Earlier this week, I joined Romaine Bostick and Scarlet Fu on Bloomberg TV. The Congressional Budget Office (CBO) had just released its annual Budget and Economic Outlook: 2023-2033, forecasting government spending, revenues, inflation, interest rates, unemployment, economic growth, and more over the coming decade. If you just want the summary of the report, click here.

The report is mandated under the Congressional Budget Act of 1974, and the “baseline” that CBO constructs as part of the exercise matters a lot when it comes to determining, e.g., whether future legislation will run up against certain procedural hurdles because of its budgetary impacts. If you want to learn more about where the baseline comes from and how it’s used in the legislative process click here.

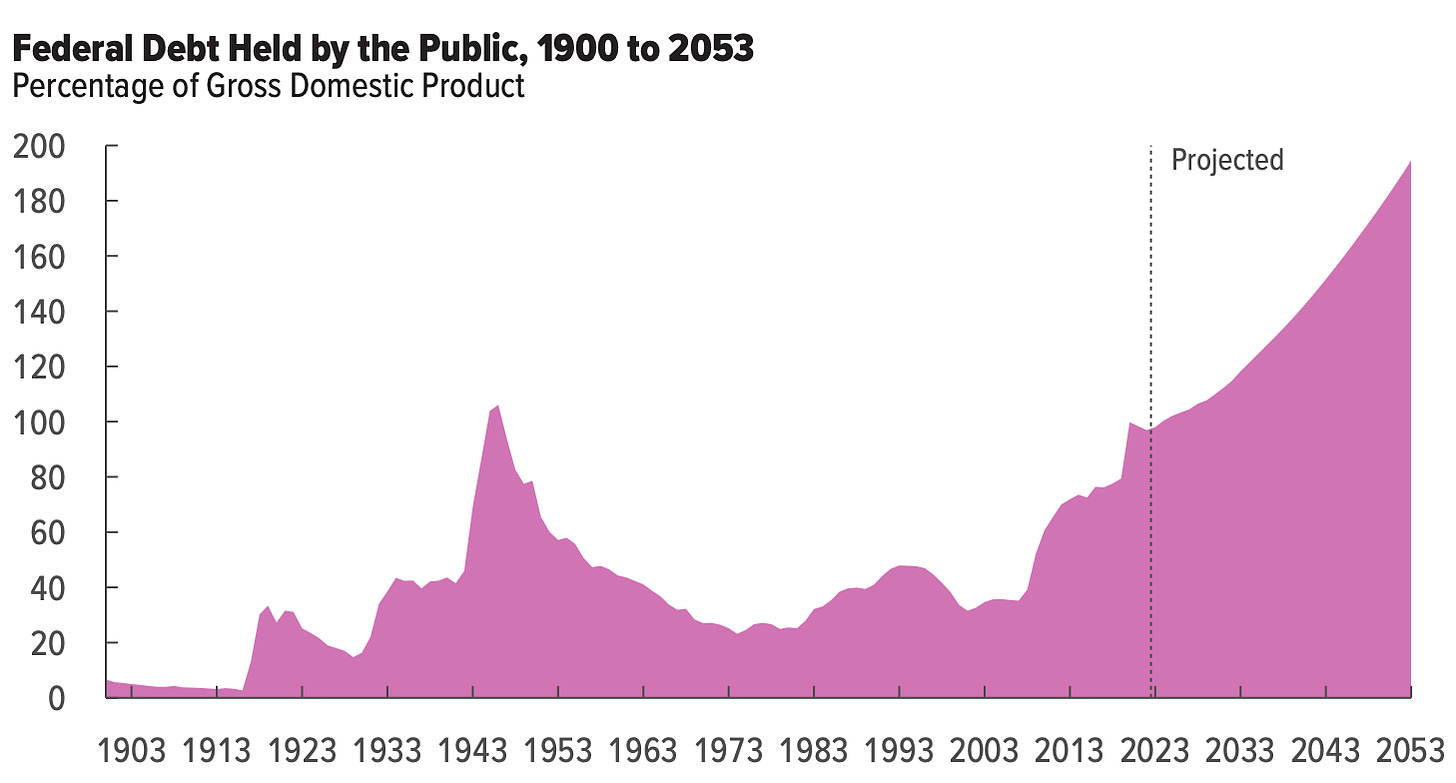

The report features this misleading image which invariably sparks a lot of unnecessary alarm and partisan finger-pointing. While Democrats point to Republican tax cuts (George W. Bush and Donald Trump) and the wars in Iraq and Afghanistan, Republicans blame the Biden administration for spending too much on COVID relief and (now somewhat sheepishly) ‘entitlement’ programs like Social Security and Medicare.

