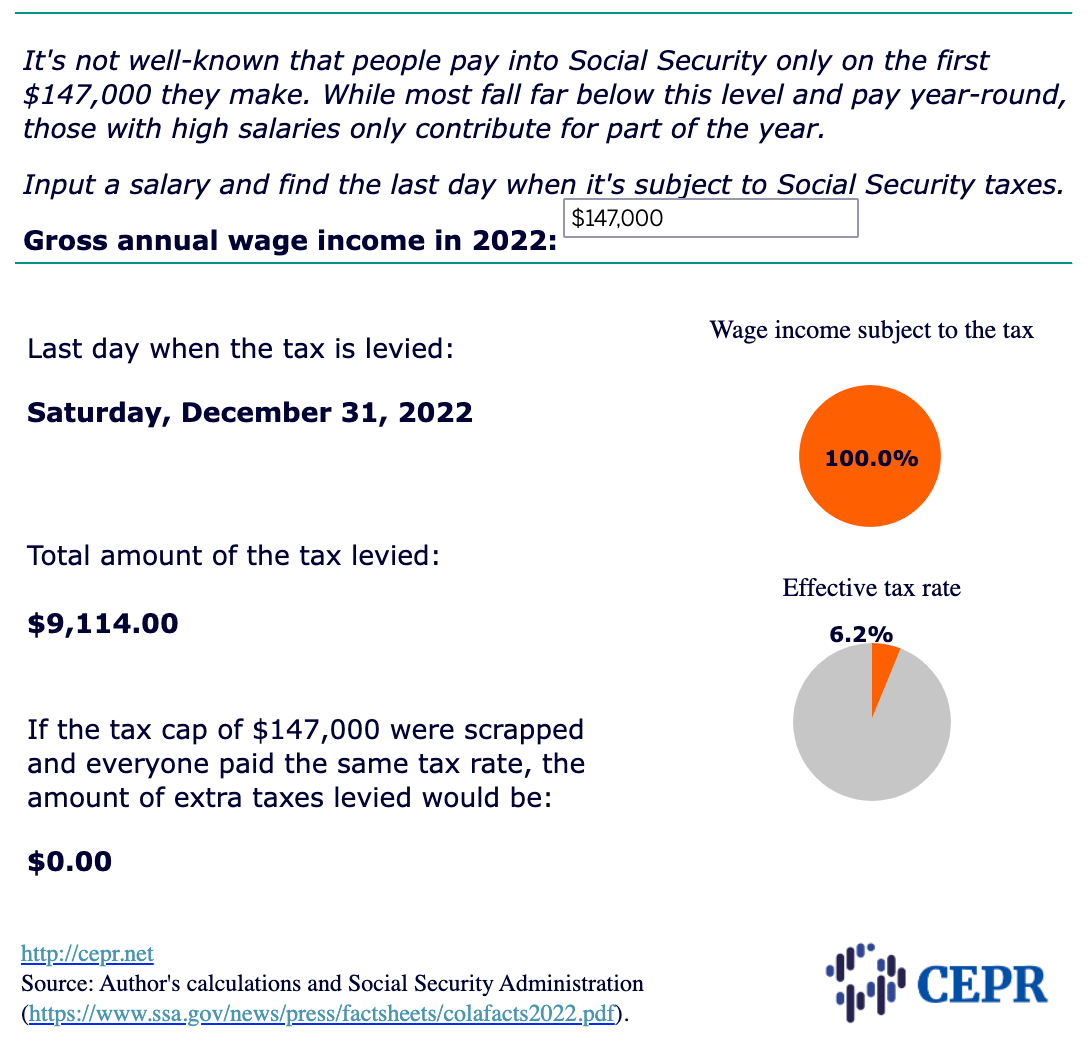

Happy 4th of July to everyone with $291,000 in gross annual wage income! Today is the last day you will contribute to Social Security. For you, Independence Day begins tomorrow, when your take-home pay will jump by 6.2 percent. That’s because only about half of your wage income (50.5%) is subject to the payroll tax withholding for Social Security.

