Happy holidays!

I’ve been working on a major project and look forward to sharing that news with you sometime soon.

In the meantime, there’s a lot I want to say about the macro environment, the looming debt ceiling fight, the ongoing—and shifting—debate over the most effective way(s) to tackle inflation, and so much more. So you can expect a steady stream of content now that the big project is finished.

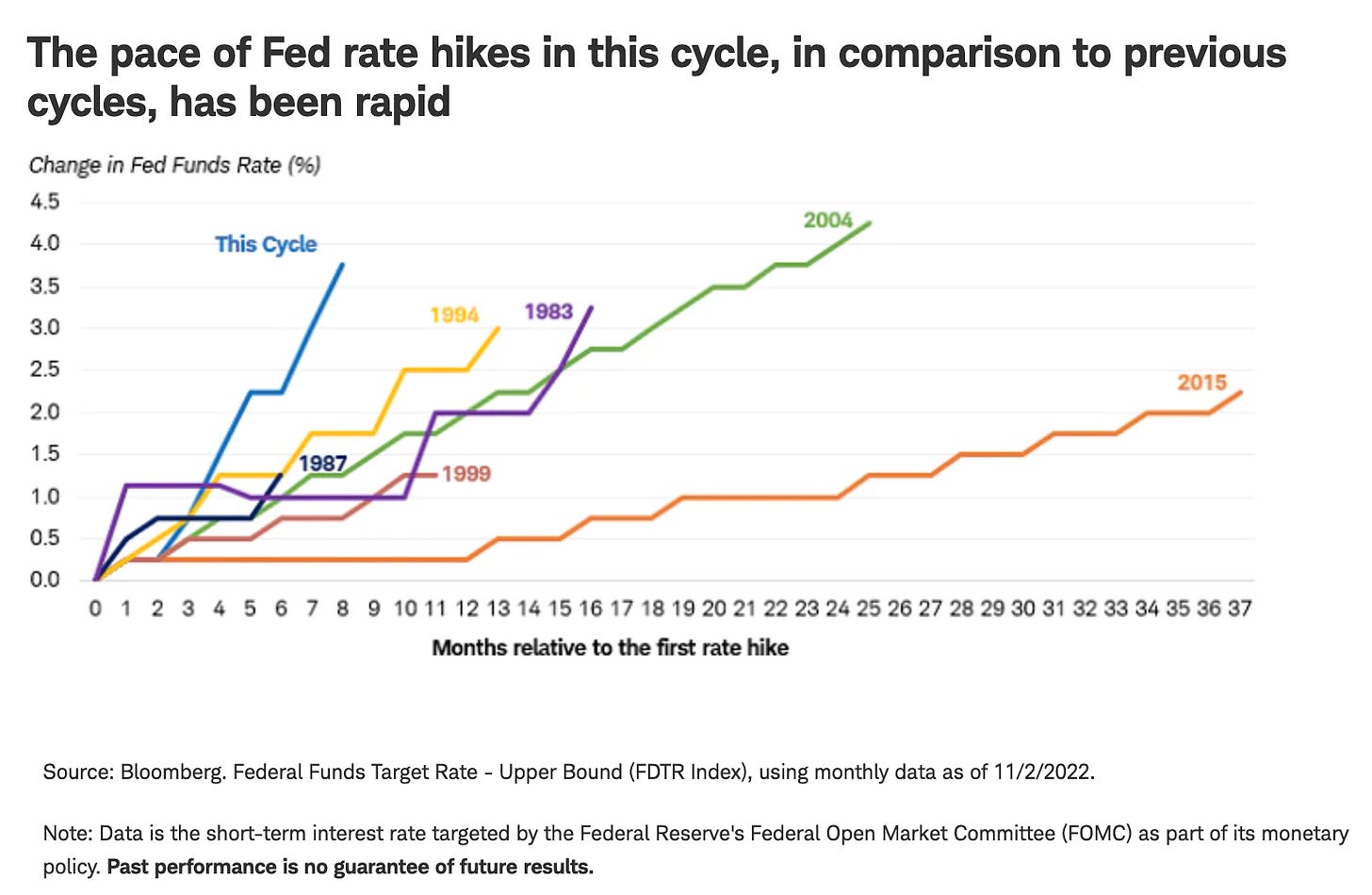

On the topic of the macro environment, the R-Word remains a serious concern despite considerable evidence that consumer spending remains strong even against the backdrop of rapid and aggressive fiscal and monetary tightening.