Regular readers of The Lens know that I am neither alarmed by nor particularly interested in projections like the one depicted above. If you aren’t familiar with my views, this chapter from my book The Deficit Myth will get you up to speed.

I’m going to write more about the CBO report tomorrow, but suffice it to say (for now) that it was a strange report in many ways.

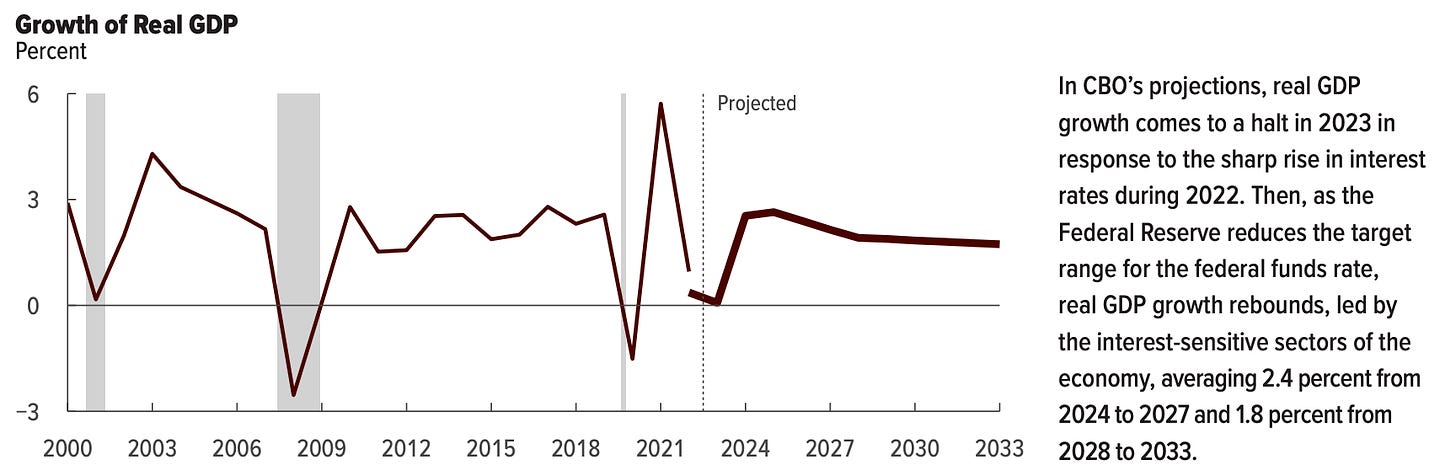

We are told that “real GDP growth comes to a halt in 2023 in response to the sharp rise in interest rates during 2022.”

