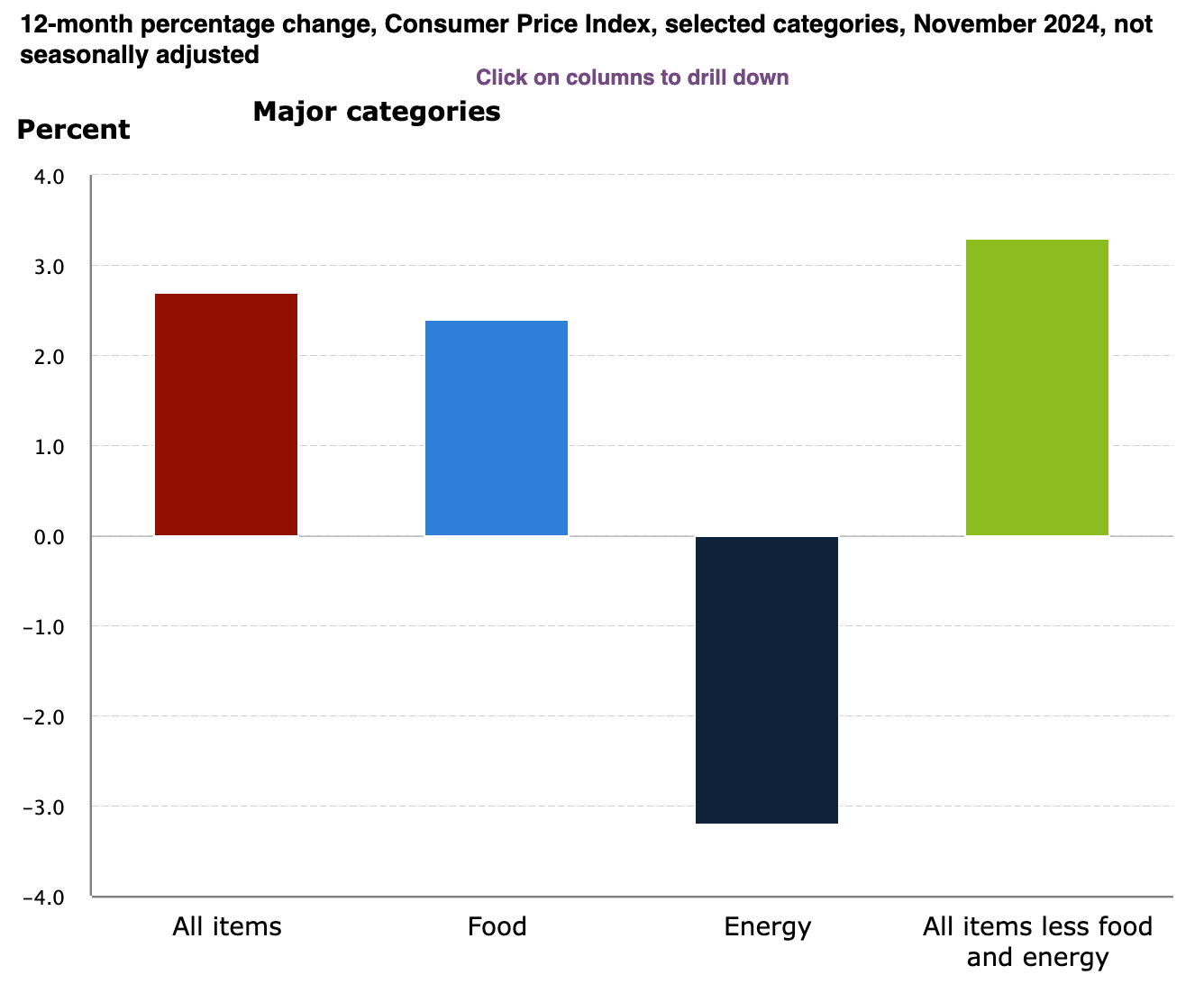

Early this morning, the Bureau of Labor Statistics (BLS) released the latest inflation data, which showed that the consumer price index (CPI) rose 0.3 percent last month. On a year-over-year (YoY) basis, headline inflation is now running at 2.7 percent. Not everything got more expensive. Electricity prices actually fell in November, and transportation services came in flat. You can dig into the data if you want to see other categories and how prices have been changing in recent months.

