How Should We Think About Fiscal Sustainability?

Yesterday, the Clinton Global Initiative announced that they’re partnering (again) with Net Impact for the Up to Us Campus Competition. The e-mail included the following attachment, along with a request to “share this material widely on your campus or with any students you know who may be interested in this opportunity.”

It inspired me to write a Twitter thread (or a Xitter thread or whatever we’re calling them these days), which I’ve decided to reproduce (with some additional commentary) here for those of you who aren’t on X (see how dumb that sounds) or who don’t follow me on that platform.

So here goes….

You may recognize the image of the three buckets from my book, The Deficit Myth. It presents a macro accounting identity that you can use to think through the balance sheet implications of the Clinton surpluses (or any other fiscal outcome) and the interplay between the different parts of the economy. If you want see how MMT uses the sector financial balance framework to do macro analysis using models, see here. OK, back to the thread.

Click here to read the once-secret document.

Quoting from The Washington Post article:

But if Galbraith stood out on the panel, it was because of his offbeat message. Most viewed the budget surplus as opportune: a chance to pay down the national debt, cut taxes, shore up entitlements or pursue new spending programs.

He viewed it as a danger: If the government is running a surplus, money is accruing in government coffers rather than in the hands of ordinary people and companies, where it might be spent and help the economy.

“I said economists used to understand that the running of a surplus was fiscal (economic) drag,” he said, “and with 250 economists, they giggled.”

Galbraith says the 2001 recession — which followed a few years of surpluses — proves he was right.

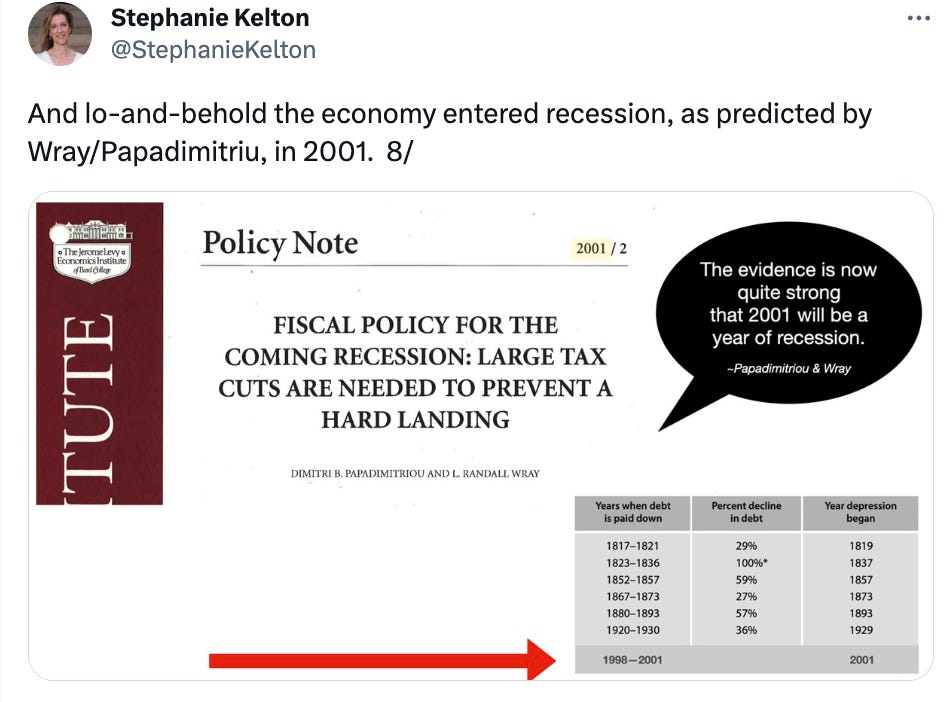

Galbraith was right to worry. Wynne Godley (who pioneered the sector financial balances framework) and L. Randall Wray were also right to worry that the government’s fiscal stance had become too restrictive and that the Clinton surpluses posed a threat to the broader economy.

