I did in all of 2024. I’ll do what I can to calm the waters. Until then, I look forward to the next time the debt scolds are forced to retreat into their caves.

Thank you for doing what you can to bring some rationality to the conversation.

I’m always curious about who, apart from those seeking an excuse to cut “entitlements,” stands to benefit from this seemingly desired austerity. Stockholders? Bond holders? Gold hoarders? Cryptobros?