The Mini-Budget is a Maxi-Giveaway

Kwasi Kwarteng and Liz Truss just unveiled their big plan to boost the UK wealth divide.

Yesterday, I wrote about so-called “Trussonomics,” asking, “Can Liz Truss Do It?” We had some idea what “it” was, but we have a clearer picture with the release of today’s so-called mini-budget.

According to Liz Truss and her chancellor, Kwasi Kwarteng, the UK government’s economic program will be a boon for the British economy. Indeed, Kwarteng predicts that the trend rate of growth will rise to 2.5%, turning “the vicious cycle of stagnation into a virtuous cycle of growth.”

The centerpiece of the economic program is the biggest tax cut since 1972. As George Parker and Chris Giles wrote in The Financial Times, it is a package that will “delight many in the city of London and the wealthy.” In total, taxes will be cut by some £45B, with the biggest windfall accruing to those with the highest earnings. The budget forestalls a planned increase in corporate taxes and axes the cap on banker’s bonuses. There are no price caps on energy—only a plan aimed at keeping average out-of-pocket energy bills for consumers at £2,500—and no windfall tax on the profits of energy companies.

While the tax cuts are aimed primarily at the highest-income earners, the benefits, Kwarteng assures us, will be enjoyed by the whole of society.

Apparently, This Time Is Different

Except that it almost certainly isn’t. It’s a flawed plan with a long legacy of failure, as this remarkable study by David Hope of the London School of Economics and Julian Limberg of King's College London attests.

Hope and Limberg studied 18 developed countries over a 50-year period, from 1965 to 2015. They compared countries that cut taxes on the rich—e.g. the Reagan tax cuts in 1982—with those that didn't pursue similar policies that year.

What did they find?

In the five years following each tax cut—ample time for them to prove beneficial to all—the data showed no material difference in per-capita GDP or unemployment rates between countries that slashed taxes on the rich and in those that didn't. In fact, the study found that tax cuts have only consistently benefited one group—the rich.

Truss’ ministers can argue until they’re blue in the face that today’s budget is something other than a rebranded incarnation of the failed trickle-down economics of the last half-century, but that’s really what it is.

For early confirmation of the likely distributional impacts of the mini-budget, check out this analysis from the Institute for Fiscal Studies (IFS). The takeaway? Today’s mini-budget is great news for “those with incomes over £155k [who] will now pay less tax overall,” while everyone else will pay more.

Same as it ever was.

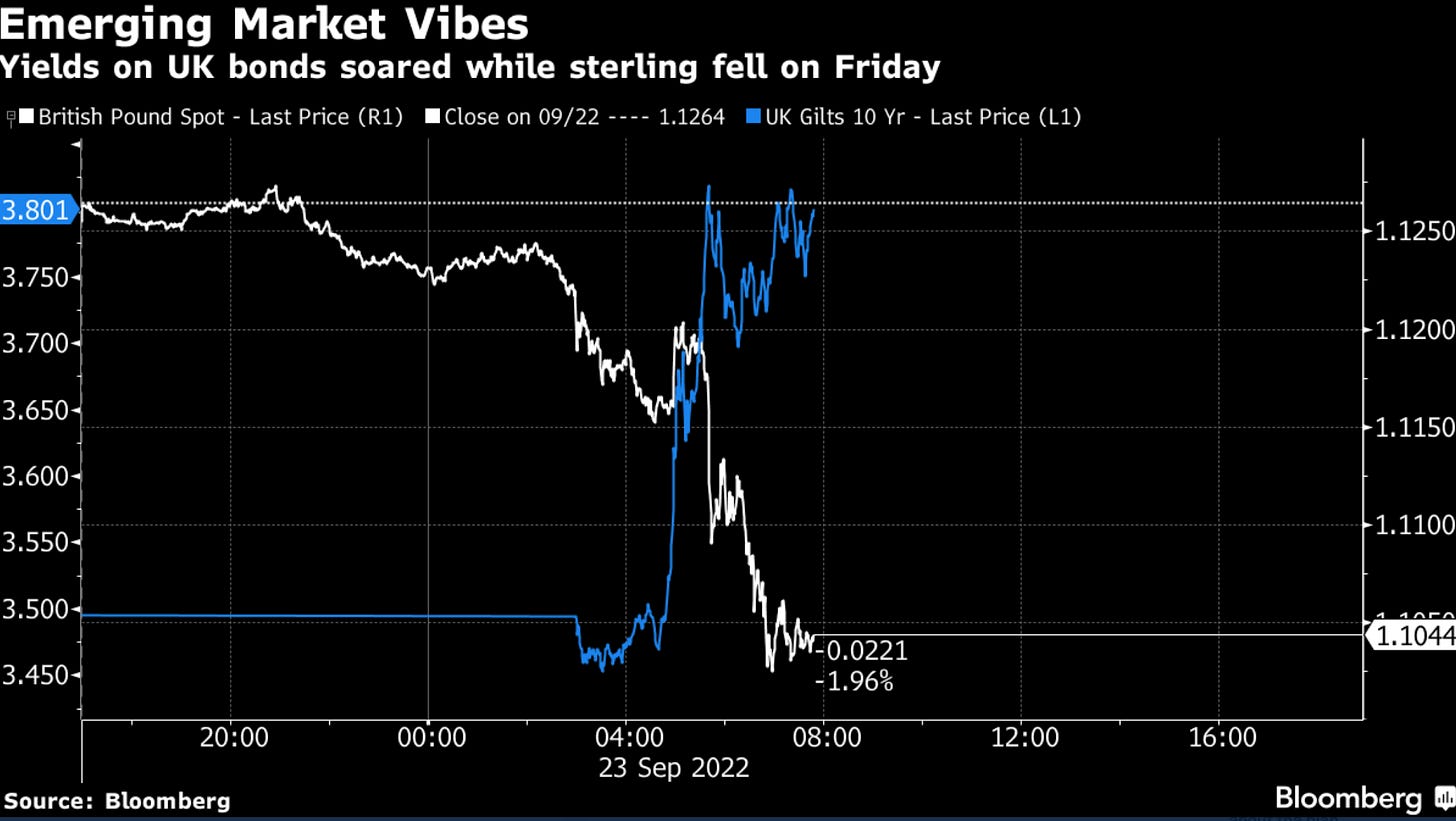

Meanwhile, sterling is getting pounded and rates on gilt-edged bonds are up sharply, leaving many to observe that UK is trading like an emerging market.

More on that soon….

And here’s my pick for the Tweet of the Day.

The whole system is designed for Finance to remain a "Colossus bestride the world". It's bad enough that private finance has a monopoly on the creation of the life's blood of every economic agent, namely money, but it's insane that they are allowed a monopoly paradigm on the sole form and vehicle for its creation and distribution, namely DEBT ONLY.

If MMTers want to be serious about dealing with inflation and thus enabling fiscal deficits (monetary gifting to government agents) they will have to consider integrating monetary gifting DIRECTLY into the economy and the individual via a 50% Discount/Rebate policy at retail sale and the rest of the policy program of the new paradigm.

https://www.amazon.com/dp/B07PLNJLRN/ref=sr_1_1?keywords=wisdomics-Gracenomics&qid=1552358772&s=books&sr=1-1-catcorr

The UK wants to imitate previous American administrations by cutting takes and increasing spending, financed though borrowing. The error is the USA is backed by the petrodollar which makes the dollar the world currency. The £ has no such backing.