I joined CNBC’s Squawk Box on Wednesday morning to respond to some breaking data from the Bureau of Economic Analysis. We learned (among other things) that the US economy grew at an exceptionally strong (3.2 percent) pace in the final quart of 2023. The segment starts around 1:47:40

After the show’s senior economic commentator, Steve Leisman, gave his initial reaction, Joe Kernan noted that “we have the best economy in the world.” He teed up his question to me by reminding viewers of the bipartisan infrastructure legislation, the CHIPS & Science Act, and the Inflation Reduction Act. “Is this is a story of big fiscal?", he asked.

As Claudia Sahm wrote in a recent Substack, it is. But there’s another important factor, which I had intended to bring up except—as is so often the case with live television—I never quite got there. So I wanted to do it here.

Big Fiscal

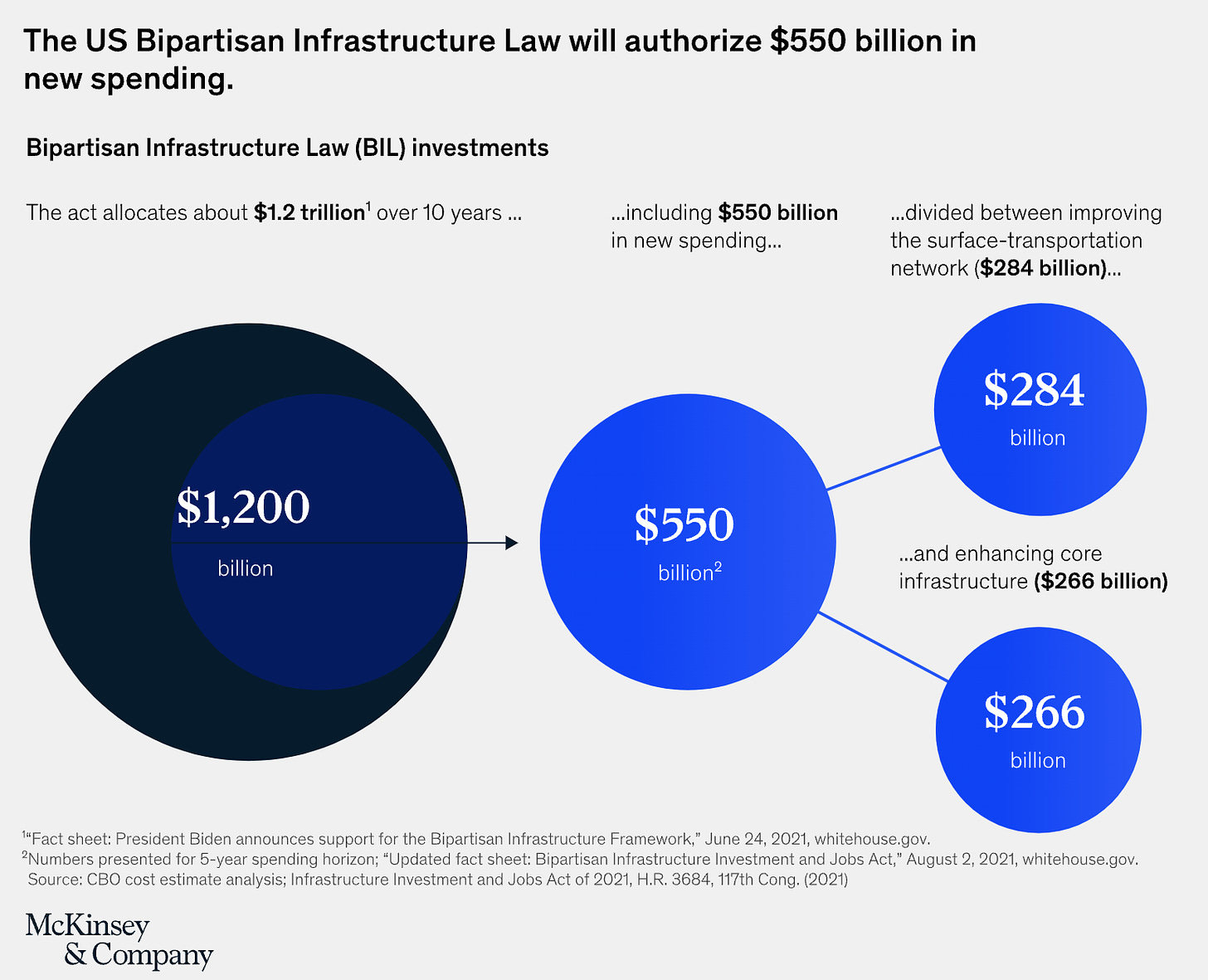

Before I do, let me say a few words about all of those fiscal packages Joe Kernan mentioned. As I reminded viewers, these were not one-off spending bills that are going to disappear after giving the economy a shot-in-the-arm in 2023. They authorize multi-year investments that will (directly and indirectly) support aggregate demand for the better part of the next decade.

Here’s a reminder of the magnitudes. For the bipartisan infrastructure law, it’s really the $500B in new spending that matters in terms of stimulus.

Here’s the CHIPS & Science Act.