This is how the BLS summarizes today’s data. Stripping out the volatile food & energy categories, so-called “core CPI” inflation (green bar) is running at 3.3 percent.

Market participants are busy trying to figure out what this means for the Federal Reserve and the interest rate cutting cycle that is now underway. Does the Fed fulfill expectations and cut by 25 basis points later this month? As The Wall Street Journal reports, markets think the December cut is basically a lock.

Interest-rate futures show that traders now think there is a 98% chance the Fed will cut rates by a 0.25-percentage point, CME Group data show. That compares with a roughly 86% chance before the report's release.

That will take the policy rate down to 4.5 percent. And then the big question is how many more times will the Fed cut in 2025? No one knows, and to be honest it’s somewhat hard for me to watch this stuff as closely as I do.

The Fed thinks rates have been in “restrictive territory” for the last year or more. Yet there’s scant evidence of this, at least at the macro level. You can definitely point to pockets of weakness and make the case that high interest rates are to blame, but we didn’t get the kind of deterioration in the labor market that so many people (including Chairman Powell) expected the rate hikes to deliver, real GDP growth is tracking at a whopping 3.3 percent in Q4, asset prices look way more than a little “frothy”, etc.

Meanwhile, Fed officials are searching for the elusive—and I’d say ridiculous—r*, which is supposed to be the long-run “neutral” rate of interest. The notion that there is an invisible and unknowable interest rate that neither juices nor dampens economic activity is the kind of thing that only passes the laugh test in the world of theoclassical economics (a wonderful term coined by my former colleague, William K. Black). Yet mainstream economists embrace concepts like this with religious fervor.

Anyway, virtually all of the market commentary following the inflation report was about whether inflation was becoming “sticky” above the Fed’s 2 percent inflation target. As if inflation typically runs at 2 percent and there’s just a question about how much longer it will be before it returns to “normal.”

Two Percent Inflation is a Myth

I’m not going to fully develop this here. I’m working on a book called The Inflation Myth, which I actually need to return to in the next few minutes. But this got under my skin , so I just wanted to put it out there. I actually find it pretty amazing how seriously Fed watchers and other commentators take Powell & Co. when they talk about getting inflation all the way back down to the 2 percent target. When we finally get a monthly inflation report that shows prices rising at exactly 2.0 percent YoY, it will be transitory.

Why am I so sure?