Here’s the link to the Policy Note.

I had also recently done a thread on Fullwiler’s masterful paper on fiscal sustainability. You can find the thread here.

And then Warren Mosler dropped in to share some additional links to prior work .

MMT economists have been at this for the better part of three decades, and there is a mountain of literature out there—books, articles, book chapters, opEd, textbooks, white papers, blogs, etc. It’s good to have so much material to point to when things like the Clinton Global Initiative competition come up, but it would be even better to elevate the discourse by encouraging young people to think more carefully about what it really means to run “fiscally sustainable” policies.

I suspect the Clinton-selected judges will not appreciate essays with an MMT perspective.

Of all the discussions the Clinton Global Initiative could have started, this one doesn't reach the top 10 in my book. But the Clintons may be planting seeds in time for a future harvest, maybe in 2024?

Maybe Hillary has decided to run again when Biden drops out, and is getting advice from Larry Summers or Robert Rubin on campaign themes that will curry favor with the donor class? E.g. bring back the neoliberal Clinton band! Focus on balanced budgets and lowering interest rates, just as in March 1993!

Sorry to scare y'all with this awful and depressing thought.

You omitted a few things: 1) the history. Andy Jackson paid off the entire national debt in 1835. People did their business with specie (gold) and more than 7,000 varieties of private bank notes of varying reliability. There was no national currency. It was a commercial nightmare, followed shortly by the Panic of 1837 (a Great-Depression-sized hole in the economy). See Wray's commentary here: https://www.huffpost.com/entry/the-federal-budget-is-not_b_457404

As all good MMT'ers know, currency is debt. It says it's a "note" (legalese for debt) right on the paper. National debt is like bank debt. Your asset, your account, is a liability to the bank. The population doesn't owe the debt to some anonymous bondholders. The Fed owes it to the population.

2) Not only are Clintons colluding with Net Impact, the Peterson foundation also supports this exercise in mass hypnosis you write about. The late Pete Peterson was Nixon's Commerce Secretary, then the "Stone" ["petros"] in Blackstone. His foundation's economists appear on PBS, and in the editorial pages. The foundation even sponsored a "Fix the Debt" tour of "budget workshops" to make federal budgeting "sustainable."

A few headlines for the "sustainability" crowd:

“Scorekeeper at the ballgame almost out of points”

“Bureau of Weights and Measures says almost out of inches”

How deep is the denial? Here’s from the U.S. Treasury itself, too:

"The 75-year fiscal gap is a measure of how much primary deficits must be reduced over the next 75 years in order to make fiscal policy sustainable. That estimated fiscal gap for 2022 is 4.9 percent of GDP (compared to 6.2 percent for 2021).

"This estimate implies that making fiscal policy sustainable over the next 75 years would require some combination of spending reductions and receipt increases that equals 4.2 percent of GDP on average over the next 75 years. The fiscal gap represents 26.0 percent of 75-year PV receipts and 21.2 percent of 75-year PV non-interest spending."

The "sustainability" argument is predicated on the absurd notion that dollars grow on billionaires. It assumes government is like a household, and "tax and spend" is the sequence of fiscal events. But where would taxpayers get the dollars they use to pay taxes if government didn't spend them first?

3) The truly scary part about this contest and its accompanying organization is that they're training "right-thinking" civic activists for the future. The passive acceptance of these lies is one reason genuine emergencies (climate, nuclear war, homelessness, healthcare, etc.) are so easy to ignore.

I once watched a hypnotist at the fair put a dozen people in a trance. He then told them to remove their right shoe and put it in their right hand. Then he said "When you wake, you won't be able to see what's in your right hand." After he woke them up from the trance he asked "What happened to your shoe." All the formerly entranced people couldn't find the shoe right in front of their face, even when the crowd shouted "It's in your right hand!"...

As Will Rogers once said: "If it weren't for lies, there wouldn't be any politics."