Danger Ahead: Mike Pence Would Pick Up Where Paul Ryan Left Off

As long as we play along with the "solvency" game, Social Security is vulnerable to privatization.

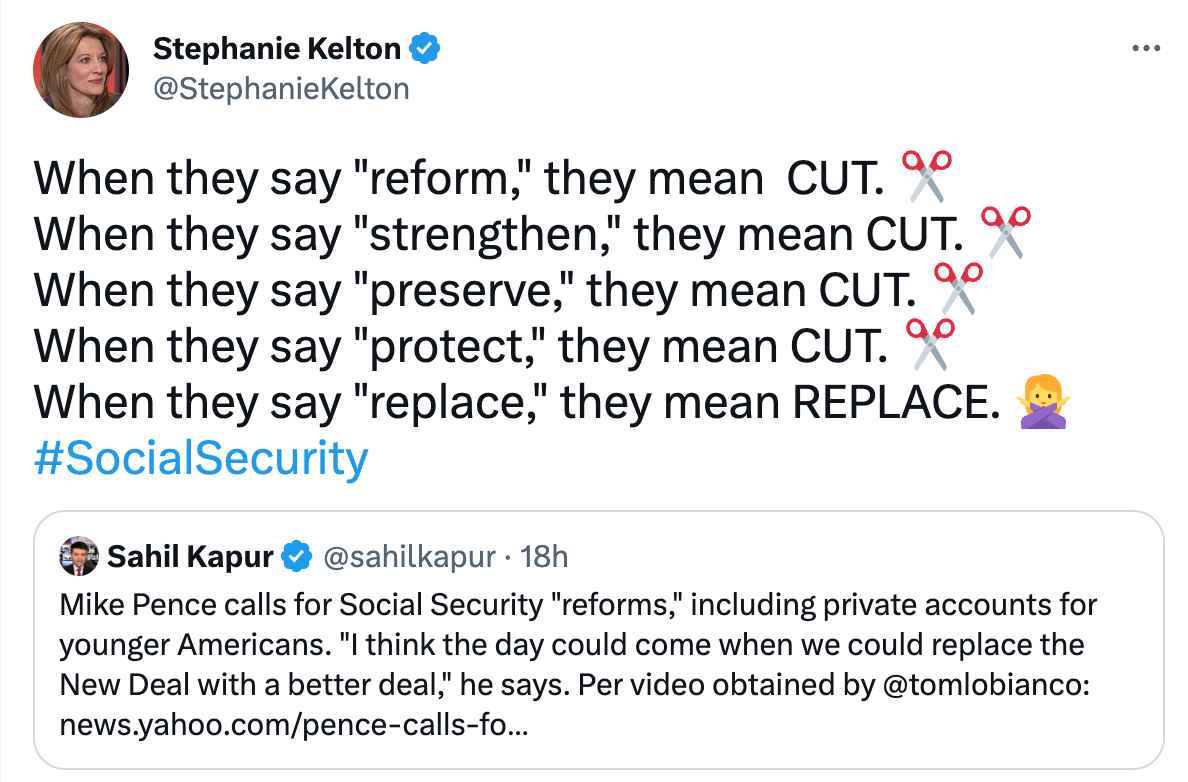

Former Vice President Mike Pence is talking about privatizing Social Security. The remarks came Thursday, before an audience at the National Association of Wholesaler-Distributors summit in Washington, D.C. Here’s the comment that’s raising a lot of eyebrows:

I think the day could come when we could replace the New Deal with a better deal. Literally give younger Americans the ability to take a portion of their Social Security withholdings and put that into a private savings account.”

After seeing a video clip from the event, I tweeted:

I’ve been writing about this kind of thing for decades, and I dedicated an entire chapter to Social Security in my book, The Deficit Myth.

In that chapter, I wrote about the following exchange between Congressman Paul Ryan (R-WI) and Federal Reserve Chairman Alan Greenspan. Mike Pence is just picking up where Paul Ryan (and before him President George W. Bush) left off. Click to watch the video, and then we’ll brake it down.

It’s clear where the Congressman wanted the Fed Chairman to go. In a courtroom, I believe this is called “leading the witness.”

In teeing up his question, Ryan uses the phrase “personal retirement accounts” no less than four times.