For those of you with gross annual wage income of $147,000 or less, your contributions will continue through December 31. That’s because 100 percent of your income is subject to the payroll tax withholding.

Many democrats would like to change that. Here’s Senator Bernie Sanders (I-VT):

Today, absurdly and unfairly, there is a cap on income subject to Social Security taxes which is just $147,000 a year. That means that if you’re a multi-billionaire you pay the same amount into Social Security as someone making $147,000 a year.

It means if you make $147,000 a year or less you pay 6.2% of your income in Social Security taxes. But if you make 10 times more – $1,470,000 – you pay just 0.62% of your income in Social Security taxes. That may make sense to someone. It doesn’t make sense to me.

Sanders has introduced legislation to change the way the payroll tax withholding is applied. It won’t pass, but if it did, it would apply the Social Security payroll tax to all forms of income, including capital gains and dividends, for those who make over $250,000 a year. It would have no impact on 93.6 percent of Americans, but it would raise taxes on the wealthiest 6.4 percent of households.

As I’ve explained in recent columns, his motivation is simple:

[O]ur legislation would make Social Security solvent for the next 75 years, expand benefits for seniors and people with disabilities by $2,400 a year, and increase COLAs, which would lift millions of seniors out of poverty.

I won’t rehash the MMT line of argument here. Just click on one of my recent columns if you need a reminder. And if you want to play around with the numbers to see when Independence Day comes for people who occupy different rungs of the income ladder, just click here.

Have a safe and Happy 4th!

I have to admit that I find this whole discussion about social security taxes to be needlessly confusing. I get the idea that making citizens "buy-in" via payroll deductions gives them a sense of "ownership" that would provoke outright rebellion if ever taken away. The logic starts to break down when folks think that they're somehow entitled to their employers' matching contribution. Social security checks are just money that the gov't wants its citizens to have so that no one lives in penury! Let's not make it any more complicated than that.

I love Bernie, but I have no idea what he's talking about when he wants the rich to pay social security taxes on their full income. The rich don't need the protection against poverty provided by soc. sec., which is why the income level is capped. By all means tax the wealthy but do so with the understanding that the gov't doesn't need their money (it CAN'T and DOESN'T spend it!). The point of taxing the rich is to reduce their political power. Why muck things up by illogically trying to boost their payments into a soc. sec. system that simply doesn't need their money?

Having said this, I wonder if it would be useful to make a distinction between federal gov't money that's SPENT, and gov't money that's SENT. Whether it's paper clips or spaceships, the gov't SPENDS for stuff that it needs or wants. The gov't deals with thousands of vendors nationwide. It can set the price it's willing to pay, even if that means building in a healthy profit margin for, say, defense contractors that it wants to make sure can stay in business. In other words, it's probably true that gov't spending may result in higher costs than necessary but doesn't actually cause inflation.

Soc. Sec. checks, on the other hand, represent money that's SENT to individual citizens who don't have the buying power of the federal gov't to dictate prices. This money ($1.2 trillion last year?) flows into the economy and private enterprise competes for it. Part of what happened during the pandemic was that a lot more money ($3 trillion?) was SENT to citizens (rightly so!) to cushion the calamity of not being able to work. And when the lack of workers led to supply chain problems, the spit hit the fan as lots of money started chasing goods and services that just weren't being produced.

Bottom line is, tax the rich to reduce the deficit if that makes you feel better. But the real reason to do it involves reducing their power. And since the wealthy have a high propensity to save, pulling their money out of the economy won't actually do much to curb the inflation we're currently experiencing.

amazing how many people, at least one, who reads you and doesn’t get it but then there is Bernie who pretends it isn’t so. I wonder what John Yarmouth has to say about Bernie’s proposal. I form one would like a total disconnect but that is wishful thinking.