How Much is that Tax Cut in the Window?

Republicans want the Congressional Budget Office to change the way it evaluates their policies. But they're going about it the wrong way.

I bought my Thanksgiving turkey yesterday. A 20.79 pound bird that cost me $62.16 ($2.99/lb). For most of us, explaining what something costs is pretty straightforward. We look at our credit card statement or the receipt the cashier hands us and we know exactly what we’re paying for things. The American Farm Bureau says the average cost of a traditional Thanksgiving dinner for a family of 10 will cost 5% less this year compared to last year, so that’s a bit of good news for people who are struggling to get by.

Unlike turkey and fixings, lawmakers in Washington, D.C., often struggle to explain what their policies will cost. When Donald Trump was asked how much the government will have to spend to round up, cage, and ultimately deport millions of undocumented workers and their families, he simply responded that “there is no price tag. It’s not a question of a price tag. It’s not — really, we have no choice.”

Of course there’s a price tag, and the private prison companies that are poised to benefit from the largest mass incarceration and deportation of immigrants in American history are already benefiting. As Bloomberg’s Stephen Dennis reported (my emphasis):

“We expect the incoming Trump administration to take a much more aggressive approach regarding border security as well as interior enforcement, and to request additional funding from Congress to achieve these goals,” George Zoley, the founder and executive chairman of GEO Group Inc., said on an earnings call Thursday.

GEO Chief Executive Officer Brian Evans added that unused beds at their facilities could generate $400 million in annualized revenues if filled, and the company has the capacity to scale up an existing surveillance and monitoring program to cover “millions” of immigrants for additional revenue.

“This is to us an unprecedented opportunity,” he said.

In addition to detaining and monitoring people, the executives said they expect their businesses to expand into providing air and ground transport, which means more opportunities to bill the federal government for services rendered.

As Bloomberg reported, shares of GEO Group closed at $24.43 on the Thursday after the election, up from a close of $14.18 a share on Monday, November 4. And CoreCivic Inc., another private detention company, saw its stock price climb as high as $22.35 Thursday compared with Monday’s closing price of $13.19. In other words, investors know there’s a price tag, and they’re betting that the federal government is going to spend a decent chunk of money on all of this. A report from the American Immigration Council estimates that deporting a million undocumented immigrants per year would cost $967.9 billion over about a decade.

What Will it Cost to Extend the 2017 Trump Tax Cuts?

But the really big numbers that republicans are wrestling with right now have to do with extending the tax cuts that were part of the 2017 Tax Cuts and Jobs Act (TCJA). Unless they act fairly soon, many of those cuts will expire at the end of 2025. If that were to happen—it won’t—Americans up-and-down the income ladder would end up paying higher taxes.

You might ask why republicans authorized sweeping tax cuts that created this “tax cliff” in the first place. Why didn’t they just make all of the tax cuts permanent (like they did with the corporate income tax cut) so they wouldn’t end up where they are today—i.e. staring down trillions of dollars in looming tax hikes on almost everyone who files federal income tax? The short answer is that republicans needed to pass the TCJA using a process known as budget reconciliation, and that essentially forced them to sunset certain provisions (like the personal tax cuts) in order to keep the “price tag” within acceptable limits.

Right now, republicans are in a bit of a pickle. Inflation is still above target, government deficits are already substantial at around 7% of GDP, and the Fed’s rate hikes, which feed hundreds of billions in additional interest income to investors each year, are helping to buoy everything from crypto to equities.

While financial markets might be pricing in tighter fiscal policy, given Trump’s nomination of Scott Bessent, who is reportedly advising the administration to aim to bring the deficit down to 3% of GDP, I somehow doubt that republicans are going to curb their ambitions. They’ve got one shot to go BIG right out of the gate (using budget reconciliation), and I expect them to make the most of it.

The biggest challenge? Figuring out how to answer the dreaded question: How much will the tax cuts cost?

If you ask the Congressional Budget Office (CBO), you’ll get a pretty clear answer: Extending the expiring tax cuts for 10 years will “cost” the federal government about $4 trillion. But if you ask Sen. Michael D. Crapo (R-ID), who’s expected to head the Senate Finance Committee next year, he will tell you that the cost of extending the tax cuts is actually closer to … $0.00.

Crapo’s logic goes like this: We already sacrificed that revenue when we passed the 2017 tax bill, so extending the tax cuts just means continuing to not get what we’re not getting anyway, so nothing gained, nothing lost. If you want to get into the budget weeds, it’s a fight over the “baseline” and whether any future tax bill should be evaluated on the basis of “current policy” (what we’re doing now) or “current law” (where things would be if the cuts expire). If you lean into the former, then you can argue that you’re just continuing down the path you’re on rather than resetting policy from a new starting point, so there’s no new hit to revenues.

