There was an interesting discussion with Evercore’s Roger Altman on CNBC’s Squawk Box yesterday. Altman talked about some of the things that economists, market participants, pundits, and policymakers have gotten wrong in recent years. Here’s part of what he said:

What I think is fascinating is how wrong the consensus on big things has been over the past year, starting with inflation where originally—when it surged—the view was this is transitory, it will self-correct. Jay Powell himself espoused that. Then, as it surged further that view was discarded and the Fed of course embarked on the sharpest monetary tightening in 40 years. Now, it looks as though it was transitory, just over a somewhat longer period, including that the tightening of monetary policy may have had no impact on why inflation has come down…. Then recession, six to nine months ago, a majority of CEOs in surveys thought we were going to have a recession, now we don’t have it and the most recent data is amazing…so recession is off the table….

In response, one of the show’s hosts, Andrew Ross Sorkin, said, “I think you’re making an argument for why the public thinks the elites know nothing.” Responding with a sense of humility, Altman said, “Well, arguably they do know nothing. Including me. I was wrong on all those things.” Sorkin conceded, “I was wrong on a lot of them too.”

Then, another of the show’s hosts, Joe Kernan, chimed in, adding:

All of our sacred cows. They’re sacred but they’re not necessarily right. We thought we had to raise unemployment to bring inflation down. We didn’t. That was like Monetary Policy 101. Like Moses on a tablet.

“So much of this in retrospect was supply-chain related,” Altman explained, “and now it has self-corrected.”

It has taken a long time for people to accept this reality, but membership on so-called Team Transitory continues to swell. It’s a bitter pill for some folks to swallow, especially those who would prefer to blame the recent bout of inflation on the Federal Reserve’s “money printing” and the Biden administration’s “excessive spending.”

“If it wasn’t overspending by fiscal authorities that caused the inflation, if it was supply chain, then can we just do MMT?”, Kernan (sarcastically) quipped. Altman didn’t take the bait on MMT. He simply said, “It was the pandemic that caused it.”

What I found most interesting about the interview was the discussion of the rate hikes, and Altman’s willingness to basically reject the dominant “soft landing” narrative. That narrative features a plane, a runway and—most importantly—a masterful pilot.

It’s not uncommon to find economists (and others) proudly declaring that they were OG members of Team Transitory (TT). I myself was OGTT. But I think too many members of Team Transitory have convinced themselves that Jay Powell is the central bank equivalent of Captain Sully Sullenberger, the hero in the cockpit of the FOMC who skillfully lowered the flaps, adjusted the dials, and guided inflation safely back down without injuring the broader economy. I am decidedly not in that camp, and neither is Altman, who dared to suggest:

the tightening of monetary policy may have had no impact on why inflation has come down