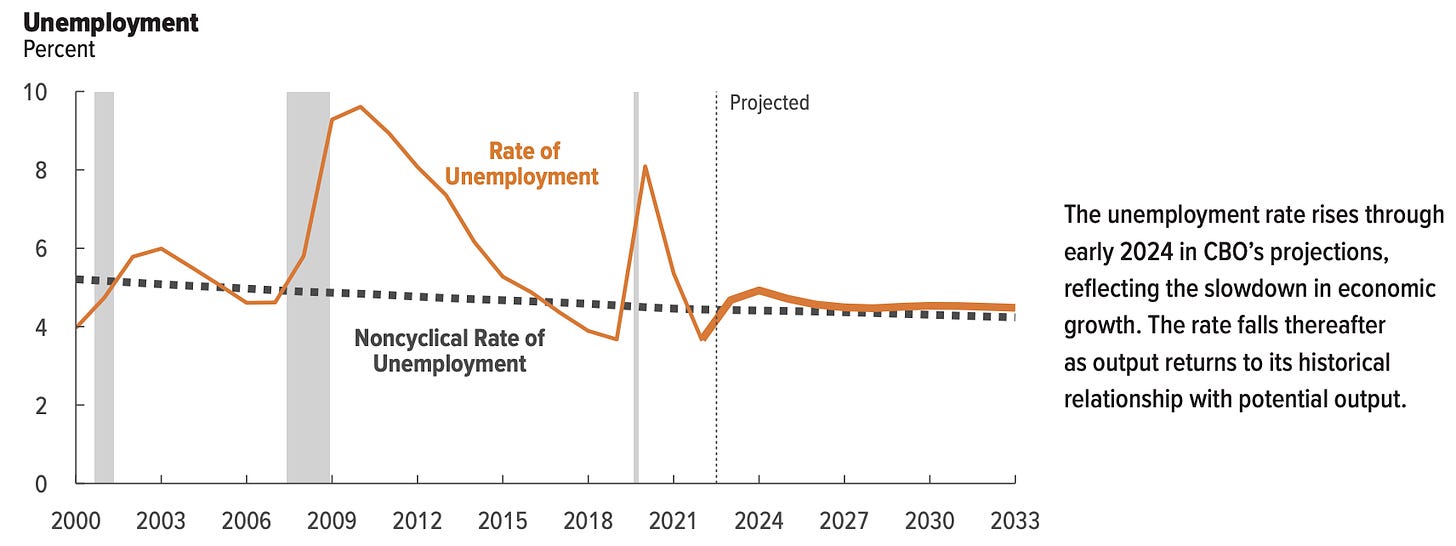

As growth grinds to a halt, CBO predicts that “conditions in the labor market deteriorate” with unemployment rising to 5.1% by the end of this year and continuing to rise into early 2024.

Is CBO predicting a recession? I’ll let you be the judge. While they expect the economy to grow at a barely discernible 0.1 percent this year, they’re not projecting a contraction in real GDP (at least not on average over the year).

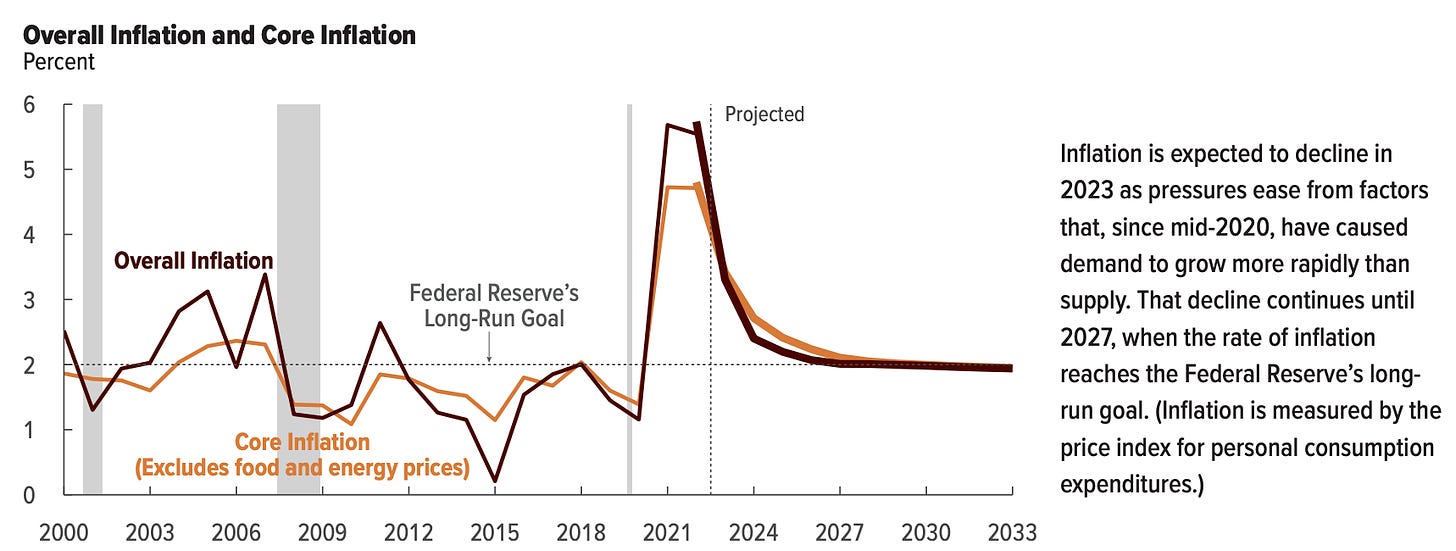

Against this backdrop, CBO predicts that inflation will fall rather precipitously this year and into next year “as pressures ease from factors that, since mid-2020, have caused demand to grow more rapidly than supply.” But they see inflation lingering above 2 percent until 2027.

