Talking MMT with Tom Keene

I was on Bloomberg TV yesterday.

Apologies for sending this out twice. I forgot to include the link to the Bloomberg interview in the earlier note.

Hello and happy weekend! I had a chance to talk with Bloomberg’s Tom Keene yesterday, and I thought I’d share the clip with you. I was invited onto the show to discuss the recent deal to avert a government shutdown and the economic outlook. But, as so often happens, the conversation went in a totally different direction. We talked mostly about Modern Monetary Theory (MMT).

I enjoyed the interview, because it gave me a chance to address some questions that come up all the time.

For example, Tom started by asking whether I really believe that we should be “handing monetary decision-making” from the Federal Reserve “to the executive” branch of government. “Can we trust [the federal government] to prosecute MMT?” Is there a way for them to budget responsibly? Surely, Congress would never have the will-power to apply the brakes if if and when it became necessary to do so.

The segment begins at 2:06.40 and ends at 2:15:05.

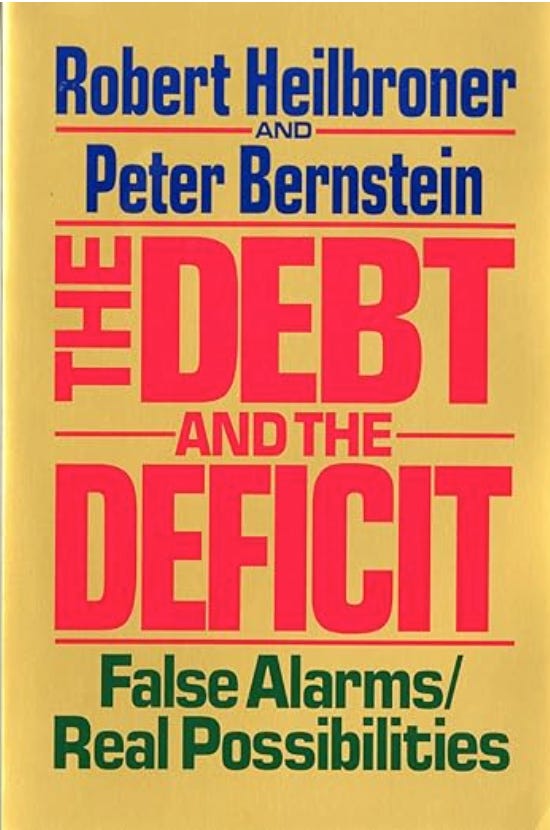

If you’re interested, here’s the little book by Robert Heilbroner and Peter Bernstein that Tom referred to in the interview. I don’t know how sales of The Deficit Myth stack up to Heilbroner and Bernstein, but I suspect I have a long way to go, despite the incredible success of TDM.

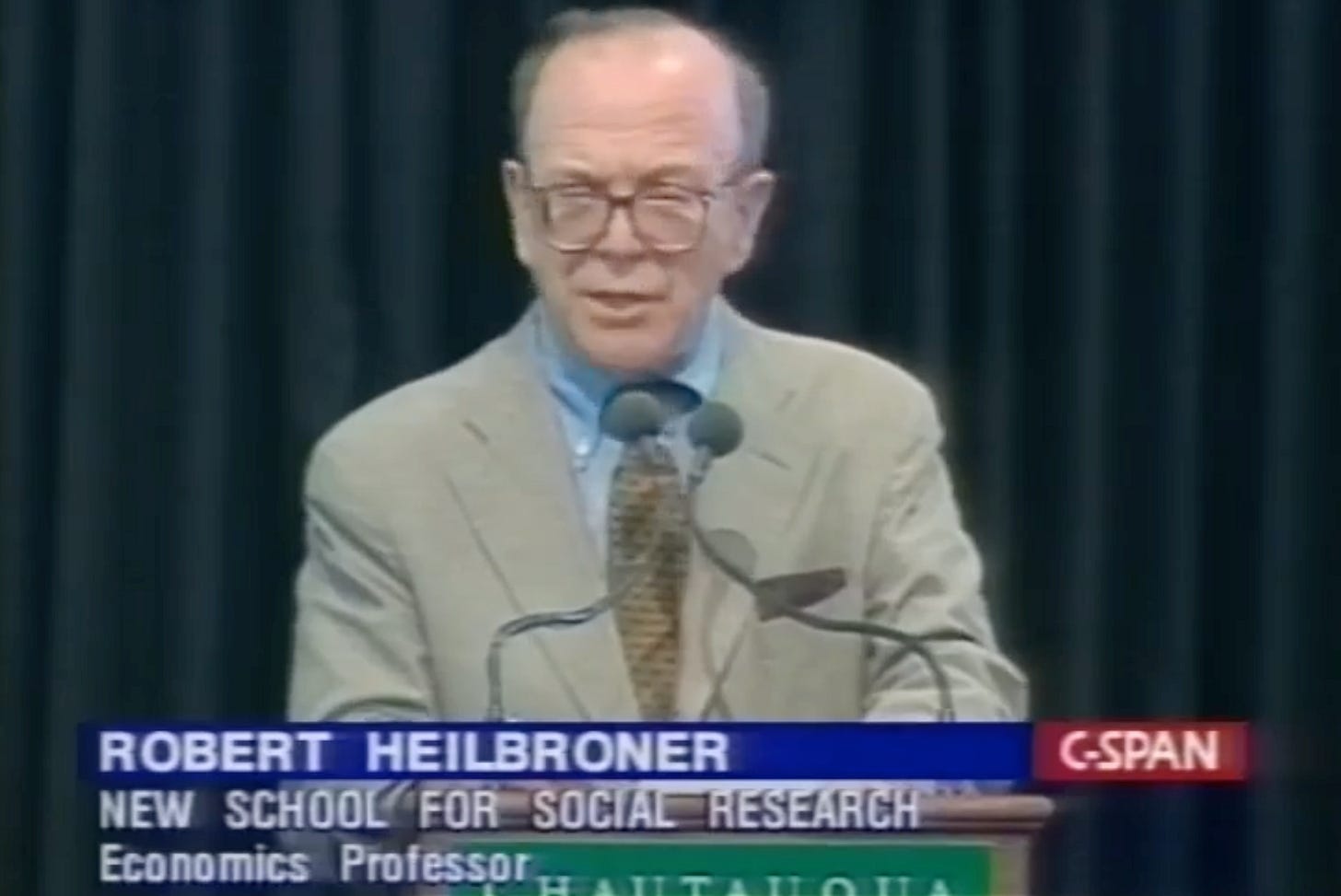

I had the great honor of taking a course with Professor Heilbroner—co-taught by Will Milberg, whom I also greatly admire—when I was working on my PhD at The New School for Social Research (the liberal bastion that produced a very long list of notable economists, including Mariana Mazzucato, Isabella Weber, Heather Boushey, Nelson Barbosa, Louis-Philippe Rochon, Mona Ali, Josh Bivens, Matías Vernengo, and countless others.)

Heilbroner wasn’t an MMTer. He had one foot squarely in the deficit dove camp, but there were also hints of Abba Lerner and even Wynne Godley if you listen closely to the way he talked about government spending and fiscal deficits. I especially love this line from a lecture he delivered in 1996: “The simple fact that the burden of the national debt doesn’t exist. The fact that the national debt itself is government bonds is one of the best kept secrets in America.”

As I showed in the opening to the third chapter of my book, it’s also one of the best kept secrets in Congress!

Can you provide a link to the Bloomberg recording?

“Can we trust congress?” Why do they hate democracy?