Wouldn’t it be a good idea, Ryan asks, to begin to transition to a system of “personal retirement accounts” in order to help the Social Security system “achieve solvency” and make benefits “more secure” for future retirees? This is exactly what Pence is talking about doing.

Ryan was hoping for a simple answer—Yes—from Alan Greenspan. Instead, he got the truth.

“There’s nothing to prevent the federal government from creating as much money as it wants and paying it to someone.” ~Alan Greenspan

Read that again. Rewind the tape. There is no solvency problem. There is not—nor can there ever be—any financial difficulty in meeting payment obligations to future retirees, their dependents, and the disabled.

Why?

As Greenspan explained in a speech in 1997:

That all of these claims on government are readily accepted reflects the fact that a government cannot become insolvent with respect to obligations in its own currency. A fiat money system, like the ones we have today, can produce such claims without limit. To be sure, if a central bank produces too many, inflation will inexorably rise as will interest rates, and economic activity will inevitably be constrained by the misallocation of resources induced by inflation. If it produces too few, the economy's expansion also will presumably be constrained by a shortage of the necessary lubricant for transactions. Authorities must struggle continuously to find the proper balance.

It was not always thus. For most of the period prior to the early 1930s, obligations of governments in major countries were payable in gold. This meant the whole outstanding debt of government was subject to redemption in a medium, the quantity of which could not be altered at the will of government. Hence, debt issuance and budget deficits were constrained by the potential market response to an inflated economy. It was even possible in such a monetary regime for a government to become insolvent.

As the lens of Modern Monetary Theory (MMT) constantly reminds us, the US dollar is no longer tethered to gold. The U.S. is not operating under a fixed exchange rate system. We have a fiat currency and a floating exchange rate. It is impossible for the government to “run out of money” or to face bills coming due that it cannot afford to pay.

Once you understand the nature of the monetary system we have today, it’s easy to see why the arguments that people like Paul Ryan and Mike Pence are relying on to justify privatizing Social Security are totally without merit.

Every Democrat should be able to explain this in very simple terms: We don’t need to address the solvency crisis in Social Security, because there is no solvency crisis.

