I just recorded a short interview with Mehdi Hasan, host of the Mehdi Hasan show, which airs on MSNBC and NBC’s Peacock TV. As always, the conversation moved very quickly, and the interview was over before I got a chance to make a number of important points.

So here I am.

I don’t always do this, but this morning I typed up some talking points ahead of my TV appearance. Since there wasn’t enough time to get to a lot of this, I thought I’d post it here.

There are so many things we could be doing—together—to crush inflation.

We need a unified and coordinated push to bring down the price of oil, which is the major driver of inflation, not just here in the U.S. but across much of the world. Even food prices—which could go much higher because of the conflict between Russia and Ukraine—are intimately related to energy costs. So we have to bring down energy prices in order to bring down inflation.

There are some things we could do to increase the supply of oil—you hear people talk about guaranteeing prices on future production to encourage producers to bring more refining capacity online in the near term. You hear people talk about nationalizing the refineries and capping margins. You hear about Keystone XL, dolling out more permits to allow more domestic drilling, and appealing to the Saudi government. Some of these are just silly right-wing talking points that would have little to no impact on energy prices now or in the near term. (There could be merit in the first two.)

But the reality is that it’s probably impossible to get prices down in the short term if you’re just focusing on boosting the supply of oil. And while I understand why Democrats are looking for ways to ramp up supply—given the midterms and what the outcome of those elections potentially means for our democracy—drilling and fracking our way to lower energy prices also works against the Biden administration’s promise to tackle the climate crisis. So I think we have to be very careful about how much emphasis we place on the supply side.

So what can we do?

It’s important that we learn some lessons from our history

If you look back, you see that the last time we had inflation running as hot as it is now, it was triggered by oil price shocks that arose from a political conflict in the Middle East. It was our dependence on foreign oil that made us so vulnerable back then. We were basically stuck for years with no way out. Paul Volcker, who was Fed Chair at the time, tried to deal with the inflation problem by jacking up interest rates. But that only made things—including inflation!—worse. Rate hikes make the cost-of-living crisis worse, by making it more expensive to buy a house, a car, or put food and gas on your credit card. And they make it more expensive for companies to borrow and invest in new capacity. It raises their costs, which tends to mean higher prices for consumers as firms pass along those rising costs. Volcker’s rate hikes triggered a deep recession that clobbered the poor and working class.

What ultimately brought inflation down was the negotiated peace treaty in the Mid-East and the development of alternative sources of energy, namely natural gas, which benefited from deregulation under President Carter.

We need to do something similar now. First and foremost, we need a negotiated resolution to the war in Ukraine. We also need to make (long-overdue) investments in renewable energy to diversify our energy portfolio—but this time not into other forms of fossil fuel—with the ultimate goal of weening ourselves entirely off of carbon-intensive sources of energy for the sake of civilization.

Amping up supply in the near term and remaining wedded to oil going forward will only leave us vulnerable to future oil price shocks, not to mention the devastating impacts of climate change.

Action on climate is action on inflation.

If the high cost of food and airfare and housing has you reeling now, just think about what’s going to happen with the intensification of droughts, more frequent and more powerful hurricanes, and raging fires and floods over the coming years.

The Federal Reserve cannot bring down inflation because it cannot bring down the price of energy. I will stipulate that if Powell goes “full Volcker,” jacking rates into the stratosphere, he can trigger a sufficiently deep recession that will crush the demand for oil as millions of hard-hit Americans stop driving to work (because they’re unemployed), avoid turning up the thermostat (because they can’t afford to keep warm), and cancelling their travel plans(because there’s no discretionary income for leisure).

It’s a terrible way to deal with the kind of inflation we’re facing today.

Instead of relying (overwhelmingly) on the central bank to fight inflation, President Biden should level with the American people. The Federal Reserve isn’t going to fix inflation. Nor is the White House. But together, we can crush it.

President Biden should ask for help

Help from the American people — Use the bully pulpit to urge conservation. Ask people to drive the speed limit, carpool with others, and avoid unnecessary travel. Lots of little things add up when you have collective action by tens of millions.

Help from US companies—Use the bully pulpit to urge employers to make every effort to accommodate work from home (WFH), and offer incentives to companies that comply.

Help from mayors and governors—Use the bully pulpit to call on elected officials to make public transportation (trains, busses subways, etc.) free to all riders.

Help from our international allies—Work tirelessly to bring a resolution to the war in Ukraine and work out a concrete plan to prevent mass starvation and political upheaval from the looming food crisis that threatens much of the developing world.

And keep working to reduce costs for families who are struggling with high food and energy. All of these (and more) are good ideas:

Lower the cost of prescription drugs (or better yet move to Medicare for All)

Universal child care and pre-K

Continue working on supply-chains. Ease backlogs at the ports, trucking, rail

Deal with known cases of price gouging

Build housing!

Eliminate non-strategic tariffs

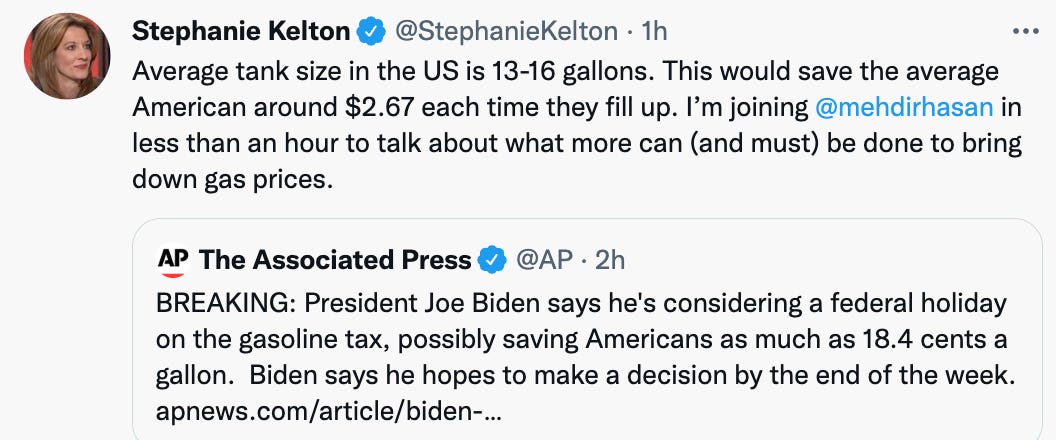

These are just some of the things we could do to bring down costs to help struggling families. The White House is apparently considering a federal holiday on the gasoline tax, which is something I don’t like for a number of reasons. For one thing, it encourages consumption (exactly the opposite of what we need) while doing little to relieve the pain at the pump. It’s bad economic policy and bad climate policy.

If you’ve got the Peacock app, I believe you can stream the program at 8:00 ET this evening.

What will it take for the Biden Administration to admit that their sanctions against Russia are hurting the western economies more than they are hurting Russia? Peace in Ukraine would be most welcomed of course, but unless the sanctions are lifted Russia has no way to sell its resources.

How do all of the businesses that rely on people going to work WFH? Restaurants etc?? Most of your bullet points suggest more government spending,/subsidization which again is inflationary. The government will borrow more which will again increase the monetary base. Do you understand how this works?