Some people think—and hope—that there are enough deficit hawks left in Congress to kick up a fuss over what they see as a “budget gimmick and an end run around the needed efforts [to reduce the deficit].” They’d rather see cuts to Social Security and Medicare than tax cuts that aren’t “paid for.” But Sen. Crapo sounds like he’s determined to do whatever it takes to bring his party along, even if it means “trying to officially change budget rules so that extending the tax cuts is not shown to cost anything.”

“We’re going to have to take the bold steps of saying to the American people that we are not going to let $4 trillion of tax hikes happen and that it’s not going to increase the deficit.” Sen. Crapo (R-ID)

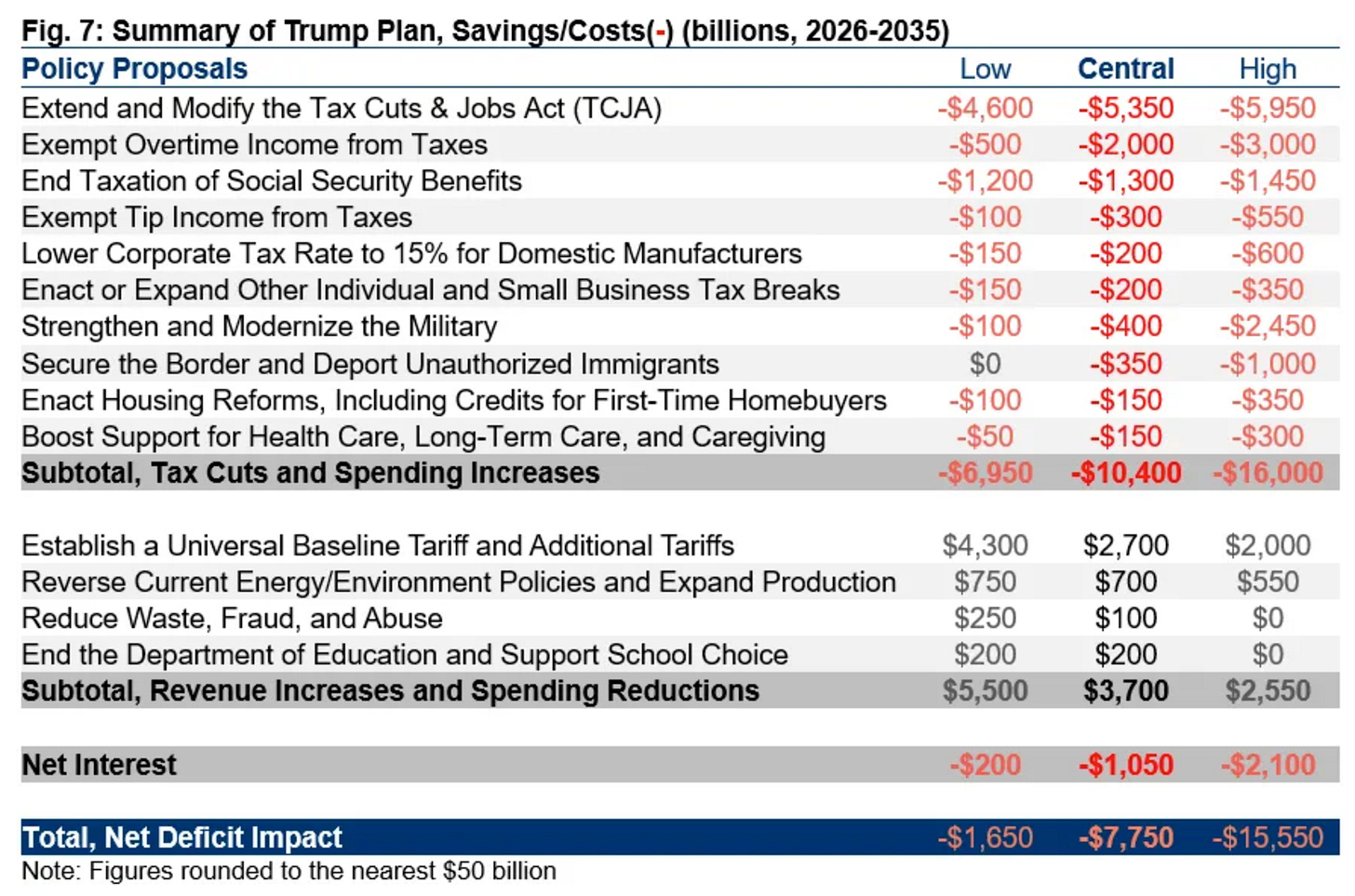

If they can hand wave ~$4 trillion away—at least in budget speak—then the price tag for many of the other things they might want to do won’t look so bloated. But here's how most observers are likely to see it. Even if DOGE manages to root out billions in waste, fraud, and abuse, and Trump’s tariffs bring in trillions (along with some other small stuff), the price tag for the whole raft of tax cuts and proposed new spending would most likely come in around $8 trillion.

Changing the budget rules to have the price tag measured against “current policy” would mute the overall cost, but many conservatives are warning against going down this path.

Sen. Chuck Grassley (R-IA) doesn’t expect to fully offset the cost of a full TCJA extension. “There will never be enough to...pay for the extension…There’ll be some deficit.” But Sen. Crapo insists that you don’t put a price tag on things you’re already doing, nor do you have to “pay for” new policies as long as you can show (or claim) that they’re growth-enhancing and hence pay for themselves. He puts corporate tax cuts in that bucket, so look for republicans to not just extend expiring provisions in the TCJA but to add new goodies like a further reduction (from 21% to 15%) in the corporate tax rate. And anything else they care to claim will work supply-side miracles.

Former CBO Director Douglas Holtz-Eakin doesn’t like the idea of messing around with the budget rules to downplay (or zero-out) the reported cost of proposed legislation. He’s afraid it would open his party up to criticism:

Maybe this helps them get to 218 and 50. On the other hand, there will be people who accuse them of changing [the budget rules] now because it’s convenient for them. They will suffer the slings and arrows of attack if they go this route, there’s no question about it.

But do voters really care about whether an agency that ninety-nine percent of them have probably never heard of adopts “current policy” or “current law” when scoring proposed legislation? Partisan media types and the reporters who cover this kind of stuff for the big news outlets care, but the average American? Not a chance.

But there is something they care a lot about: inflation.

