“Yesterday, the national debt passed $30 trillion for the first time. Does the administration see that as a problem, or do you share the view of some economists that debt doesn’t matter?” That question was posed to White House Press Secretary Jen Psaki by USA Today’s Michael Collins last week. On the same day, Collins published ‘Sound the Alarm’: national debt hits $30 trillion as economists warn of impact for Americans.

Psaki responded by noting that “more than 95 percent of the debt was incurred before [Biden] took office, that it was Trump & Co. that piled on a lot of that debt, that Democrats were committed fully “paying for” their agenda, and that the president would like the debt “to be lower.”

There aren’t many economists who (publicly) take the position that the national debt doesn’t matter, so I can only assume Collins had people like me in mind when he posed the question.

I titled chapter three of The Deficit Myth, “The National Debt (That Isn’t)” not because I believe that the so-called debt doesn’t matter but because I think it doesn’t matter the way we’ve been taught to believe. I gave the Milken Institute permission to publish the chapter in its entirety. You can find it here.

Since I dedicated an entire chapter to expressing my views, I’m not going to repeat the argument here. If you’re interested in a shorter version—and you can get around the paywall—here’s something I wrote for the Financial Times. Here’s an excerpt:

“While most see big deficits as a price worth paying to combat the crisis, many worry about a debt overhang in a post-pandemic world. Some fear that investors will grow weary of lending to cash-strapped governments, forcing countries to borrow at higher interest rates. Others worry governments will need to impose painful austerity in the years ahead, requiring the private sector to tighten its belt to pay down public debt. They should not.

While public debt can create problems in certain circumstances, it poses no inherent danger to currency-issuing governments, such as the US, Japan, or the UK. This is not, as some argue, because these countries can currently borrow at very low cost, or because a strong recovery will allow them to grow their way out of debt.

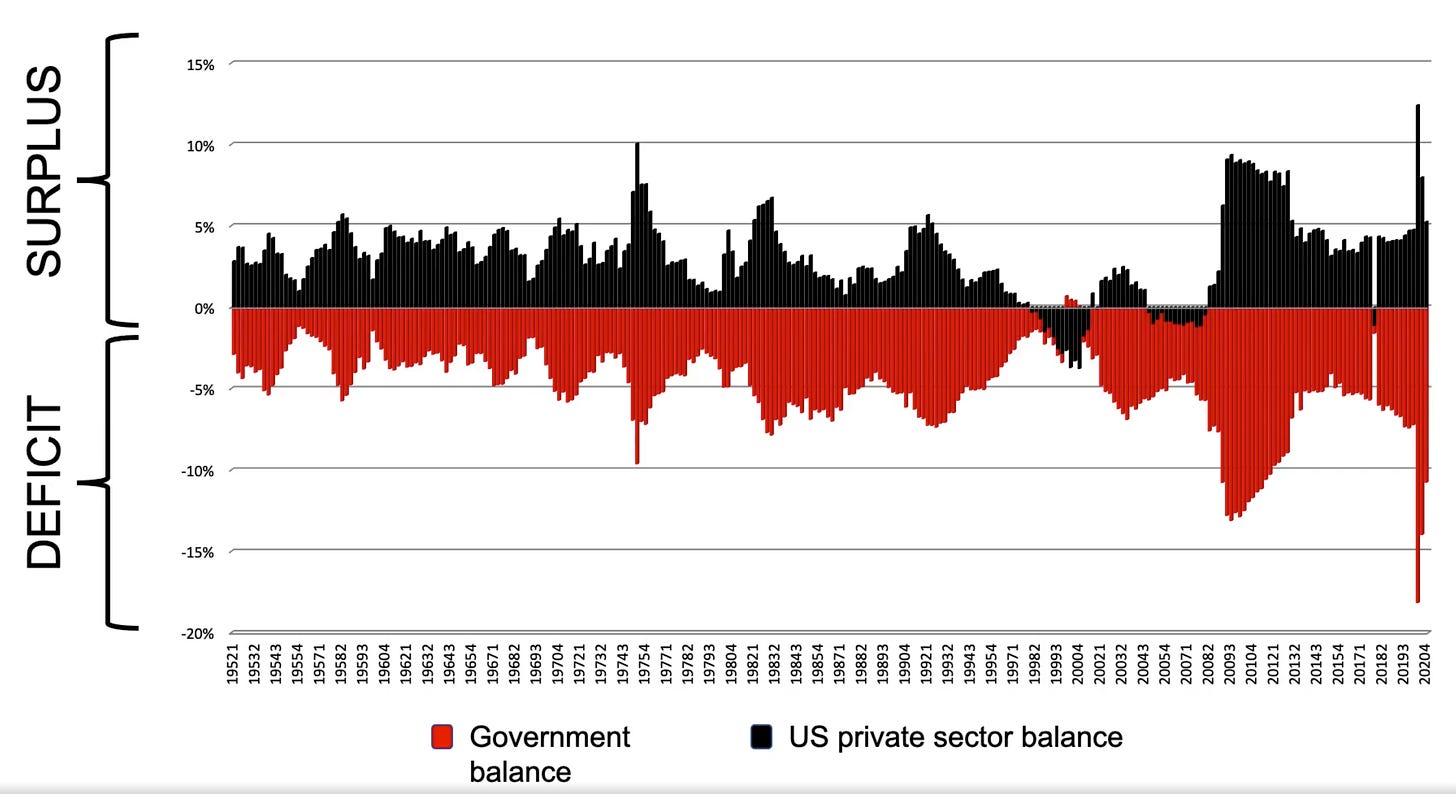

There are three real reasons. First, a currency-issuing government never needs to borrow its own currency. Second, it can always determine the interest rate on bonds it chooses to sell. Third, government bonds help to shore up the private sector’s finances.”