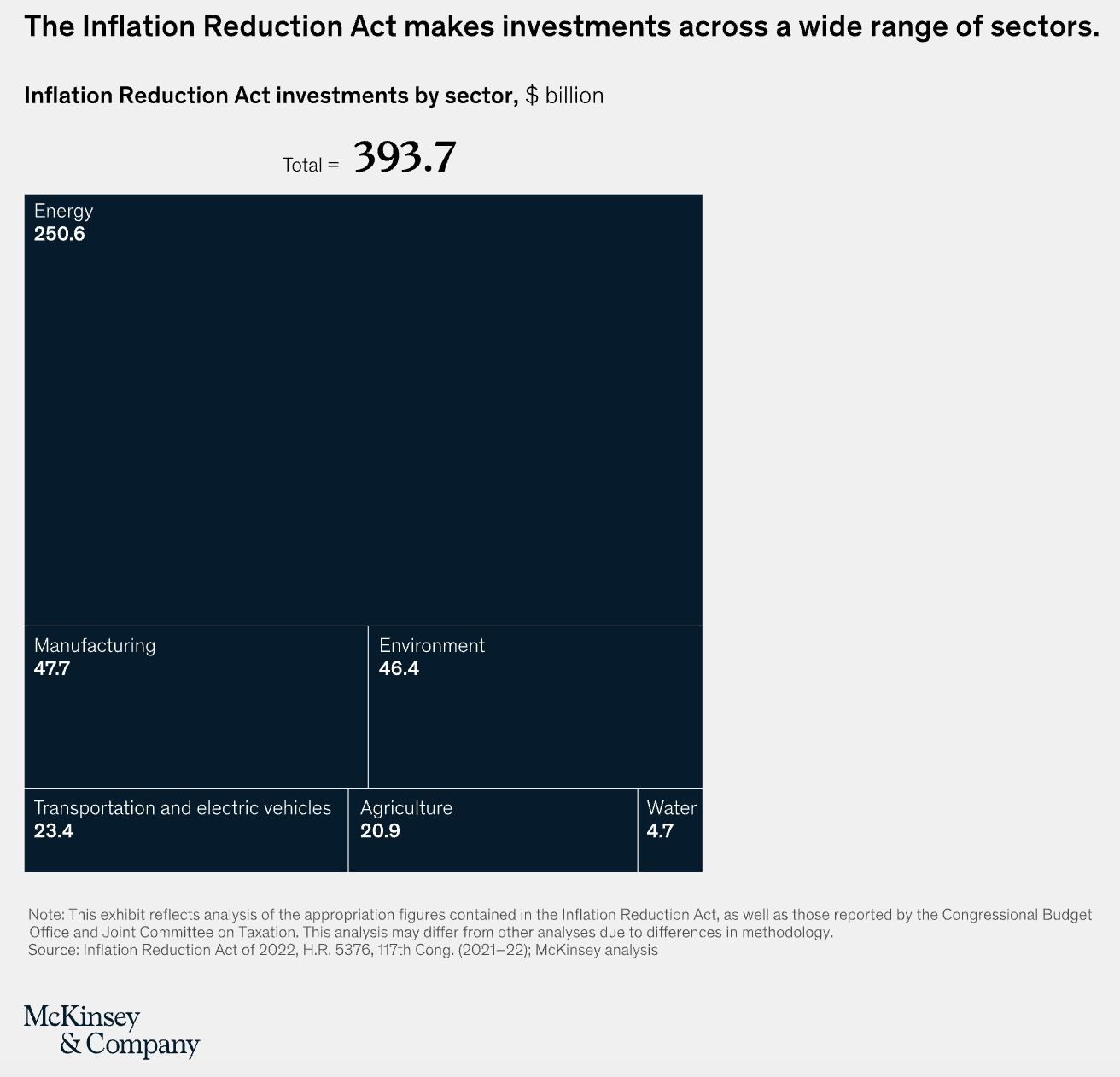

And here’s the game-changer, the Inflation Reduction Act, which was originally touted as a deficit-reducing bill that would catalyze close to $400 billion in clean-energy-related investments. But as Goldman Sachs pointed out after the bill’s passage, “most of the spending under the law comes in the form of uncapped tax breaks, meaning the cost will increase as more companies and households take advantage of the incentives.”

During the interview, I pointed out that we have blown way beyond the original estimates. The editorial board at the Wall Street Journal considers that a problem, because it means that the budgetary effects—i.e. impact on future deficits—are much bigger than the Congressional Budget Office (and others) initially envisioned. Here’s the WSJ:

The Inflation Reduction Act may go down as one of the greatest confidence tricks on taxpayers in history. Democrats used accounting gimmicks to claim the partisan law would reduce the budget deficit. But now a Goldman Sachs report projects its myriad green subsidies will cost $1.2 trillion—more than three times what the law’s supporters claimed.

The Congressional Budget Office forecast that the IRA’s energy and climate provisions would cost $391 billion between 2022 and 2031, but this appears to be a huge under-estimate. One reason is companies are rushing to cash in on tax credits that aren’t capped. The Biden Administration is also loosely interpreting conditions for the credits.

Anyway, the point is that there is a lot of fiscal support baked in for years to come. And while it is true that higher interest rates have curbed some enthusiasm for some of the green energy investments (offshore wind, solar, etc.), Goldman still sees the IRA unleashing a clean energy boom that could catalyze about $3 trillion in clean energy investments over the next decade.