Is A Recession Imminent?

It depends who you ask. Some CEOs claim to see no sign of weakness, so the r-word isn’t even in their vocabulary.

Others, like the Chief Investment Strategist at Charles Schwab, Liz Ann Sonders, see worrying signs that a recession is coming (if it’s not already underway). In her view, some segments of the economy, “most notably, housing, several goods-oriented segments of the economy, consumer confidence, and CEO confidence", are flashing bright red 2022 recession signals, while other indicators, like the inverted yield curve, point firmly to recession in 2023.

So far, strong household balance sheets and a relatively strong labor market, have helped consumers weather the fiscal and monetary headwinds1, but Sonders expects that to change:

Unfortunately, consumers have also drawn down a significant amount of their savings and have hit the borrowing window to an increasing degree (even among the higher-income tiers). In fact, per Ned Davis Research, other than households in the top income quintile, the share of outstanding consumer credit exceeds the share of demand deposits. Delinquency risk is rising, and if the labor market weakens noticeably and banks continue to tighten lending standards, consumers' moods and spending habits are likely to shift to a decidedly more cautious stance.

Her bottom line? “We think it will only be a matter of time until…cracks in the labor market widen.”

Other experts, including former Fed economist Claudia Sahm, remain relatively optimistic about the prospects of avoiding a recession altogether. She’s among those who see the path to a “soft landing” narrowing but still within reach. If you’re not reading her Substack, I highly recommend it. She sees the Fed slowing the pace of rate hikes potentially in time to avoid a “hard landing” scenario that drives the economy into recession. She doesn’t overplay her hand, but she makes the case that a combination of factors—including monetary tightening and supply-chains easing—have already gotten us on a pathway of decelerating inflation and that we can get back down to 2 percent without crushing the labor market.

While technically still in the “narrowing but within reach camp,” Mohamed El-Erian, the chief economic advisor at Allianz, seems increasingly convinced that inflation won’t be coming back down anytime soon. You should check out this recent podcast conversation with Ezra Klein to hear him articulate his thinking.

Anyway, these are all really smart people with diverging views about the economic outlook. Incidentally, this was my take on the question back in June.

I’ll continue to share my own views with you here at The Lens. And I’ll share with you some of the materials I’m putting together for an upcoming talk I’m giving for the FPA of Greater Kansas City. I last spoke to the group in November 2019. That talk was provocatively entitled, “Recession Looms: Are We Up a Creek Without a Paddle?” I might just use the same title again next month.

Enjoy your weekend!

I should note that Sonders points to a “surge” in U.S. government outlays on net interest expense as a potential concern over the “sustainability of government debt.” Instead of raising concerns about “sustainability” per se, she should think about the implications of paying out hundreds of billions in additional (risk-free) interest income to the non-government sector. It provides a level of fiscal support that she’s overlooking in her analysis.

How do you create all of a roaring economy, accomplish the goals of Andrew Yang/UBI, Stephanie Kelton and every other MMTer, Steve Keen, Michael Hudson, Ellen Brown, enable us to effectively confront climate change, integrate the best aspects of the economic and political agendas of the right (tax cuts) and the left (economic democracy) and completely slay inflation...all in one fell swoop?

Answer: Become a system's philosopher and change the current monetary and financial paradigm which has been in effect for the entire course of human civilization, and has be-deviled humanity on many levels as a result.

Every one of the above movements and areas of activism are reforms, EXCELLENT reforms, reforms that in fact point at and conceptually align with the new paradigm concept...but they haven't recognized the specific new paradigm concept or the most efficacious points in the economic process to apply the new concept and hence temporally implement and change the ENTIRE PATTERNS of economics and the money system.

Reforms are good...and always incomplete and temporary. Only genuine paradigm changes are permanently progressive. Let us begin to analyze on the operant concept/paradigmatic level and integratively solve the key problem, namely the current pattern, not just (ineffectively) hit at it with various reforms. Please.

Ho, everyone joining my chat today. If anyone here could introduce yourself that would be great.