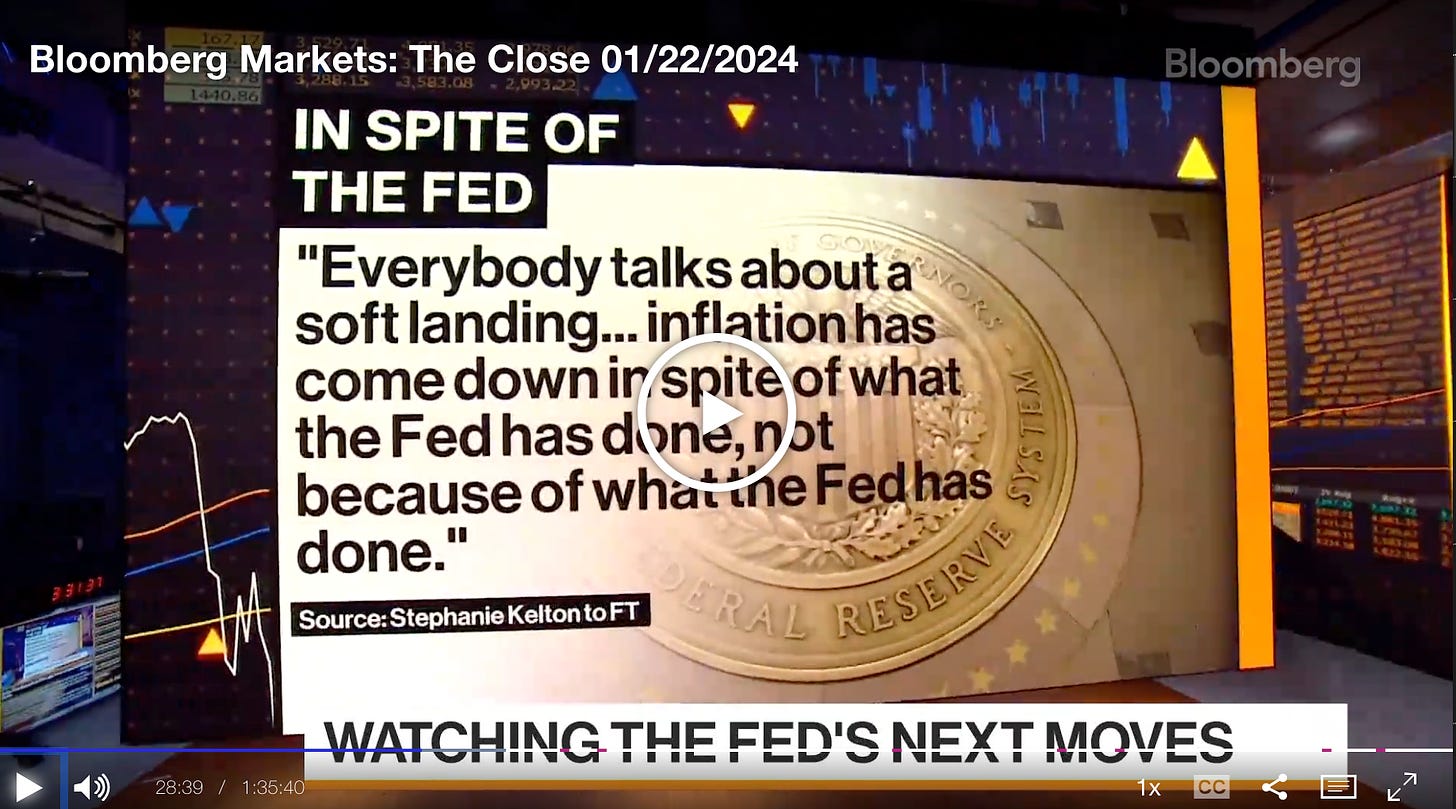

That’s a pretty sacred cow, but it’s one I hope more people will wrestle with. I went even further in a recent interview with the Financial Times, sparking this headline:

Last week, I had a chance to elaborate on the FT interview with the hosts of Bloomberg TV’s The Close. (Click to watch.)

Here's what I find amazing. The Biden Administration spent about $5 trillion on pandemic relief. And, lo and behold, inflation is roaring back down toward 2%. The benefits to society were absolutely enormous--and continue to be so. So why aren't people screaming: "Let's do it again! Except this time without the price gouging." Another $5 trillion could easily be spent on green energy projects, creating tons of good jobs in the process.

Worried about interest rates? The Fed should stop selling bonds altogether! There have been two seismic shocks to our economy in the last 60 plus years. The first was going off the gold standard in 1971. The 2nd was making it legal around 2009 for the Fed to pay "Interest On Reserves." The FDIC could simply insure ALL bank reserves in any amount (say goodbye to the $250K limit) and pay, say, 2% interest. Forget the "bond vigilantes." Anyone who doesn't like it can go pound sand or invest in the stock market. Holders of US dollars have a lot less leverage than folks imagine.

Jen Andrews points to the size of corporate debt taken on for growth. Large corporate debt is one of the chief factors that gave us the Great Recession - and it persists as a far greater threat to our economy than government debt. Yet deficit "hawks" never talk about it. It would be one thing if that corporate debt represented investment in R&D and manufacturing, but a lot of it is tied up in financial shenanigans like stock buybacks--useless to most of us. I recommend Rana Foroohar's Makers and Takers as Foroohar takes on financialization as a drag on, and risk to, the real economy. Lots of people make similar arguments as Foroohar, but the difference is she, as does Stephanie, uses language and examples that non-economists can understand. The next time you hear a politician or pundit drone on about the supposed perils of the national debt, think of what they are NOT talking about.