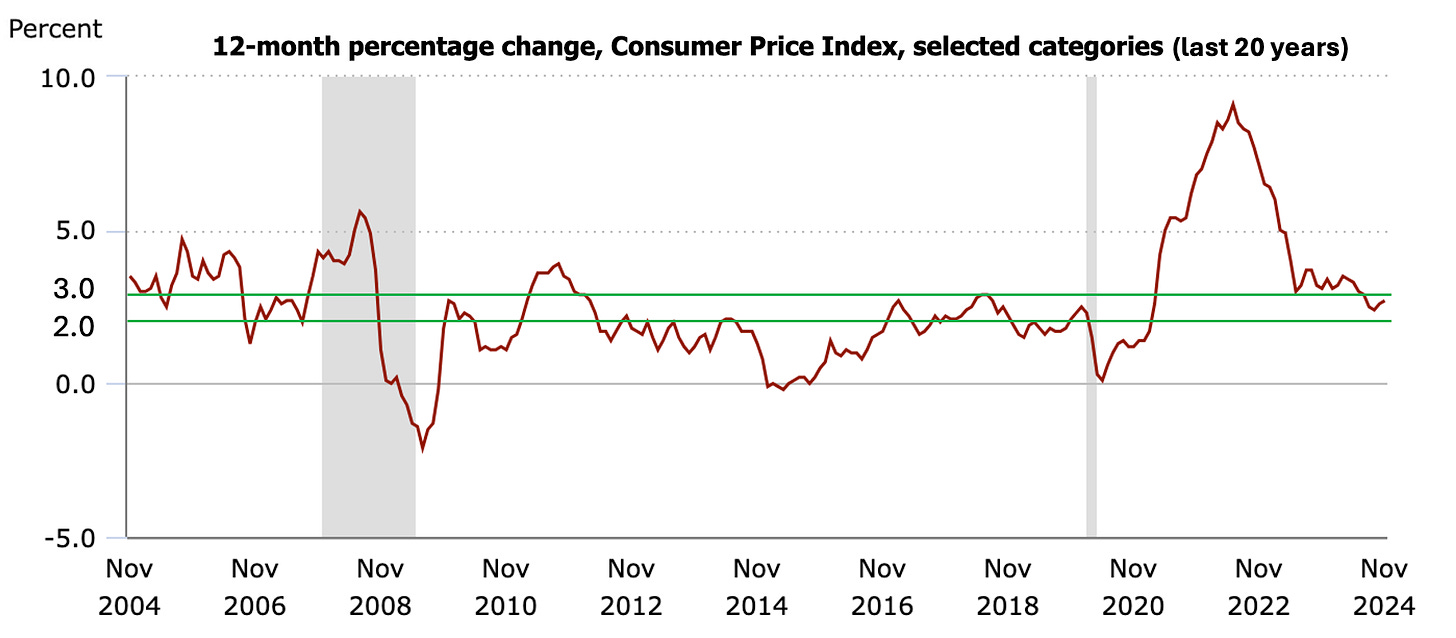

Here’s a snapshot of annual inflation (CPI) over the last 20 years.

If the Federal Reserve was targeting inflation the way the Reserve Bank of Australia does, it would aim to keep consumer price inflation (as measured by the CPI) in the range of 2-3 percent. I added the green lines to show what that target band would look like. As you can see, even with a more forgiving target, the central bank would still end up missing—more often than achieving—its goal.