Big Immigration

So big fiscal policy is a big part of the reason the US has absolutely crushed it compared with our peer countries (both on an absolute and per-capita basis). It is, as Arin Dube says, part of the story.

But it’s not the entire story. The other really important reason the US recovery has been the most robust in world? The Washington Post has the answer: The Economy is Roaring. Immigration is a Key Reason.

Immigration has not slowed. It has just been absolutely astronomical, said Pia Orrenius, vice president and senior economist at the Federal Reserve Bank of Dallas. And that’s been instrumental. You can’t grow [the economy] like this with just the native workforce. It’s not possible.

If you’re interested, the Congressional Budget Office (CBO) breaks it down. Foreign-born workers accounted for half of labor market growth in 2023. Do you remember when Fed Chair Powell talked about the need to rebalance the labor market? Do you remember when he (and others) argued that this could only happen via an economic slowdown that forced unemployment to rise? That turned out to be wrong, and big immigration is a big part of the reason the US economy has outperformed.

Just last year, the US labor force grew by 5.2 million workers, thanks in large part to net immigration. According to CBO, that translates into an additional $7 trillion in US GDP over the coming decade.

So hats off to Big Fiscal and Big Immigration for lifting America to the top of the heap!

Thank you for this post. I'm glad to learn more about the long-term benefits ($trillions!) and, especially, about the connection to "Big Immigration."

Excellent job Stephanie K! You’ve done superb work getting the MMT lens out to the masses in the most consumable I encountered. I use your words to advocate for MMT to my Federal colleagues continually to some success. When’s the new book coming out?