Back in 2017, there were plenty of democrats speaking out against the TCJA. Larry Summers famously argued that passage of the Trump tax cuts would leave the U.S. “living on a shoestring for decades to come because of the increases in the deficit that will result.” Instead of complaining about the price tag and the budgetary effects of the proposed tax cuts, I urged CBO to embrace a new way of scoring proposed legislation, one that helps lawmakers by flagging inflation risk instead of just giving them crude cost estimates. If republicans want to push for new ways of evaluating their tax and spending proposals, that’s the place to start. In fact, it’s more important than ever.

BONUS MATERIAL

Here’s how I talked about the tax cuts and the risk to inflation when I was on Bloomberg’s The Close earlier this month. (starts 48:00)

But why would the investor class care about inflation? The Fed will respond by jacking up interest rates. They benefit from a higher principal in lending and a return on interest that’s sheltered from inflation. They’re making money hand over fist. It’s more wealth transfer from the economy into their bank accounts.

This also leaves out the ideological reality of the GOP’s funders. That coalition of negatives between pure corporatist and right wing libertarians. The latter seek ideological fulfillment by destroying the government by destroying the economy by destroying the dollar. The world they want is a shattered United States, where their monopolies become their private fiefdoms on its shattered remains. And they fantasize that cryptocurrency will liberate them from the tyranny of sovereign currencies because they’ve bought so many bitcoins.. not realizing that people can perfectly well create their own regional currency. Cheimgauer works.

This economy is not just rigged, it’s predatory. And I think many people will find with the economic chaos the billionaires the patrons of the GOP intend to inflict. The people are going to have to do what they did in the throes of the Great Depression, unions, churches, socialist and communist parties, banded together to provide basic services to keep people alive, like the Black Panther’s in their time where they created schools, fed children and educated them.

Economic growth is nothing more than a measure of economic concentration, and that economic concentration is a measure of energy intensity. In order to put an end to carbon emissions we have to from the national and the global economy, and that is going to be forced on this anyway because extreme weather is very good at destroying existing productive capacity, and that process is only intensify as a climate becomes warmer. . Eventually, it’s going to incapacitate any sizable supply chain because that kind of infrastructure cannot be designed for a future that is constantly changing.. yeah I know I understand that that’s perfectly fine yeah I understand. I understand you make those kinds of decisions. You think you’re a guy you’re a guy who thinks Trump is a comedic.