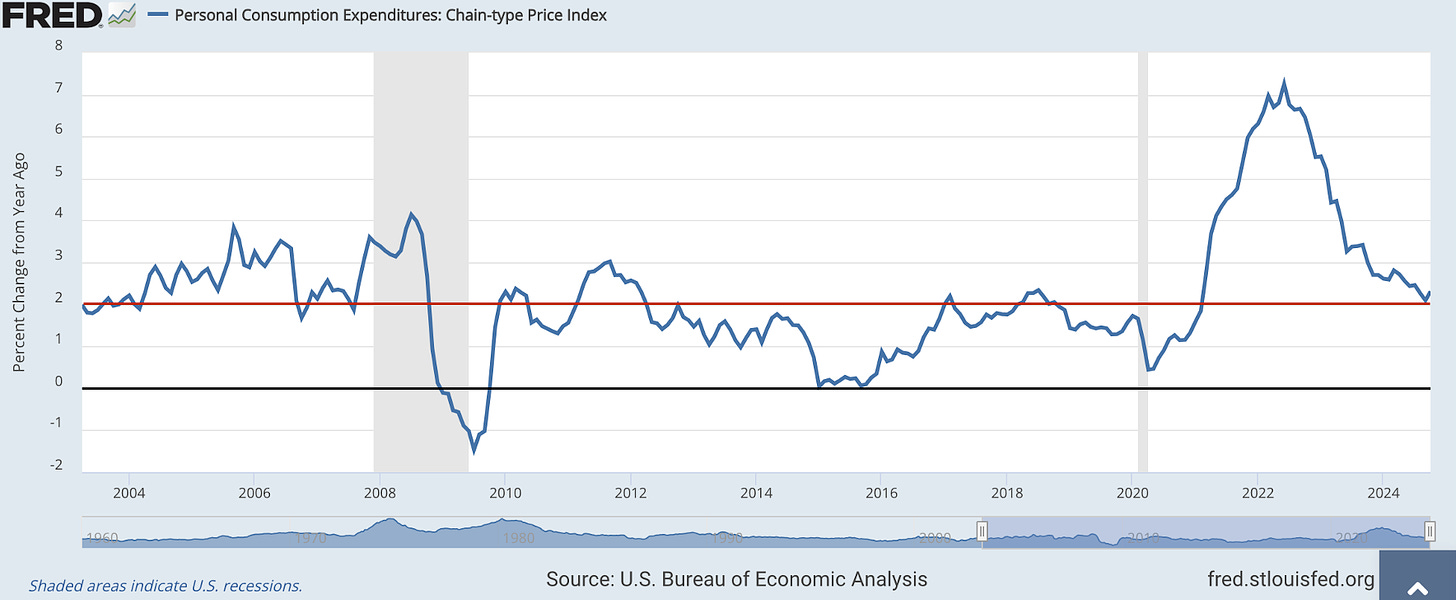

But the Federal Reserve doesn’t target CPI. Its preferred measure is an index known as Personal Consumption Expenditure (PCE) price index. That’s the one Fed Chair Powell says he’s committed to bringing all the way back down to 2 percent.

We will do everything we can to support a strong labor market as we make further progress toward price stability. With an appropriate dialing back of policy restraint, there is good reason to think that the economy will get back to 2 percent inflation while maintaining a strong labor market.

But here again it’s a myth that when inflation finally touches 2 percent, it’s just going to settle in and stay there. That’s not just because we might get tariffs, mass deportation, tax cuts, and even more speculative frenzy with aggressive deregulation or because of a climate doom loop but because there is no reason to expect everything that goes on under the hood of the PCE (or CPI) to consistently deliver a stable increase in the average price of the consumer basket at a rate of 2 percent per year. Again, look at the last 20 years—this time for PCE—and tell me how it makes sense to talk as if the central bank is going to anchor inflation at 2 percent.

As Blair Fix makes clear in this post, the real story of inflation is a story of variation.

Now, back to the book.

As always, thank you for subscribing to The Lens.

I can't wait to get a copy of your new book. I'm so glad you are writing about this ongoing nonsense. As an active Stock market investor, I turn on CNBC daily while around the house to track market activity. I know exactly what you are talking about and have the same reaction as you; sometimes, I turn the sound off so I don't have to listen to these clowns as they pretend the Fed is driving the "Inflation car" and repeat "neutral rate" nonsense all day.

I hope I'm not getting too far off the subject, but these people (so-called market analysts) have no idea where US dollars come from. It reminds me of the scene in your film "Finding the Money," where you show people turning over rocks looking for money. They bring on CEOs (and others) like Larry Fink of BlackRock that is the largest global asset management firm in the world (11.5 trillion US dollars), to complain about the size of the "Federal government debt" and the need to address it. What is Larry's solution? You guessed it, Larry: The Federal Government has a "spending problem," not a "revenue problem!" Where does he think that 11.5 trillion dollars came from? It's probably 12.5 by now! Does he think the "nongovernment sector" can support that much debt accumulation being sucked out of the economy? At the end of the day, all money is someone's debt! The US is a net importer, so the external sector is not supporting it.

Never underestimate Prof Kelton in busting myths about the economy that many of us have been brainwashed into believing. The brainwashing still continues to be propagated by those in econ and govt who should know better. Yet it seems they intentionally (or believe it themselves) keep spouting off about the "unsustainable deficit and debt" and how the govt is doomed to BANKRUPTCY unless drastic spending cuts in the budget are enacted.....Hello, Elon. He is convinced his austerity program, that is sure to cause "momentary pain", will save the govt from going under and protect our children and grandchildren with sky rocketing debt.

Or is this all smoke and mirrors to line his own pockets with his deregulatory schemes for his own businesses and fulfill his fevered dream of becoming the first $trillionaire the world has ever seen?

I hope Prof Kelton can also bust some myths about the blockchain crypto/bitcoin world of scams and get rich schemes Elon and the tRump regime are so fond of. Down with Doge.