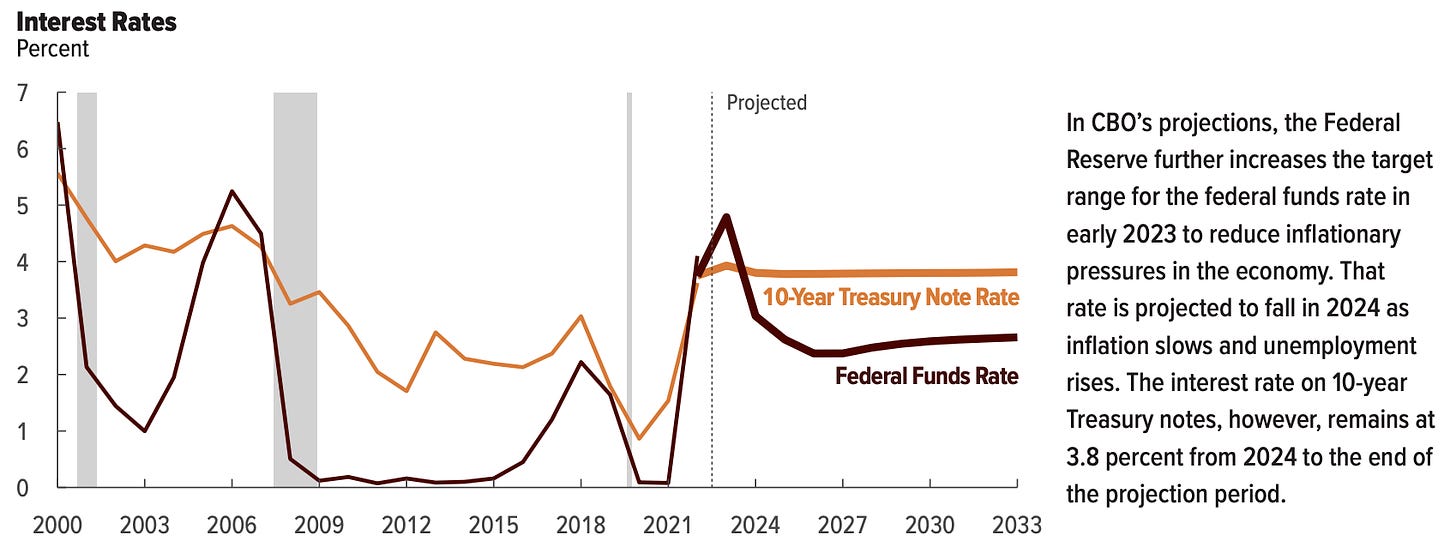

In response to the economic slowdown, CBO predicts that the Fed will begin cutting interest rates sometime in 2024, several years before inflation returns to the Fed’s long run target.

None of us should put too much stock into any long range economic outlook. But CBO’s economic outlook impacts its (baseline) budget projections, which matter for policymaking in all kinds of ways.

By assuming a gloomier economy—no growth, higher unemployment, stickier inflation, and more aggressive rate hikes in the near term (among other things)—CBO is telling lawmakers that projected deficits over the period 2023-2032 will be $900 billion higher than previously forecast (back in May 2022). Part of that jump is due to higher (revised up $295B) projected debt service over that period.

Keep this in mind, because I’m going to write more about rate hikes and their budgetary impacts in my next post.

As always, thank you for reading The Lens.

Caveat: the honesty of CBO reporting fluctuates based on appointments, etc. The current regime has already proven itself to be not very good. That is to say, overly partisan. So presuming no GDP growth this year is, well, I don’t have the words for such complete willful BS.

The problem, in turn, is exacerbated by establishment media that don’t care about proper framing or honesty. So we get a day or two of hysteria over the $31t number which does us absolutely no good. To the contrary: it benefits the pro-austerity crowd for whom austerity is the answer to everything.

The CBO is a joke in my opinion but I guess there are some people that are still slaves to whatever they say about the economy in their report. However, Warren Mosler was right about rate hikes in which so many economists have it backwards. It's funny that they don't realize that those rate hikes for which the federal government is paying interest income into the hands of those who are better off financially.