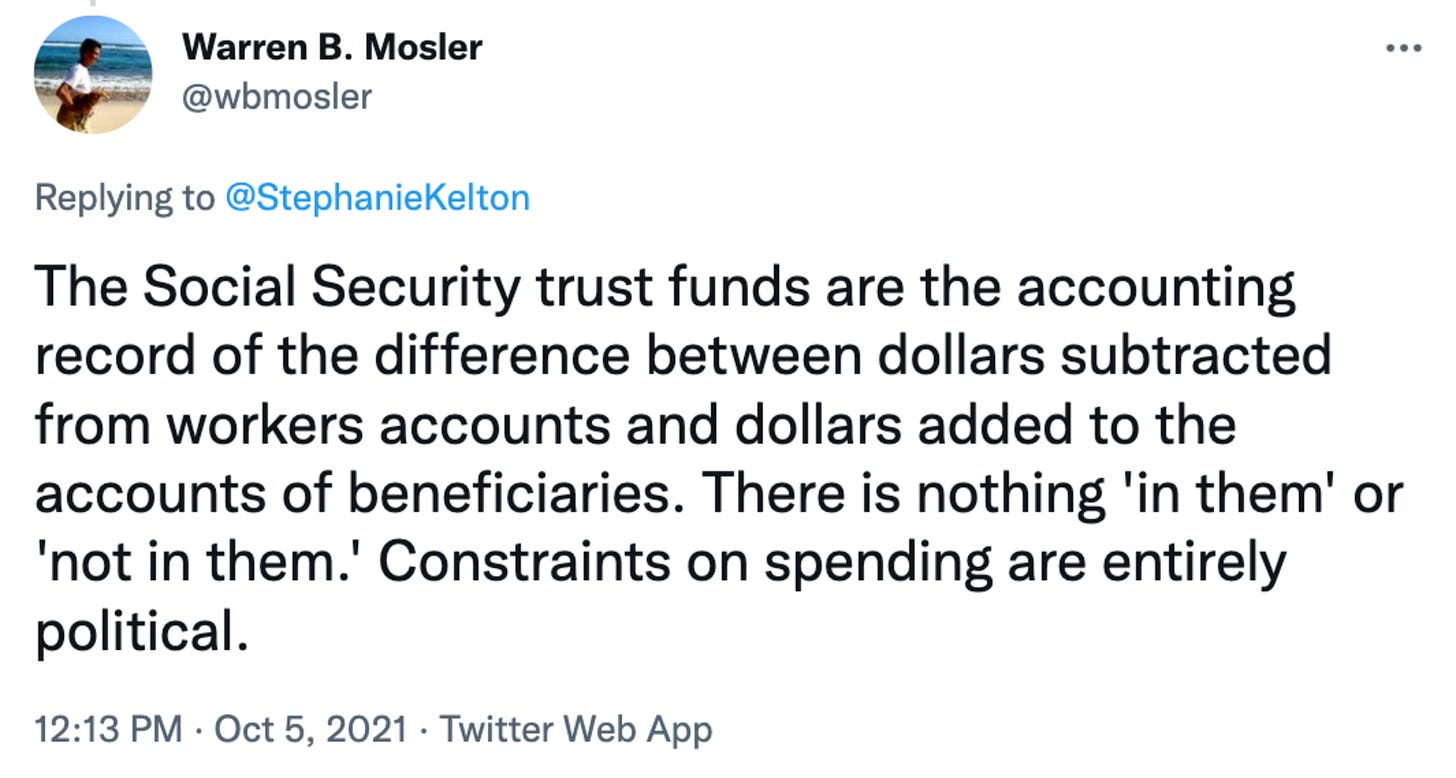

As Warren Mosler put it:

You don’t have to subscribe to MMT to arrive at this understanding. After all, Alan Greenspan got it. And as I’ve written numerous times before, Northwestern University Professor Robert Eisner got it too.

It’s About Inflation Not Solvency!

What all of us—MMT economists, Alan Greenspan, and Bob Eisner—understand is that the real challenge is, well, just that. A real resource challenge.

Go back and listen to Greenspan’s response again. After he tells Congressman Ryan that there’s nothing to prevent a currency-issuing government from meeting its financial obligation to all beneficiaries (present and future), he goes on to make the really important point. The question, he tells Ryan, is “how do you set up a system which assures that the real assets are created which those benefits are employed to purchase?”

Think of it like this.

We are an aging society. Each day, roughly 10,000 Americans reach the age of sixty-five. As the elderly move out of the workforce and into retirement, they leave behind a smaller and smaller population of younger workers who must produce the lion’s share of the real good and services that all of us rely on to meet our needs.

Our national debate should revolve around our changing demographics and our economic productivity, not some red-herring about Social Security’s “solvency.”

Imagine what would happen if we end up—in 10, 20, or 30 years—with a dwindling labor force and little productivity growth. Meeting our obligation to future retirees isn’t primarily about sending them money each month. It’s about helping them maintain a decent real standard of living, and that can only be realized by having access to the real things they need—health care, housing, food, leisure, entertainment, etc.

If democrats and republicans were having the right political debate, they would stop arguing about Social Security’s so-called “solvency” and start arguing about who has the better immigration plan and whose policies will do more to boost productivity-enhancing investments in the years ahead.

For those interested in what it would mean to replace Social Security with a system of personal savings accounts, here’s something I published in 2005, when George W. Bush was pushing the idea.

Have a great weekend, and thank you for subscribing to The Lens.

In The Deficit Myth, you point out that much of the fuss about Social Security (and Medicare) stems from the perception that the trust funds out of which Social Security and Medicare payments are made are "running dry." You also observe that while the two trust funds for Social Security and one of the two for Medicare have provisions to the effect that benefits payments can only be made when the funds have a positive balance, the second of the two Medicare funds has no such proviso, meaning that the government commits to making payments from that fund regardless of the balance in the trust fund. The trust funds for Social Security were not necessary for payment purposes; rather, they were part of FDR's strategy for building political support for the program.

That suggests that, nearly ninety years later, it's time to change the laws governing the first three trust funds and to simply guarantee payment of Social Security and Medicare payments on a "full faith and credit" basis. Do you know of anyone who has drawn up or introduced legislation to that end?

Private accounts. Just look at how poorly American fund retirement accounts now. Private account just mean giving financial institutions another way to get Americans to pay for the privilege of retirement security. America should understand that SS is a base amount to keep them out of poverty and that they need to save additional money if they want to have a comfortable retirement.