There are so many problems with the dominant way of talking about the outstanding stock of US Treasuries—aka “the national debt.” First, it’s a big number and big numbers are easily weaponized, especially when the word “debt” is attached. People have trouble wrapping their heads around such huge figures, so numbers with lots of zeros make great fodder for shock-and-awe headlines, political cartoons, and so forth. Here’s a cartoon depicting the enormity of the “problem” from 1937.

Here’s one from 1988.

This one’s from 2009.

2019 …

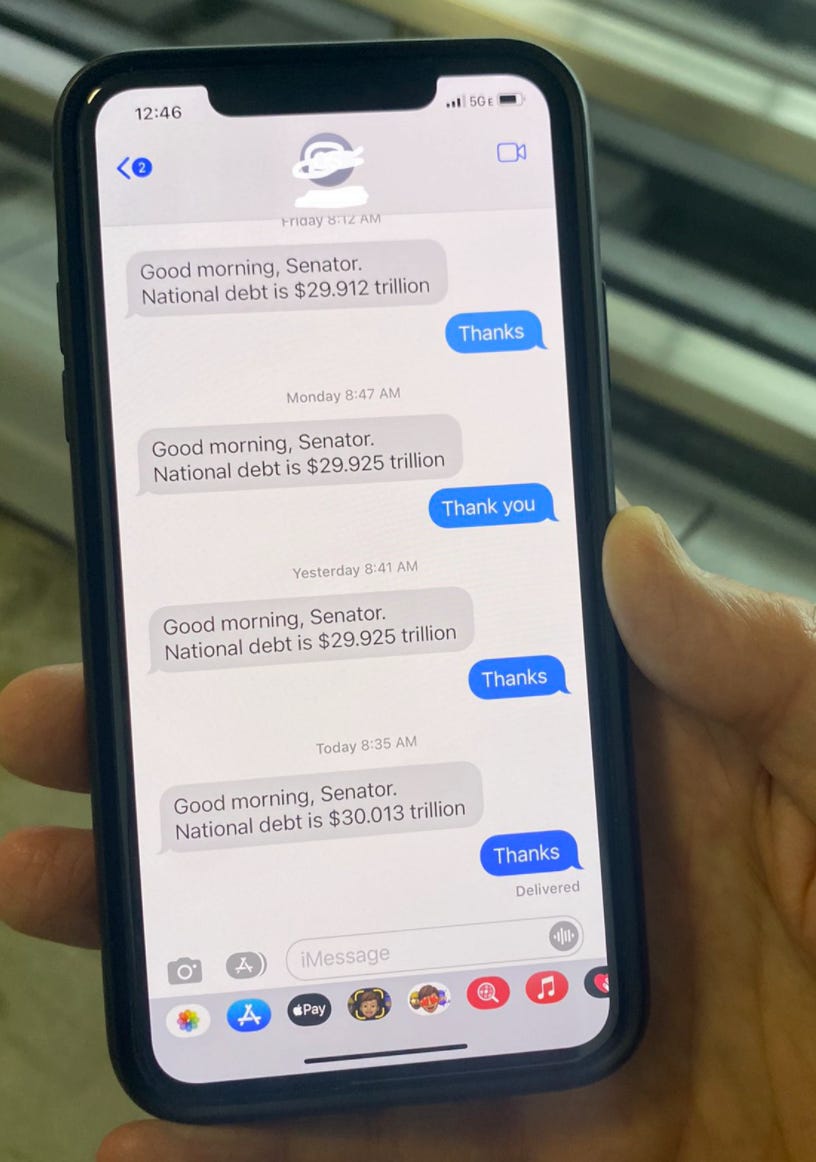

And now Americans are being advised to “brace for impact”’ because, well, $30 trillion is a really big number. You can see more cartoons in this presidential lecture I delivered at my university in 2018.

Not everyone wants to send people running for the caves. I’ve worked hard to counter the dominant way of thinking about the outstanding stock of US Treasuries—a.k.a. “the national debt.” But it’s a heavy lift, especially when prominent democratic figures lean into the hysteria by warning Americans that a “debt crisis is coming.”

Still, the debate has shifted in favor of MMT. It’s less common to hear mainstream economists talk about soaring interest rates driven by bond vigilantes or national insolvency. And it’s more common for people to understand that government deficits supply the non-government sector with net financial assets—i.e. the government’s red ink is our collective black ink.

MMT is shifting the debate, but there’s a long way to go. Just last week, NBC News’ Sahil Kapur reported that Senator Manchin had pronounced the Build Back Better Act “dead”, in part due to his obsession with the national debt.

If you have the time, I hope you’ll read my chapter. We’ve got a national communication problem, not a national debt problem. We need to improve public understanding—soon—if we’re going to tackle the real crises that will impact all of us.

I have your book & I reckon it should be on every High School ‘required reading’ list, along with a ‘Politics & Economics’ Basics class. If voters weren’t politically illiterate we would have a much better public debate around politics. They would know that calling Biden or any Dems “Communists” is ridiculous and, along with more similar political idiocy, makes the US a laughing stock around the world. (I currently reside in the U.K.) We really do get the politicians we deserve.

Enjoyed seeing the article about you in the NYT this morning. Thanks for leading the charge and shaping the national dialogue on needed expenditures.